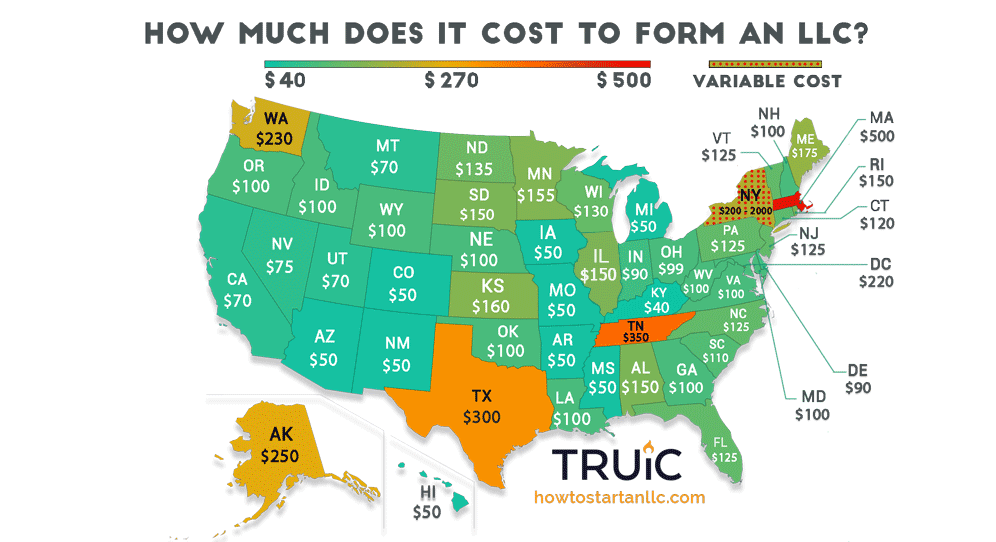

When you choose a corporation or LLC, you must pay a one-time registration fee to the Secretary of State for that state. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi have the lowest $50 charter fees.

Annual LLC Fees

To keep your LLC compliant and throughout its operations, there are ongoing fees that you must always pay to your staff. You must pay this fee regardless of how much your LLC is worth or how many moves it makes. Some states require payments within a year, others every two years. In over 90% of states, the state will close all of your LLCs if you don’t pay your annual LLC fee.

LLC Cost (e.g. Express 2022):

Important: Fact Just because some states have lower fees doesn’t mean you have to take them seriously! As a result, it can bring you much more money. You may end up doing illegal business in your country and must register2 LLCs (one domestic LLC and one foreign LLC). If you haven’t seen the video about the best state of our company, be sure to check it out: what is the best state to form an LLC in?

Pros And Cons Of An LLC Liable For Debts Or Lawsuits Of The New LLC, And Remit Taxes When Profits And Losses Pass To Members, Whether Or Not They Pass On Their Tax Returns. In Addition, LLCs Offer Distinctive Features Because They Are Relatively Easy To Form And Therefore Maintain, Unlike S Or C Corporations. Collectively, LLCs Tend To Be More Trusted Than LLCs, Individuals, And Partnerships, As They Have Much More Formal Business Structure. Statutory Corporations, Which Are State-affiliated Entities Such As General Partnerships, Which Generally Do Not Require Any Paperwork To Be Filed Or Government Fees To Be Paid Prior To Doing Business, If You Want To Legally Incorporate Your LLC, You Absolutely Must Filea Document, Usually An Article, That Mentions The Named Organization (sometimes A “certificate Of Incorporation” Or “certificate Of Organization”) At Your State’s Registrar Of Business. In Most States, This Is The Secretary Of State, And The Sale Price For Filing A Articles Of Association Is Most Commonly $50-$100, But In California It Is $250.

>

Other LLC Costs And Fees

Depending on the geographic location and location of your industry, your business may require federal, state and local permits/licenses to operate legally. This is true regardless of whether the families create an LLC or another key business structure.

Which state is best for registering LLC?

The first way to create an LLC, you see, most of our readers opt for ZenBusiness because of its low price and simple task. Register an LLC in any state for $49 plus government fees.

How Much Does An LLC Cost?

The cost of establishing an LLC consists of three main items: state fees ( fees for state registration, LLC accelerated fees, name reservation fees, commercial computer software license fees, etc.), LLC annual service fees (including annual return, taxes, registered agent fees, etc.) and your approach tochalu DIY, huh?? Use an online registration service or perhaps an attorney.

LLC Registration Fees Chart

Kentucky offers the lowest LLC registration fee of $40. Arkansas, close behind, is about $45, and the following states charge a one-time fee of $50: Arizona, Colorado, Hawaii, Iowa, Michigan, Mississippi, Missouri, New Mexico.

What Is All The Processing Time For Creating An LLC?

For example, the time required to create an LLC varies, but can vary from a few minutes to several weeks. In many states where expedited processing takes longer, processing is available at an incredible additional cost.

LLC Fees: Getting Started

There are a few fees associated with filing a creation application, and most of which are the legal documents establishing your LLC. There are also additional fees associated with registering your state LLC with the territorial authorities. For example, you want to make sure that you have all the necessary documents, llicenses and certifications required by local, express, and federal government agencies. The amount you end up spending depends on your willingness (or ability) to build a website yourself.

Is there an annual fee for LLC in PA?

Unlike most jurisdictions, Pennsylvania does not require an LLC to file an annual return. However, professional limited liability companies (PLLCs) and foreign limited liability companies that enter into professional services contracts must file an annual certificate of incorporation (DSCB Form: 15-8221/8998) with the Department of State. They must be submitted to the company office by April 15 almost every year. You can register online or by mail. hedgehogan eligible refund of $520 multiplied by the number of consumers in the LLC must be paid.

Is there an annual fee for LLC in Ohio?

Perhaps you are looking to start a cool limited company in Ohio. People think that it is difficult and expensive to create a large LLC. However, this is usually not difficult and the cost varies from state to state. We have all the information you need about the costs of setting up an LLC, specifically the costs of an LLC in Ohio.