What is a Wisconsin Taxpayer Identification Number (EIN)? The Wisconsin Federal Tax Identification Number, also known as an Employer Identification Number (EIN) or Federal Tax Identification Number, is a unique nine-digit identifier assigned by the Internal Revenue Service to individuals for tax purposes for corporations, nonprofits, trusts, and trusts. estates. .

Applicable Laws And Regulations

This document contains clarifications and interpretations of Ch. 71, Wisconsin Statistics. and s. 14, tax Wisconsin Adm. Code promulgated on October 13, 2021

Explanation Of Employer Tax LiabilityEmployer (Publication 15-A 15 & 15B)

Publication 15PDF provides information on employers’ tax liability. You received from taxpayers, tax deductions and what tax benefits to claim. More advanced topics are covered in Publication 15-APDF, and information on many employee benefits can be found in Publication 15. We encourage employers to download these publications from IRS.gov. Copies may be requested online (search for “Forms and Publications”) or by calling 1-800-TAX-FORM.

Do I need an EIN in Wisconsin?

If you are a business owner in Wisconsin, you should know how to get a taxpayer identification number before you start your business. Most businesses require a singlesolution and all businesses can benefit from it, but what is the best way to get it? Nonprofit organizations, LLCs, corporations, partnerships, and sole proprietorships may require a tax identification number depending on how they operate. Luckily, it’s easy to get a taxpayer identification number these days if you use the correct application method, especially since much of the taxpayer identification number preparation process is very complicated to get a Texas taxpayer identification number or your Ohio taxpayer identification number. . Either way, these tips and tricks will teach you everything you need to know to quickly get a phone identification number for your Wisconsin business.

Steps To Obtain A Wisconsin EIN

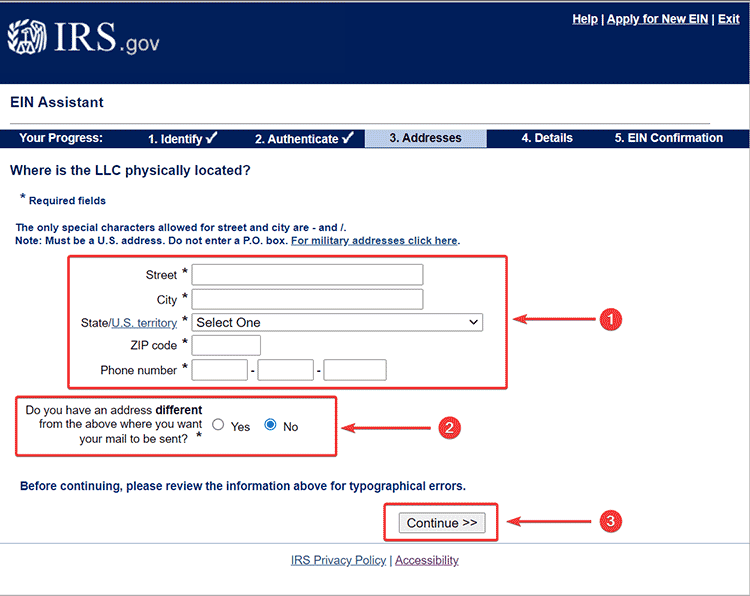

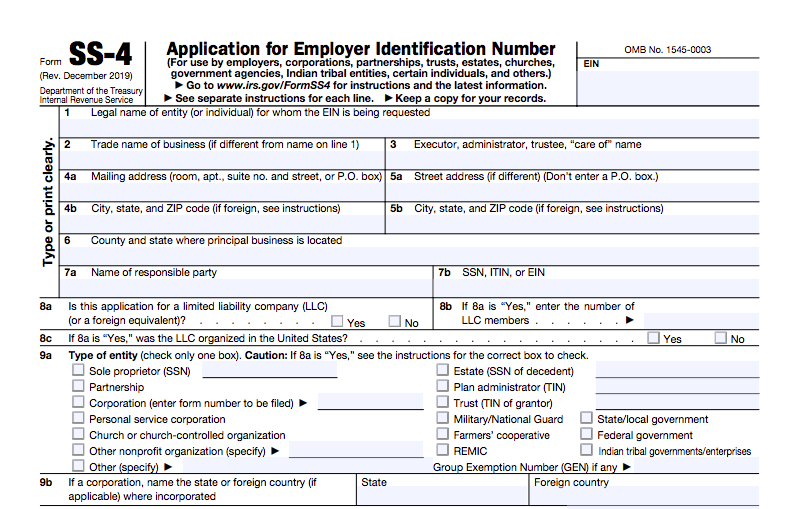

To obtain a tax numbers an identification number, you must register your company with the government. There are different ways to do this and you always repeat the same basic options. You must provide key information about yourself and the business as a partner, as well as about your market as a whole. If you collect this information in a timely manner, you will be able to quickly complete the application and eventually your tax identification number.

