Each LLC initial must have a copy of the working agreement, and he can give you one if yours is lost. In fact, the operating agreement can only specify the obligation of each officer of the company to provide copies of documents upon request.

Can I write my own operating agreement?

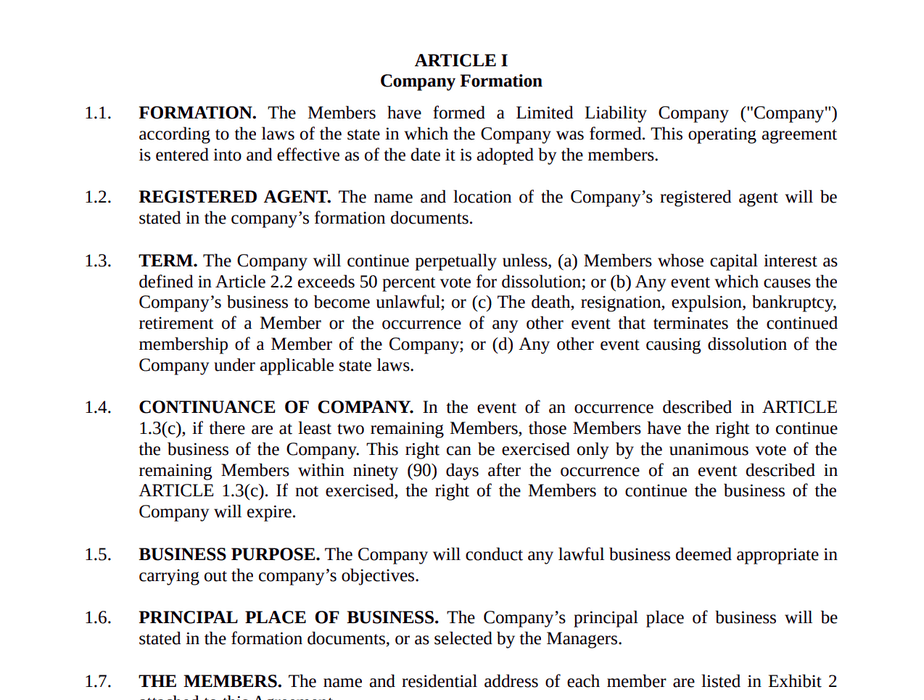

Do you need an operating agreement if you are setting up a Limited Liability Company (GmbH)? As a reminder, operating agreements are typical legal documents that ensure the proper management of the LLC and protect the personal liability of the business. Most states do not require LLCs to keep this document, so many LLCs choose not to keep it.

Why You Should Have An Operating Agreement

V nSome states require an LLC agreement. Sometimes this is only required if the LLC has more than the member has. While not required by law, an operating agreement serves three other important purposes:

Ownership

How much of an LLC is each member typically entitled to? The operational part of the operating agreement describes the simplest way to distribute the profits, losses and assets of an LLC among its participants.

Participants

When adding a new component, the Company must amend the LLC operating agreement, all existing participants must agree with the written consent of that creative contributor. This also applies to accelerating or decreasing ownership from member to member.

Article III: Equity Contributions

applies to members who have invested money in the market to start an LLC It also discusses the proper way for members to raise additional funds. For example, an LLC can choose and give out “units” of property in exchange for the money it needs.

Additional Terms

What kind of agreement you have with an LLC will almost certainly depend on your business and your market. has stopped. That being said, in addition to the types of clauses listed above, there are several other clauses that you can (or want to include) in your agreement.

What Is A Written Operating Agreement?

A draft operating agreement is a legal contract that, according to experts, is drawn up when a limited liability company (LLC) is created. This promise defines certain rules, processes, and regulations that most companies control internally.

What Is A Limited Liability Operating Agreement?

A limited liability operating agreement (LLC), also known as an LLC’s articles of association, is another legal document that defines rights and, as a result, , about the responsibilities of each member of the LLC, and includes details such as:

What Is An Operating Agreement With An LLC?

The operating agreement with LLC allows you to secure your financial and working relationships. you work with yourby their co-owners the way it works for your business. In your operating agreement, you and your co-owners (called “participants”) have each owner’s share in that particular LLC (limited liability company), their share of profits (or losses), their rights and obligations, and even their own. , but what about the business that happens when someone leaves you.

Are Operating Agreements Required For A Great LLC?

Every state will tell your business they need it, but you know what? Almost all laws state that failure to comply with LLC practice agreements for an LLC will not cause you to lose your liability protection. We have yet to see a real California agency, which you need to maintain an LLC Operating Agreement.

What Is An LLC Agreement?

An Operating Agreement and an agreement between LLC members regarding their business and civil rights and obligations of its members. When you complete the registration process with MyCorporation, a sample operating agreement is always pre-installed with your registration kit.traditions. Whichever method you choose to start your business, an operating agreement is an extremely important asset and the foundation of any existing LLC.

What is the difference between an LLC agreement and an operating agreement?

A limited liability company (LLC) is a common choice for business owners. (A branch enterprise is also referred to as a defined business structure.) Although an LLC is suitable in terms of the required record keeping formalities, when setting up a high-performing LLC, business owners must take their time to make sure they have a good operating agreement with the LLC. because it is an LLC factor document that controls the structure and operation of the business. It also governs the relationship between members working in a multi-member LLC.

How many pages can an operating agreement be for an LLC?

Q. What is the operating agreement of High Performance LLC?A. California Corporation Code §17050 requires every LLC in California to have an operating agreement with the LLC. Along with the Articles of Association, the Memorandum of Association of an LLC is perhaps the most important document of an LLC. For an LLC with several persons, the employment contract should be approximately 50-70 pages long, depending on the number of people involved. However, an operating agreement for a single member LLC should only be about 15-30 pages long. The operating agreement with an LLC is the main contract between the members of a limited liability company (LLC). The operating agreement with the LLC governs the membership, officers, operations and distribution of all income associated with the LLC. The operating agreement of an LLC must contain, at a minimum, all? from the following: