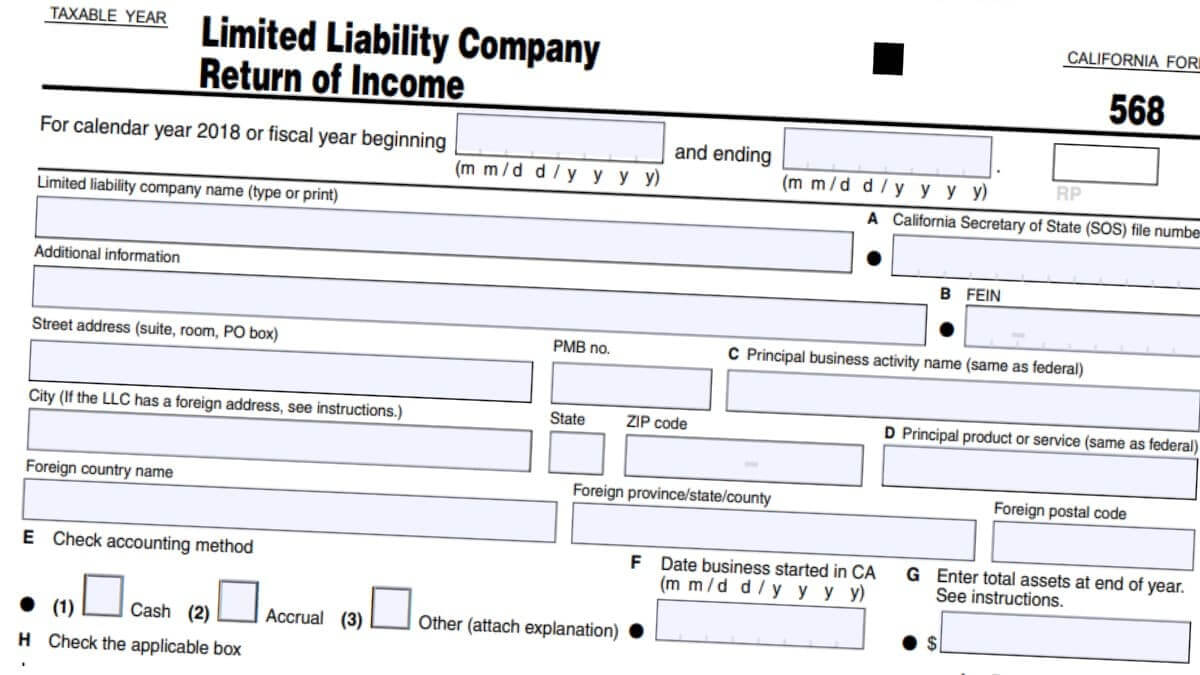

Use Form 568 to: Determine a specific LLC fee amount (including unaccounted for business unit fees) based on total California income. Report LLC Fees. Annual taxes are usually reported. Declare and pay a lot of taxes for dissenting non-resident members.

Does a single member LLC need to file form 568?

We require SMLLC in file form 568 even though they are considered disregarded legal entities for tax purposes. They are subject to annual LLC fees and credit limits.

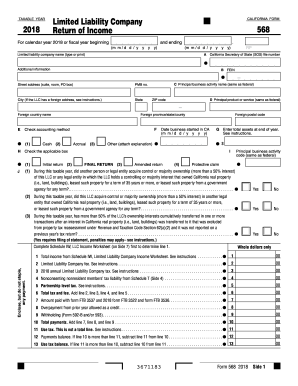

What Is A Form 568?

A Form 568 is something that companies wishing to become owners when forming an LLC often have the opportunity to ask questions. Form 568 is the income statement that many small limited liability companies (LLCs) are required to file in your state of California. LLCs that are classified as a separate disregarded entity or require a partnership to file Form 568 with the California Franchise Tax Board along with Form 3522.

Add Limited Liability Statement (Form 568)

To Add Form 568 With Limited Response?Responsibility To The California Declaration, Select File > Client Properties > California Tab, And Select The Form 568 Limited Liability Company Check Box In The Other Declaration (n) Section. This Allows For 100% Renewal, Return, Filing Instructions, And Consolidation Of Multiple Federal Entities Into A Single Limited Liability Company (LLC). The Input LLC Screens Are In The Limited Liability Folder. To Create A Computer LLC, Enter Form 568: CA With State Usage Code 3 And Secretary Of State’s Unique Account Number (SOS) In The State Of Operation Code Section On Federal Screens C, Rent, F, 4835, Or K1. All Activities With The Same Account Number Are Almost Always Contained Within The Same LLC Activity Application. All Account Numbers Must Be 10 Or 12 Digits, With The First Two Digits Being 19 Or Whatever. An LLC Unit Will Not Be Created If An Invalid Code Is Entered. If The LLC Has Not Yet Been Assigned A Number, Enter “None” In The State Number Field.

Form 568 Instructions

Form 568 lists returns, coverages and withholdings, taxes, and all fees.financial portions of your limited liability company LLC. To complete it, you must pay close attention to each line.

California Franchise Tax Exemption

In 2020, the California legislature passed a law that explicitly exempts certain businesses from paying California franchise tax during the first tax year. California LLCs, LPs, and LLPs incorporated between January 1, 2021 and December 31, 2021 will not be required to pay California franchise tax for the first tax year. These businesses continue to pay California franchise tax starting in their second fiscal year. For more information, see California State Assembly Prop 85.

What Is Form CA 568?

Form CA 568 is a type of tax receipt. For It llc, this was perhaps the most important tax document. All other additional financial documents and tax documents must comply and comply with what ultimately leads to the CA 568 condition. You can think of the CA 568 system as a “basic tax document”.document for your LLC. /p>

Who Needs A 568 Form?

LLCs can be considered more like partnerships, ignored corporations or processed corporations are classified. In California, they must file various types of tax returns with the IRS office. Only partnerships with an LCS rating are required to complete the 568 submission and contact form.

Learn More About California Form 568

We last updated California Form 568 in March 2022 from the California Franchise Tax Board. This form applies to income earned in fiscal year 2021 with tax returns due in April 2022. We will update this home page with the new 2023 institution version when it is normally updated, which is available from the California government.