By Type (2)

Single member operating agreement LLC –? For use by an individual owner who is likely to want to describeShare your company’s procedures and policies with many people. With the completion of the business, the owner is separated from his business, relieving people of any concerns about private property.

â?? Select A Company Name

All organizations must register a unique company name when searching for an LLC. To determine if a name is already registered with the State of Ohio, enter it in the “Company Name” field on the Secretary of State’s Business Search website and click “Search” to display the results. If the same name is already in use, the task must be repeated until a unique name is found.

Does an LLC need an operating agreement in Ohio?

Here are the methods you should use to register a particular LLC in Ohio. For more information about starting an LLC in any state, see How to Start an LLC.

More Usage Information

on this site with material facts, consistent with security monitoring and review. For security reasons, and to successfully ensure that the public service is still available to users, this government computer system provides network traffic monitoring programs to detect unauthorized attempts to download or tamper with change notices, including attempts toprevent users from using the service.

Why Does An Ohio LLC Need To Have An Operating Agreement?

An Ohio Limited Liability Company must have an operating agreement for a company that cannot act on its own behalf. An LLC needs human beings to operate, other people (and legal entities) to run the business.

What Is An Ohio LLC Management Agreement?

LLCs come in all shapes and sizes. , goals. They are also very flexible in terms of structure. For this reason, it is recommended to create a functional and clear set of rules and procedures that your LLC and its partners (owners) must follow in order to avoid disagreements or lengthy debates on how to proceed on individual issues. .

>

In?? Legal Representatives

Each LLC in Ohio must select a person who may be an agent to process standard LLC forms on behalf of the corporation. This could very well be someone who is a state resident, or a partnership or corporate group, LLC with a business address, often in the same state.

Corporate Law Operating AgreementsOhio Statements

While an Ohio LLC does not require an operating agreement, it is still a smart business decision, especially if you work with Rest. A business agreement can protect you in the event of a legal dispute between partners. It also ensures that members only agree on the purpose and structure of the LLC.

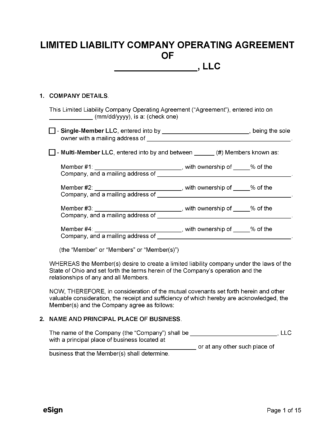

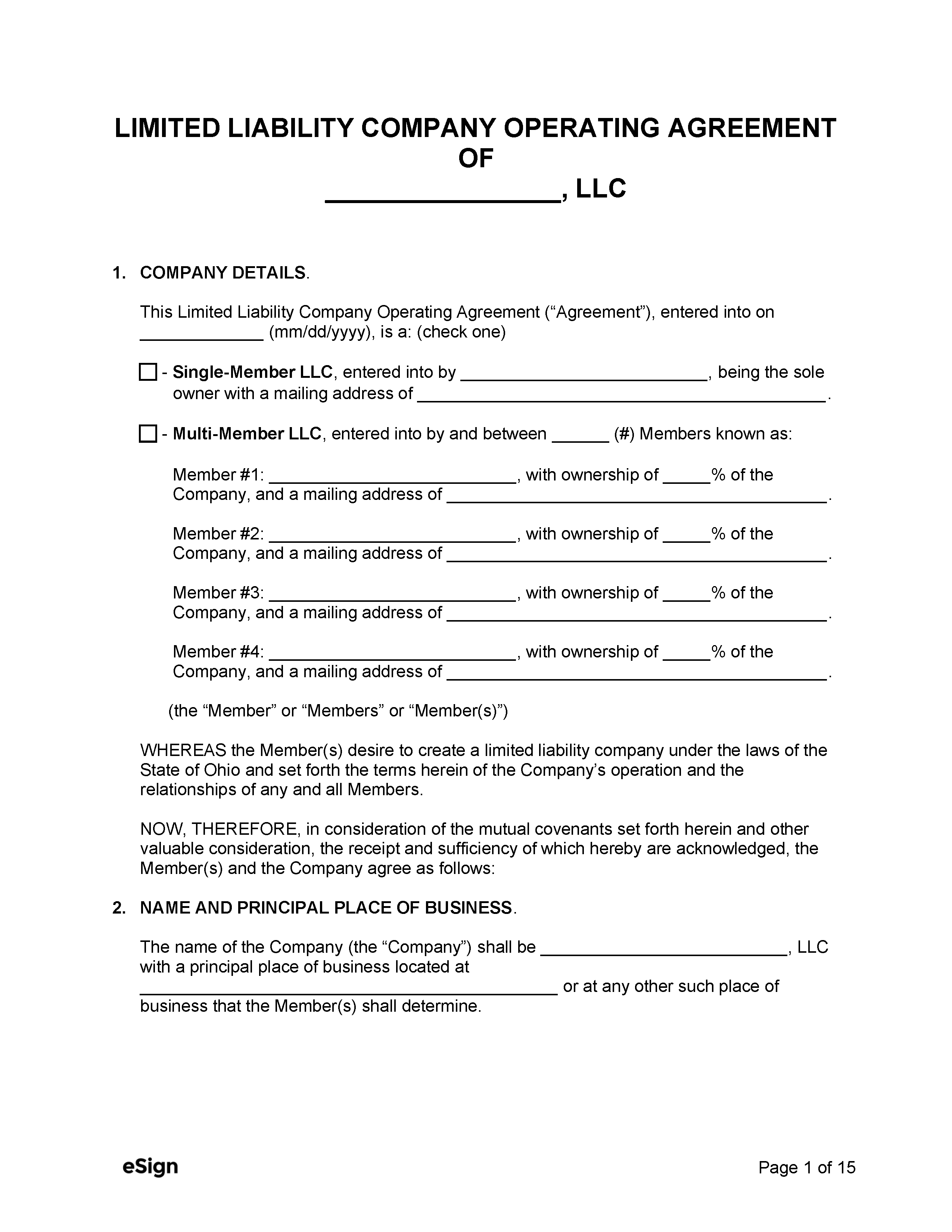

Sample Ohio LLC Operating Agreement

. legal information. questions to provide you with a different operating agreement tailored to your amazing business. You will also have access to their entire library, business documents, contracts, and other important legal documents.

Ohio LLC Operating Materials

The Operating Agreement is a document that details the activities LLC. System of organization and operating procedures. Optional topics for an LLC can be discussed with one or more members. Although these determinations do not even affect day-to-day operations, they must be made for legal reasons.

Here Are The Steps You Need To Take To Register A Companyand Limited Liability Company (LLC) In Ohio.

A Limited Liability Company (LLC) is a way to legally structure a business. Each of our companies combines the limited liability of a corporation with the flexibility and informality of a partnership or individual ownership. Any business owner who wants to limit that person’s personal liability for business credit card debt and lawsuits should consider forming an LLC.

How do I file an operating agreement for an LLC in Ohio?

The Ohio LLC Operating Declaration is a legal document between the professionals (participants) of a business that establishes our own rules for its operations. As in the memorandum of association, members and their shares of ownership are regulated. The agreement should include provisions such as policing, member responsibilities, capital investment, and profit sharing. All participants are required to sign up.

Does an LLC operating agreement need to be notarized in Ohio?

Any Ohio LLC is almost certainly recommended, but not required, to have a great operating agreement to keep the company going from incorporation to dissolution. This ensures that, in turn, all LLC members understand their roles and responsibilities. This page will help you draft an Ohio operating agreement.