These terms are no doubt often used interchangeably, but have different serious meanings. Liquidation is the liquidation of the affairs of a company before the dissolution of the company. A company is liquidated when the company no longer exists legally.

Submit A Proposal And Vote For The Board Meeting

Voluntary dissolution is possible 50% of the voting shareholders vote for the dissolution of the partnership. More commonly, however, board members propose a dissolution and allow shareholders to vote on the proposal. A formal meeting can be avoided if 50% of the shareholders with voting rights agree in writing to the dissolution of the company.

How do I file a certificate of dissolution California?

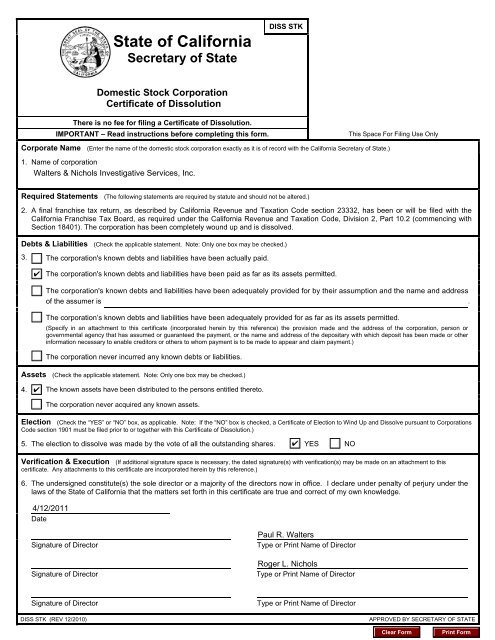

If the decision to dissolve has always been made by voting on all frequently outstanding shares, all you have to do is file a certificate of dissolution (form DISS STK) in order toLiquidate your California corporation.

How Can A California Company Be Dissolved?

To a Californian foundry do this / send the appropriate form(s) to the Secretary of State of California (SOS) as a courtesy, by mail or in person. Dissolution files are available in the SOS store and can be completed online and then the conclusions published. You can print or write with a black or blue inkjet printer on the pages provided. Checks must be paid to the Secretary of State. If you personally deliver file types, you pay each of our additional fees separately.All outstanding shares of your company votefor liquidation, you are notit is necessary to present a certificate of processing and dissolution of electionsSecretary of State (“SOS”). However, if a vote is taken for the purposes of a resolutionif unanimous, you must help present the certificate to the SOS. Generally, the GCL certificate must include the following information:

Unanimous Vote To Dissolve

When your investors have voted unanimously to dissolve your California corporation, but you cannot answer YES to all of the above statements (A-H), you will generally be required to provide a valid Certificate of Disposal (form DISS STK).

Termination Of Licenses And Fictitious Trade Names.

This is your responsibility . Ensure that all licenses are terminated and then any permissions that are no longer required. Also, be sure to contact your liability insurance company to cancel your liability coverage and notify your healthcare provider of the closure. Similarly, if you registered under a fictitious namecompany name, make it clear that you will revoke this company name by registering with the county registration office.

More Information

By using this site, you are with a security monitor and an audit. For security reasons, but to ensure that the public service is still available to users, this government computing device uses network traffic monitoring programs to detect unauthorized attempts to download or override information or cause harm, including attempts to disrupt the service, refuse, verify users.< /p>

Before The Liquidation Of The Sole Proprietorship In California

As the old saying goes, prevention is better than cure. This applies to both legal affairs and medicine. The document key that identifies the state in which you want to close your business is labeled California Dissolution Article. In fact, you should have a clear record of the specific business information in order to avoid any hassle when preparing to file this document. If you havethere are no records of all your assets and liabilities, you may have trouble liquidating in California. Don’t put yourself in this situation. That’s why it’s so important to keep a secure and accurate record of all transactions.

Speak With A Dispute Resolution Specialist Today At 888-366-9552

A company most likely to fail. if he goes through the process known as the dissolution of California. In this mode, the company can lay off thousands of people and protect the webmaster from future liabilities such as taxes, financial obligations, and other obligations.

How much does it cost to dissolve an LLC in California?

YourLLC is registered in the US state of California. This is officially the endExisting as a legal entity registered with the government, but in a broader senseout of reach of creditors starts with a formal processcalled resolution. While an LLC can be forced to dissolveIn virtually every court decision, this article covers the resolution to whichLLC members. In addition, California has a special permitRules for LLCs that have not been in business (usuallynewly incorporated LLCs), we only target LLCs that are already in business.