Starting A Career? Get Your Free Personalized Step-by-step Guide!

Learn something about creating the licenses you need to start your business and avoid fines. We will answer with you a few questions about registration; Please tell us your legal form, source of information, and location.

How much is NJ annual report fee?

Every business in New Jersey is required to file an annual return. This simply includes verifying your registered agency and address, and paying a $75 registration fee.

Get The New Jersey Annual Reporting Service Today!

START

New Jersey Annual Report Information

Businesses and non-profit organizations must prepare annual reports to keep up with Secretary of State. Annual returns are required in most US states. Deadlines and fees vary by state on and device type.

What Makes New Jersey’s Annual Report Great?

Including your organization is just one of manymany reporting requirements. In fact, in addition to regular tax returns, most states require corporations and LLCs to file fantastic annual returns. If you lose the case, your new business may be terminated or cancelled. Some states, including New Jersey, may require an annual Corps Pay franchise fee. The annual income differs from the New Jersey LLC Application filed with the Department of Taxation.

The Annual Income Differs From This LLC Application:

Annual income (and fee $75) is filed with the team’s tax office, and it’s not a real thing, like the LLC affiliate tax (also paid annually) that is filed with the entire unit’s tax office.

p>

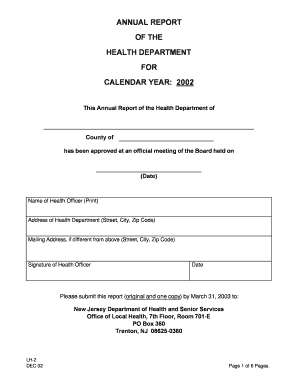

Nj Annual Report

The Internet Services Annual Report is an annual document that charitable and commercial organizations are required to submit. When used, both Limited Liability Companies (LLCs) and Limited Liability Partnerships (LLPs) must provideWell, the same e-book. The content of the report describes the state of the organization. The Ministry of Revenue sends reminders to businesses a few months before the deadline. Corporate reports are usually due on the last day of the New Jersey company’s school month.

What Is An Annual Report?

New Jersey LLC’s annual report is reported to the New Jersey Department. Have you made any changes to your business in the last year. You may need to verify members, registered agents, and other important information.

Annual Return

The State of New Jersey requires the client file to contain an annual return for your current LLC. The report must be submitted online through the DOR Corporate Online Annual Report website. To access the online form, you will need your state-issued LLC number and the original organization date. Only a small amount of information is required to complete the entire report – primarily the name of the registered limited liability company and the address of the limited liability office provided by theGentom.

The Costs Of Forming A Foreign Limited Company In New Jersey

If you already have an out-of-state LLC and also want to expand your business in New Jersey, Jersey, you must register your LLC as a foreign LLC in New Jersey.

What Is Annual Filing?

Annual Filing is the process of updating your business records with state authorities annually Jersey. Businesses such as corporations, LLCs, and partnerships are required to file an annual return in every state in which they do business. Failure to file annual returns with the New Jersey Secretary of State’s Department of Business results in interest and late fees, resulting in a complete loss of “good reputation”. and active nature, and subsequent administrative dissolution of your company and your business name. Depending on the design and style of the company and its incorporation, incorporation or qualification status, you may be required to pay certain annual return filing fees with different? business deadlines for submitting documents online or by mail. Filing an annual return in New Jersey, like incorporation, is a legal process that is best done with the help of corporate establishment lawyers. Let the professionals at Spiegel & Utrera, P.A. ensure the accuracy and timeliness of your New Jersey annual returns.