How Do I Get A FEIN Number?

Identification numberWisconsin Employer Information (EIN) is important for employers who pay wages to help you withhold Wisconsin or other income taxes. Women support the demand for retention. Apply for this number online using the Internal Revenue Service Registration Form (BTR101), available from the Wisconsin Department of the Treasury at 608-266-2776. (This is the same form used to obtain a vendor license.)

Wisconsin Identification Card

The external tax burden for obtaining a Wisconsin Federal Taxpayer Identification Number (EIN) is also for you, probably need a Wisconsin tax ID. This ID is required to pay corporate taxes, state income tax, and/or sell the tax information you sell. Typically, the state tax identification number is used for the following purposes:

DUNS (universal Number System)

627906399.(NOTE: This number should only be used inout-of-school support grants, a unique organization number (UEI) may be required instead. UEI likely to be required after April 2022)

Tax Information

In general, please note that a retailer doing tax-exempt sales of federal or state of Wisconsin water heaters may accept Form S-211 as proof that the sale to a government agency, normally made by the State of Wisconsin, is tax-exempt. . County and land taxes on sales and use, as well as exhibition taxes. This certificate may be accepted in lieu of a purchase order or similar written document identifying a government agency as the purchaser in accordance with Wisconsin Tax Bulletin 97 – July 1996. The City of Madison, Connecticut, as a municipality, is exempt from the burden of federal excise taxes. taxes (registration number 39-73-0411-K) and Wisconsin taxes in accordance with Wisconsin law 77.54(9a). federal tax identificationnumber 39-6005507. A completed Wisconsin Tax Department Form S-211 is attached. Our tax exemption: 008-1020421147-08.

Institutional Information

The following information is often questioned by funding agencies. If you don’t see information about the organization on this list that many of you need, please contact the Office of Grants and Research.BUT1. Official name and information about the organization requesting assistance:University of Wisconsin Board of Trustees, d.b.a. UW Green Bay2420 Nicolet Cove Boardwalkgreen WI 54311-70012nd constituency: WI-0083rd Senate District: 2nd4. Employer Identification Number (EIN): 39-18059635. Unique Identification Number (UEI) of Brand Management System (SAM): GBJMUZDMLN84.6. DUNS number: 7824318037. To whom the check should be written: De et College Wisconsin-Green Bay8. Authorized representative of the organization:The list to sign on behalf of UW-Green Bay includes the Provost and Provost for Academic Affairs, the Associate Provost for Graduate Studies, and the Director of Scholarship and Research.9. CAGE CODE: 1J1S410.FICE#: 00389911. ?Animal Insurance (AWA):12. Federal Insurance Number (FWA) of test subjects: 00016002, effective August 14, 2024.13. Systemic Management Registration Award: valid and valid until April 16, 2020.14. Additional benefit rates15. Overhead Pricing Letter16 Agreement. Agency IDC Cognizant: Federal Ministry of Health and Human Services17. Tax Exemption Letter18. Link to last calendar calendar year check

Wisconsin VAT ID Listed At $39

and Vendor Authorization, Wholesale ID, Resale ID, reseller ID.

What Is A Wisconsin LLC?

This post provides information about the tax treatment of a Wisconsin LLC. For LLC owners or members, an LLC presents a limited liability issue and can generally be treated as a pass-through corporation for state and federal income tax purposes.

Can I look up an EIN number?

If you have already applied for and easily obtained an Employer Identification Number (EIN) for your business, but have since lost that situation, try one or all of the indications to find the number:

How much is an EIN in Wisconsin?

Here are the guidelines you should follow to form an LLC in Wisconsin. For more information on how to set up an LLC in each state, see Nolo’s How to Set Up an LLC article.