Names Adopted By The DBA

Here is a brief overview of the actual types of large business structuresavailable in Minnesota. You may wish to consult with a lawyer or accountant, or other source, before deciding what type of business to register.

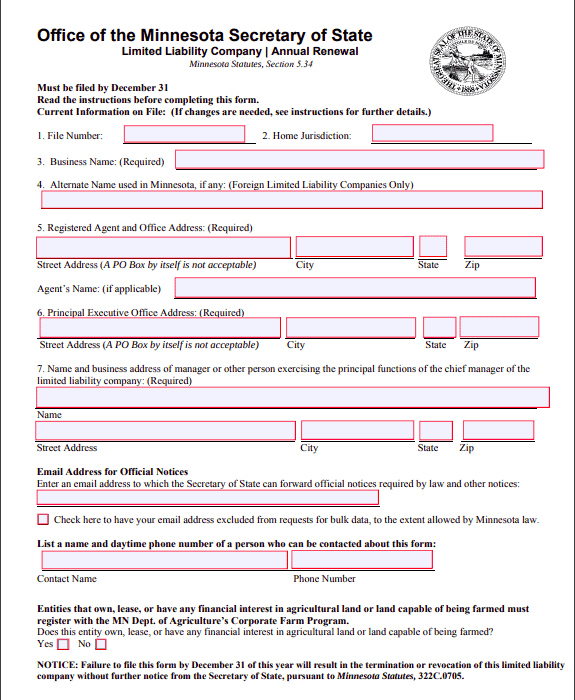

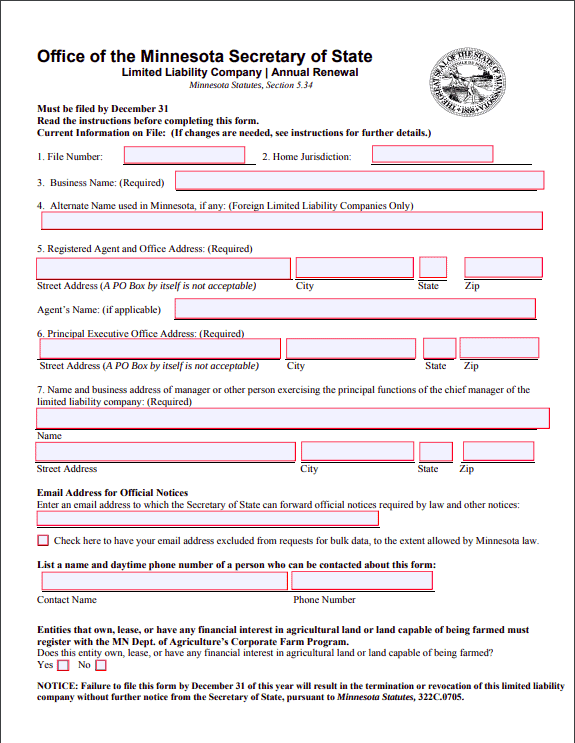

When to file a Minnesota Secretary of state business renewal?

The MN Secretary of State Business Extension for an LLC must be filed by December 31st of each year to keep the LLC in good standing in your state. Reading time 3 minutes 1. Two ways to apply for an annual renewal

Common Reasons For Rejection Of Documents

Documents are usually reviewed on the day they are actually received. In case of complex documents and/or high seasonal workload, the review may i. to say it. A. Take one day after receiving. Non-deferred applications will likely be reviewed the day after they are submitted.

Two Ways To Renew Your Annual Application

You have two options to apply: online or by mail. While you can choose the plan that suits you best, the trust of companies lies more in applying online. This is because it allows for faster processing times and is likely easier to fill. If you are trying to go through the mail, it can take four to seven days, while an online application requires significant processing time.

Minnesota Annual Return Deadlines, Then Minnesota Collection

H2>Your AnnualThe Report Can Be Submitted Online, In Person, Or By Mail. To Obtain A Paper Form Or Submit It Online, You Must Visit The Minnesota Secretary Of State Website.

Minnesota Annual Return Fees And Instructions

If you are a business entity or You LLC, you probably won’t be able to pay registration fees. However, he may still have to submit a report by 31 December. Minnesota is unique in that there is no charge for raw reports. The only type of business that charges a fee is the foreign business, which must pay $135 to file a report with the Secretary of State’s office. Partnerships are not required to file an annual return in Minnesota. At this level, there are no late fees, no medical history, but you must pay $45 to reopen if the suit dismisses you.

What Is Minnesota’s Annual Income?

LLC and corporations in Minnesota must do an annual renewal, which is known in other states, even if they file an annual return. The repository, of course, provides the state government with up-to-date information about all your transactions. And foreign domestic corporations and LLCs must file an annual viability report. National non-profit organizations are also required and must be represented.

Minnesota Annual Report Information

Businesses and nonprofits must file annual returns to stay on track with village secretary. Annual reports are required in most cities. Deadlines and fees vary by state and entity type.

Here Are The Steps You Need To Take To Form A Limited Liability Company (LLC) In Minnesota.

A limited liability company (LLC) is indeed a legal way to structure a company. . It combines the limited liability of any corporation with the flexibility and informality of a partnership or individual ownership. Any business owner who wishes to limit their personal liabilityLiability for business debts and lawsuits, should consider forming an LLC.

How often do you have to renew LLC in Minnesota?

Here is what you need to do to set up a good LLC in Minnesota. For more information about starting an LLC in your state, see Nolo’s article How to Start an LLC.

How do I reinstate my corporation in Minnesota?

The Minnesota Secretary of State (SOS) may authorize the reinstatement of domestic and foreign corporations after dissolution or annulment. SOS accepts reintegration documents by mail, in person or online. You can pay additional Minnesota SOS registration fees by cash or check for traditional registration and by check or credit card for electronic registration. Writes checks for fees due to the Secretary of State of Minnesota.

How do I file last year of an LLC in Minnesota?

If you want to be able to register and manage a limited liability company (LLC) in Minnesota, you will need to prepare various documents as wellsubmit them to the state. This article covers the basic tax filing requirements for an LLC in Minnesota.

When do I have to renew my LLC in Minnesota?

The MN Secretary involved in the state business renewal for an LLC must file by December 31 of each year to ensure the LLC remains in good standing with the state. 3 Minute Read # 1. Two ways to apply for an annual renewal 2. How much does it cost to apply for an LLC business renewal? 3. What happens if you don’t renew your subscription? four.

What happens if you don’t renew your business license in Minnesota?

Your organization will be “legally dissolved” (no longer recognized as existing in Minnesota) unless you file an annual renewal. If your company was legally dissolved, your company can retroactively reinstate (while the name is still available) to apply for the current week’s renewal and pay the fee.

What is the “Minnesota Business snapshot?

The Minnesota Office of the Secretary of State has launched a new initiative to better serve the people of Minnesota and the state’s business community, the Minnesota Business Snapshot.