Colorado taxes corporate net income at a flat rate of 4.63%. This is the current state tax rate on net personal income (excluding the alternative minimum tax, which also plays a role in state income tax).

Annual (Periodical) Return

The State of Colorado requires you to file one Periodic Return per year for an LLC. You must submit each of our reports online on the SOS website. Specify a period within three months, starting from the first day of the anniversary month of registration of your LLC. For example, if you registered an LLC on June 15, the report will be published from June 1 to June 31 of each year. You can also submit your main report up to two months earlier. The final registration fee is $10. There is also a $50 late filing penalty.

How is an LLC taxed in Colorado?

Keeping Up With Taxes Colorado LLC Helps Everyone take full advantage of opportunities when they get up and avoid lesser known pitfalls and common misconceptions about LLC Colorado. The tax laws governing LLCs change regularly. Find out about? these changes and their impact on your business Help your needs determine which classifications and methods to use implementation, and therefore when you may need to obtain relevant tax and legal information Tips.

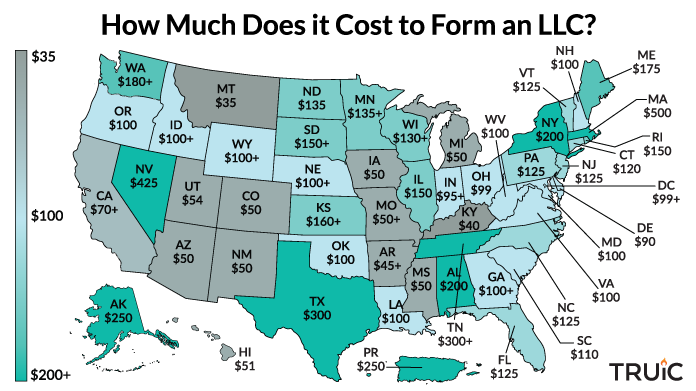

Online LLC Registration Fee In Colorado: $50

The basic cost to form an LLC is approximately $50 per filing your LLC organizational unit. online at the State DepartmentColorado. Please note that the State of Colorado has lowered the development filing fee from July 1, 2022 to June 30, 2023.

What Is Each LLC In Colorado?

< H2>What Is Each Colorado LLC? ?

H2>Colorado LLC Is A Legal Entity Created As A Result Of State Litigation. It Can Be Used To Run A Specific Business, Or To Hold Assets Such As Real Estate, Boats, And Therefore Aircraft.

Total Costs Of Forming An LLC In Colorado

Reservation of a working name is optional part of Colorado LLC, but registration can be a very useful service. If you’ve spent some time looking for a big name that you really don’t want to lose, you can hire $25 to put a 120 day ban on them. When you apply for a name reservation, you can usually rest easy on keeping your name idea unique. And if you need more time, you can extend your current booking for an additional $25 fee per renewal.

Can I ChargeReserve A Company Name In Colorado?

Yes. If you’re not yet ready to open your own LLC, you can reserve your company name for up to 120 days by filling out an Application to Reserve Virtually Any Name with the Minister of State of Colorado (online only) and paying a $25 health fee. pay a history fee.

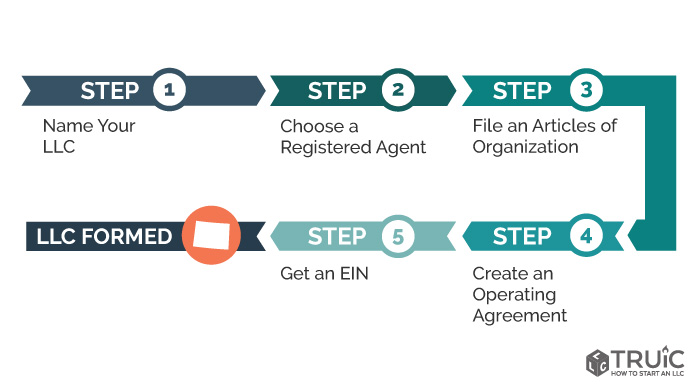

How To Form An LLC In Colorado

Forming a new corporation comes with many challenges. Described below are a few key steps required to ensure your business corporation complies when deciding to incorporate a small limited liability company in Colorado. Initial expenses are required, including the formation of the charter of Colorado LLC. Articles are a computer file that officially represents your business in that state. Colorado charges a small fee for this performance: $50. There are no document options for this form; it must be submitted online.

Certificate Of Training Costs

Certificate of Training in Colorado bears most of the costs, which can vary greatly from person to person.depending on the country and whether to take the form of the relevant domestic LLC or foreign LLC. However, you can submit both applications to the Colorado Secretary of State.

How Much Does An LLC Cost In Colorado? ?²

To formally register your limited liability company, you must file a Declaration of Status with the State. For the first time, July 1, 2022, the entry fee is $1. The Colorado State Legislature passed a law in 2022 that reduced the cost of setting up an LLC in Colorado from $50 to $1. The Secretary of State of Colorado expects the fee waiver to last until the end of June 2023.

Additional Costs That Colorado LLC Must Reimburse

In addition to the state filing fee, you probably consume more for other operational things â?? from drafting an LLC operating agreement, opening a bank account, or applying for an Employer Identification Number (EIN) with an accurate IRS.

Is there an annual fee for LLC in Colorado?

An LLC or Limited Liability Company has always been a type of organization that offers limited liability to members, and fees may apply to an LLC in Colorado. 5 minutes of reading

How much does it cost to maintain an LLC in Colorado?

Maybe you are hoping for a Colorado LLC. People assume that the right way to start an LLC is complicated and expensive. However, this is usually not difficult as the cost varies from state to state. We have all the information you need about the costs of starting an LLC, specifically the costs of an LLC in Colorado.