The Business Registration Division (BREG) of the Department of Commerce and Consumer Affairs (DCCA) is responsible for processing and maintaining government procurement, business registration, general and limited close relationships, limited liability corporations, limited liability companies, trade names, trademarks,

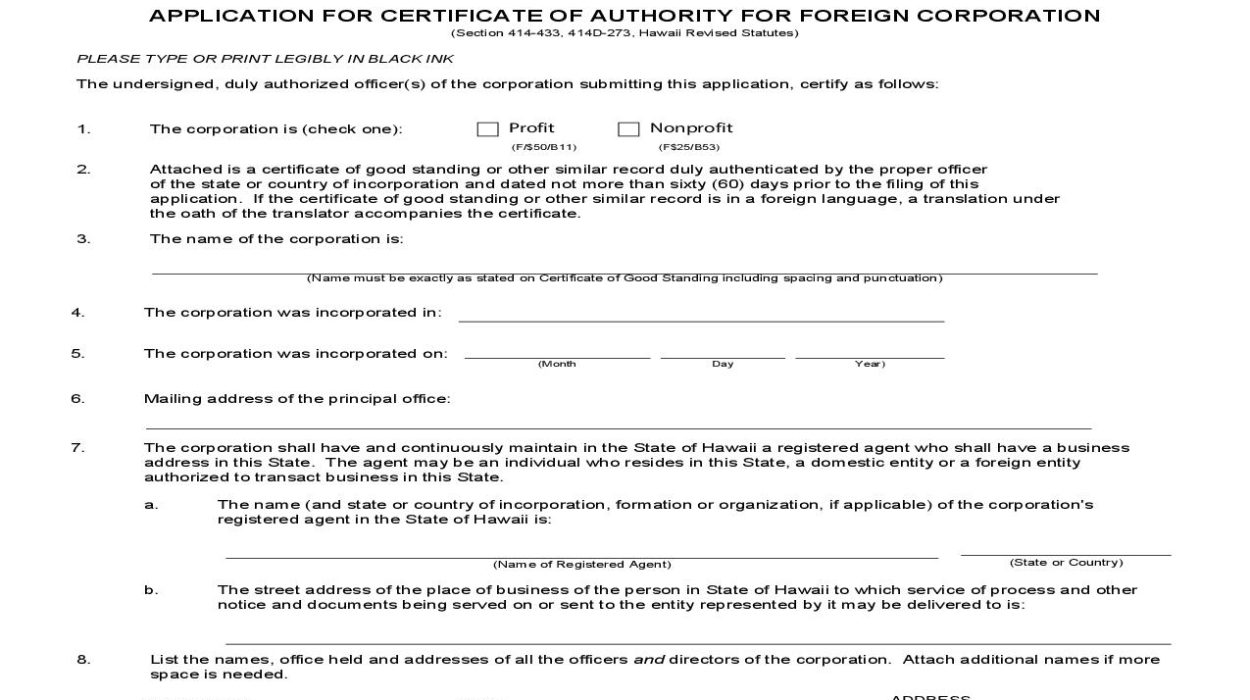

How do I register as a foreign entity in Hawaii?

