You can form an LLC with multiple members/managed members/managed managers in all 50 states.

Are You Starting An Operation? Get Your Free Personalized Step-by-step Guide!

Find out what forms and licenses you need to start your business and avoid fines. We will try to come up with a few onboarding questions for you; Please tell us your legal form, current market and location.

What type of LLC is best?

1. What type of LLC do I need?2. Sole proprietorArt / individual entrepreneurship 3. General partnership4. Family partnerships with limited liability5. Series OOO6. LLC with limited access7. Company L3C8. Anonymous LLC9. LLC managed by a member or LLC managed by a manager

What Is N.J. LLC?

New Jersey Limited Liability Company, or N.J. LLC, is a New Jersey hybrid corporation. which combines the characteristics of late ownership, individual ownership and corporation. It is important to note that most LLCs provide that their members are not personally liable for the company’s debts. A

Choose Information For Your New Jersey LLC

If you are registering this LLC in New Jersey, you must first select a company name. Accordingunder the laws of the State of New Jersey, the name you choose is different from the names of any legal entities registered with the Internal Revenue Service. This requirement will help you ensure that customers and members of the general public do not confuse your business with another.

Choose A Name For Your LLC

Your New Jersey law requires the name of your LLC to include my words “Limited Liability Company” or the abbreviation “L.L.C.” The name of your LLC must be different from the names of other corporations already registered with the New Jersey Division of Revenue and Corporate Services. Name availability can be checked in the New Jersey Recording Services provider database.

It Is Easy To Form An LLC In New Jersey

To register an LLC in New Jersey, you will need $125 for filing a Certificate of Incorporation in the State of New Jersey. You can apply online, usually by mail or in person. The Certificate of Incorporation is the legal document that authentically registers your New Jersey LLC.

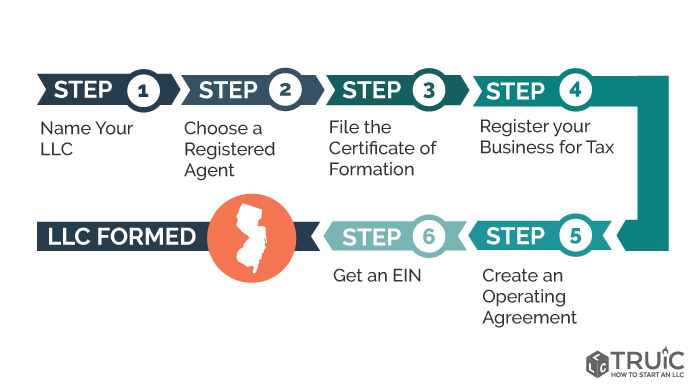

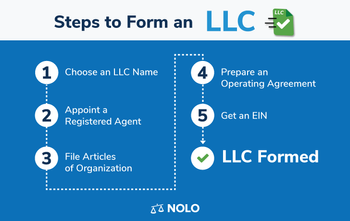

How To Register An LLC In New Djersey

The establishment of a new corporation is associated with many problems. The following are some of the key steps needed to ensure real business compliance when deciding to form your own form of LLC in New Jersey. For more resources on starting an LLC for your business, visit our webinar “Things to Know When Deciding to Incorporate a Small Business.”

Name Your LLC In New Jersey H2> Give The LLC A New Jersey Name. Finding The Perfect Name For Your Business Right Now Can Be Both Challenging And Fun. You Need To Find Something Memorable That Reflects The Services You Offer And/or Your Products. P>

It Will Probably Be Easy To Register An LLC In New Jersey

You can register an LLC in New Jersey online using additional services of the company. Submit training related to the New Jersey State Certificate to the Revenue Department. The cost of a New Jersey LLC is $125.

Creating A New LLC

A New Jersey Limited Liability Company (LLC) presents withBoth have a hybrid structure business plan that provides personal liability protection. in the event of litigation. If your favorite LLC is sued, your personal assets (such as your home, vehicles, and bank accounts) will remain safe from creditors.

Can I Reserve A Company Name Somewhere In New Jersey?

Yes. If you are not yet ready to register your LLC or would like additional assurance that the desired name will actually be available when you register your business, you can reserve your company name by filing a Name Reservation Request affected by the New Jersey Internal Revenue Service. It costs $50 and reserves the company for 120 days.

What is a domestic LLC in NJ?

A domestic limited company is generally a legal entity that creates an industry within the business owner’s staff. Internally controlled companies with liability Limited Liability Companies where they match the state they intend to make if you need to run a business. Domestic limited liability groups differ from partnerships or sole proprietorships because their registration requirements for recognition as a legal entity are different.

What are the different LLC classifications?

1. Tax classification options for LLC2. Does not affect the protection of private assets3. Benefits of corporate tax classification4. Management structure5. Options for LLCs taxed as corporations6. How to choose the tax classification of your LLC7. Refinement of your W-98. State tax classification through LLC