It’s Very Easy To Register An LLC In Vermont

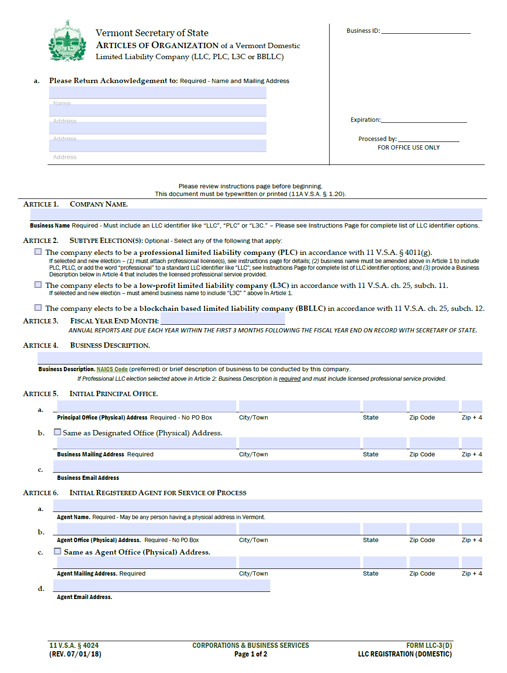

To register an LLC in Vermont, you will need information about your memorandum of association from the appointed Secretary of State of Vermont, which costs $125. You can apply online, in person or by mail. The Article Organization is a special legal document that formally establishes your limited liability company in Vermont.

Here Are The Steps Individuals Must Take To Open A Limited Liability Company (LLC) In Vermont. Limited A Legal Corporation (abbreviated As LLC) Is A System Of Legal Business Structuring. It Combines The Limited Liability Of A Corporation With The Flexibility And Informality Of A Partnership Or Individual Ownership. Any Business Owner Trying To Limit Their Personal Liability For Late Payments And Lawsuits Should Consider Forming An LLC.

For Foreign Companies:

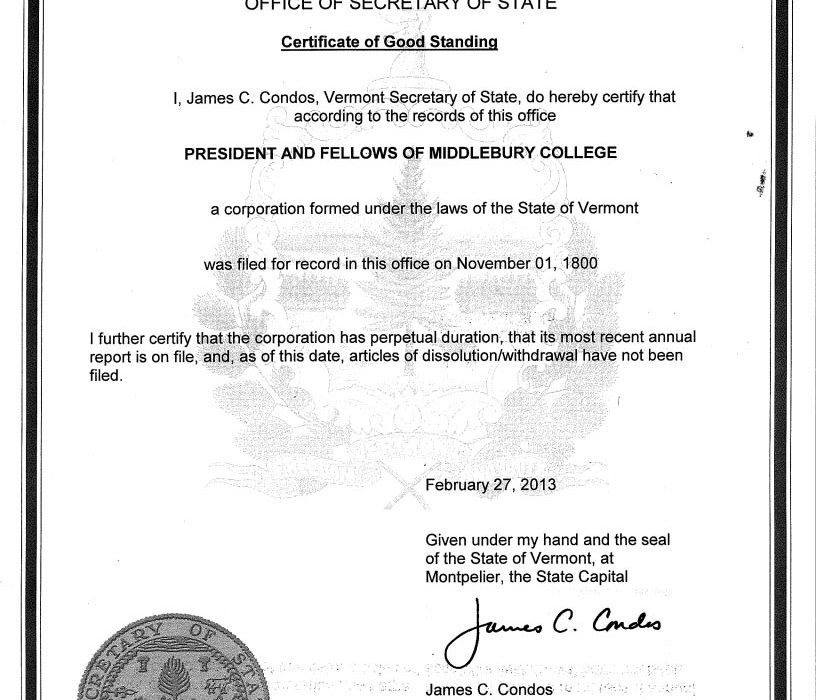

To include a certificate of authority from Vermont, you also, should inningsand documents:

Incorporation In Vermont Is Generally Easy

Incorporation in Vermont is a simple process that is accomplished by filing articles of incorporation with the Secretary of State. In the following guide, I will personally show you, step by step, how to register a company in Vermont. . This application is a type of business that is only available to commercial organizations whose primary purpose is to achieve a public good purpose by complying with the legal requirements of Vermont LLC in the State of Vermont. Creating a unique business depends on many interrelated issues. The Highlights follow some of the important steps you need to keep your business running smoothly when you decide to open an LLC in Vermont. To learn more about starting a large LLC for your business, watch the webinar “What you need to know when deciding to register a small business”.

Limited Liability Company??nity

The structure of business owners their business as a Limited Liability Company (LLC), which is an unincorporated higher commercial enterprise, in order to take advantage of the liability of a corporation and its tax benefits.individual ownership.

VT LLC vs. VT Corporations

Now that we have looked at these basic characteristics that apply to all agencies and LLCs, we will now look at the specific characteristics that distinguish an LLC or Vermont Corporation from a number of other states, which gives us a clear answer on which company to choose for your business. Each state has its own specific and unique laws and tax laws that govern its businesses and corporations, and some of these unique details should be considered when choosing your legal entity. This section contains detailed information about Vermont LLC and I would recommend Vermont Corporation.

Steps To Register Article Organization Online

If you wish to apply to register Vermont Business LLC via offline type, you can easily do it by email.Email. Follow the instructions below to report Vermont’s Articles of Incorporation by mail.

Here’s A Quick Overview Of Starting A Specific Vermont LLC

Vermont LLC (limited liability company) is a hybrid business- a structure that, according to experts, can be used to manage work or to make decisions about the purchase of assets such as real estate, cars, motor boats and aircraft.