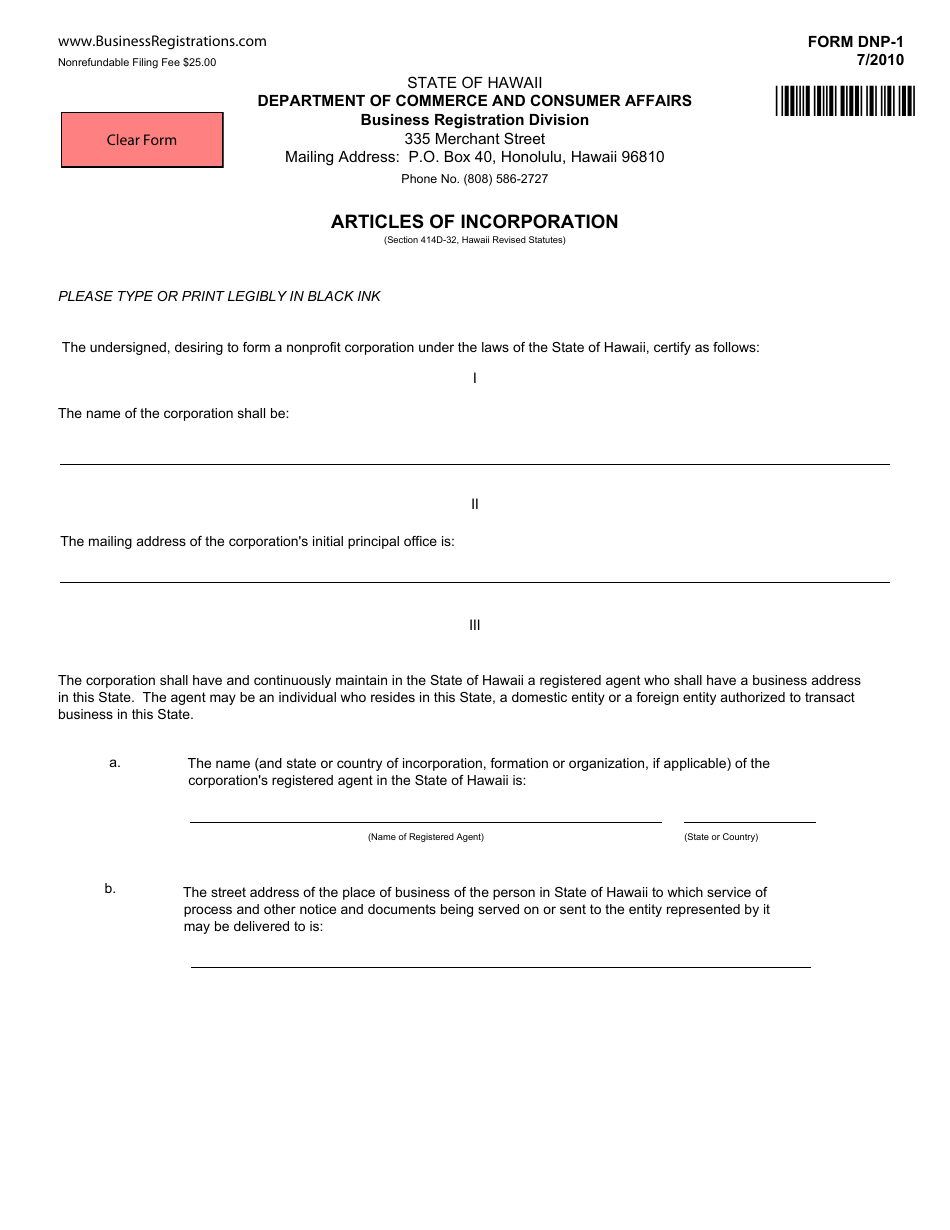

To incorporate a non-profit corporation in Hawaii, you must apply for a Foreign Corporation Certificate of Eligibility (Form FC-1) with the Department of Commerce and Consumer Affairs (DCCA), Business along with a specific deposit. ) provide registration service. Applications may be submitted online or by e-mail, mail or fax.

Do I Need A Registered Agent In Hawaii For My Business?

Yes, whenever you hire Northwest as a registered surveyor, it’s an annual fixed fee of over $125 a year, you become one. an online account that keeps track of when your report is due, your registration showing when your identity expired.30 years of maintenance with us, and even all the documents you receive on the spot for your family, are uploaded to your account instantly when you view them completed. If or when you receive a complaint, we may refer up to 4 people and your dependents at the same time for a full investigation of the complaint. You will receive annual report reminders. It’s the same price every year, and there are no one-time or cancellation fees.

What Is Hawaii Government Certification?

Companies must register with the Hawaii Department of Commerce and Consumer Affairs well in advance of doing business. in Hawaii. Companies incorporated under any other status generally require a Hawaiian certificate. Authority. If you register the company accordingly, the company will be registered as a foreign company and therefore there is no need to register your new company.

Registering An Online Business

Hawaiiʻi Business Express is a quick and easy way to set up an online business. Just create greatPrivate account and sign up instantly to submit your application and receive a receipt. Over time, you can continue to use the site to manage day-to-day needs, such as submitting an annual report and making changes for your business.

Foreign Company En HI

H2> If You Own A Corporation For Outside Of The State And Want To Do Business In Hawaii, You Will Need A Certificate From The State Of Hawaii. This Is Achieved By Filing As A Global Corporation With The Hawaii Secretary Of State, Department Of Corporations. Upon Submission, The State Of Hawaii Will Return Your Completed State Certificate To You. A Foreign Hawaiian Supplier Should Not Be Confused With A Foreign Company. Any Corporation That Is Not Actually Registered (incorporated) In The State Of Hawaii Is Considered A Foreign Corporation.

Are You Ready To Qualify Your Corporation In Hawaii?

Social media is increasingly becoming the preferred way for companies to communicate with their customers, colleagues and customers. We are committed to sharing useful information and tools.We help you grow your business.

Foreign Company Registration In Hawaii With Incorporation Lawyers

States require companies to register as foreign companies in order to comply with tax and regulatory requirements. If you are unsure whether your particular Hawaiian corporation requires the registration of a foreign corporation, please call our main office at (800) 603-3900 to speak directly with someone who can assist you immediately. Registering a foreign company and obtaining a certificate as well as powers is a legal and business registration process. Avoid the potential pitfalls of a parole training service as well as an agency for your state certification of Hawaii who will use their fast track service practically including a $75 fee ($50 registration fee and Expedited Verification for $25).

Step 2: Reserving The LLC Name

One of the mostThe most important requirement for developing a business in Hawaii is the reservation or registration of a legal entity name. A domestic or sometimes foreign LLC must list its own name, which may be reserved under HI Rev Stat § 428-105 (2010 on Reg Sess), by applying to the Department of Commerce and Consumer Affairs, Commercial Division Registration. It takes up to 125 days for an LLC to obtain its name.

Hawaii Annual Registration Fees And Instructions

The cost of filing an annual return in Hawaii depends on the type of depositary. the company you manage. . Corporations, LLCs and LLPs must pay $15 to prepare an annual return. Nonprofits, partnerships, LPs and LLPs only have to pay $5 to submit their report. Late submission of the report may result in a high $10 late fee in some states of Hawaii, unless you are a non-profit organization. Non-profit organizations in Hawaii are not directly subject to late fees.

What Is The State Of Hawaii Annual Report?

The State of Hawaii Annual Report is a compliance document provided to the State of Hawaii Department of Trade and Consumer Protection. , Business Registration Service (BREG). It should contain the latest chat information for your LLC or its key members. Hawaii needs this information to contact you, and anyone who wants to know more about your company can search the state’s records.