A qualifying certificate is essentially a license that allows a new foreign entity to “do business” in California. In this case, “foreign” means supplied not by another country, but by the state. In particular, this applies to a company incorporated under the laws of any other state or country.

Does California require a certificate of authority?

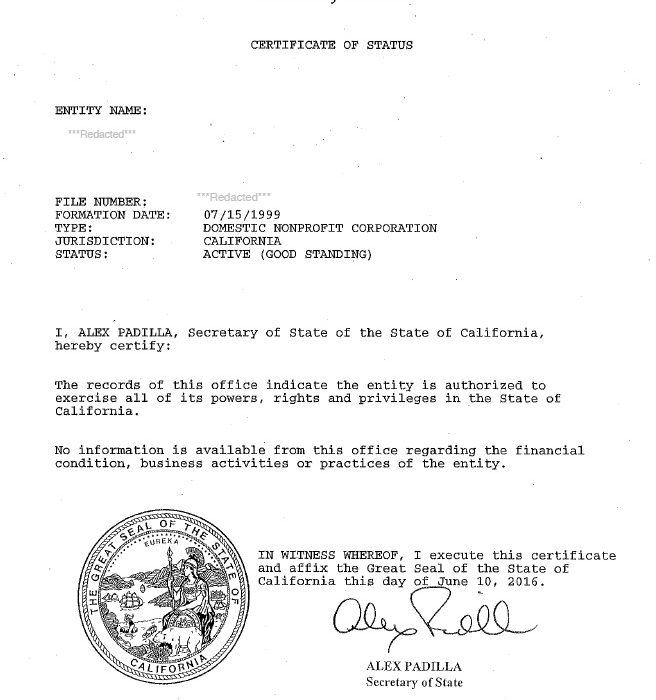

Businesses must register with the California Secretary of State before doing business in California. Out-of-state businesses usually require California’s best certificate of authority. This registers the company as a completely foreign entity and eliminates the need to help set up a new legal entity.

Get A Trust Certificate From Your State Or Country.

If you have already received a company trust certificate, indicate that it has not been used for less than 6 months or is in the process of being used, skipthose this step. If you need help getting a Good Standing certification in your country, I’ll be more than happy to help you for an additional fee. If the corporation is a non-profit corporation, the Certificate of Existence/Certificate of Good Standing must state the corporation’s popularity as a non-profit corporation, or the California Secretary of State must register it as a commercial company. . company and require additional registration fees.

Fill Out An Application

The application you need to file for California certification depends on the type of business you have registered in another state. For example, the proper evidence of authority to designate California as a limited liability company (LLC) is a California Foreign Limited Company (LLC) Registration Form (Form LLC-5). For a limited liability partnership (LP), your organization must apply to register a foreign limited partnership.Private Liability (LP) (Form LP-5).

What Is A California Power Of Attorney?

Corporations must register with the California Secretary of State before doing business in California. Incorporating corporations with another corporation usually requires a California marriage license. Thus, registering a business as a foreign company eliminates the need to create a new final legal entity.

Doing Business In California

Under California LLC law, if you are “doing business” in California, you must sign a foreign company registration agreement with the state of California. What does it mean? Well, as in most states, the California LLC Law does not necessarily define “business activities” specifically in relation to foreign registrations.

California Foreign Qualification

California native is home to 4 .about 0.1 million small enterprises, including domestic and imported enterprises, and is considered the most important engine of economic growth. One of the reasons for creating foreignWhat has always been a part of this California LLC is that the state provides a business location that encourages new investment while lowering all of the overall cost of doing business. This has been made possible through the implementation of various specific incentives, programs and measures such as California Zones of Opportunity, Foreign Trade Zones (FTAs) and funding programs among other companies. Registering with a foreign limited liability company in California will help you access incentive programs as well as open the door to multiple grant applications, greatly reducing your start-up costs for your foreign business.

Alabama – Certificate Of Authority Application

To register to do business in Alabama with a new large LLC or Crown Corporation, you will need the following: $28 Name Reservation Fee, $150 Application Fee, two copies of the Application for the issuance of a certificate of authority. Lawyer and foreign corporation uniform for conducting business throughout the territoryAlabama, a certified copy of your personal articles of association (memorandum of association or articles of association), and a registered professional in Alabama.

California Free Guide To Forming A Foreign Company

California currently charges the standard $0 medical card fee for incorporating a fantastic foreign (foreign) business company (this is short – survived a $100 price drop and will last until June 30, 2023), but other costs remain. To register, you must obtain a California Application and Foreign Corporation Designation (Form S&DC-S/N) from the Minister of State of Arizona. The State also requires Australian companies to submit an initial application within 90 days of incorporation, which is usually accompanied by information that unfortunately carries an additional selling price of $25 ($20 for a report plus $5 for a disclosure). ).

How To Calculate The Late Filing Fee?

The late filing fee is determined by? counting the number of full or partial years since the court liquidated the company in Texas, multiplied by the filing fee. Ready to

Qualify Your California Business Overseas?

Social media is increasingly becoming the preferred method for many companies to connect with their customers, friends and customers. We have made it our mission to find useful information and tools that will help customers grow your business.

What Is A Foreign ID?

A foreign ID allows your LLC to do business in California. It doesn’t matter which ad you originally started your business in. or, in other words, the state in which the entity’s domestic LLC is located. In comparison, the qualification process to register another LLC in California is the same no matter where your local LLC is likely to be based.

How do I get a letter of authority in California?

Are you ready to do business in California? Here you can get a reputable certification that will help you succeed.