This is how you finally present your annual report. If your limited liability company or corporation asks you to file an annual return, you can do so online through your state’s resources. In addition to submitting the annual page, you will also need to pay certain fees – these fees vary from state to state and can range from $50 to $400.

Idaho Statement, Annual Gross Income And Fees

Can’t remember whendi started your business? You can find the due date for the annual return by searching the Idaho Business Database. After clicking on your company name in Search Rewards, the due date will still be listed under the heading “AR Due Date”.

Is There Any Penalty If I Don’t Submit My Annual Return? Submit A Report To The LLC? Yes, If You Do Not File An Idaho LLC Annual Return, The State Has The Right To Administratively Liquidate (close) Such LLCs. In This Case, You May Have To Apply For Reinstatement And Income Tax.

Idaho Annual Report Information

Businesses and non-profit organizations are required to submit annual reports to maintain high quality Secretary of State. Annual returns are required in most states. Deadlines and fees vary by state and enter after the object.

Idaho Annual Return Fees And Instructions

Unlike many other states, Idaho does not always charge a 12-month return filing fee.and to the secretary of state. health service. This applies to all transport companies in the country. In addition, there is no fee if you withdraw after the deadline.

What Is The California Annual Report?

The Idaho Annual Report is a form that must be filed with the State Secretary of State of Idaho. The report provides the state with detailed information about your LLC or business, such as the web address and contact information of famous and important people, in order to finally file an annual report for your LLC. The secretary of state sends a reminder to his own LLC before declaring the principal debt. Can you submit the full annual report online on the SOS website? There is no fee to file a full return.

Do you have to renew your LLC every year in Idaho?

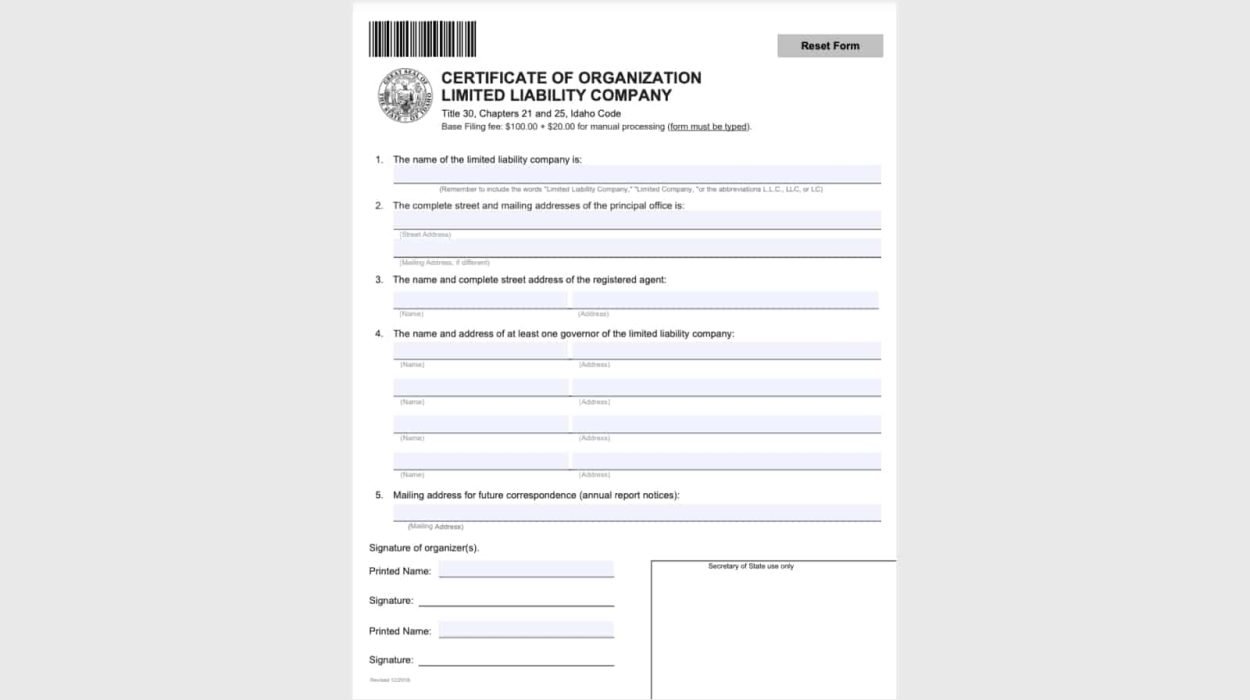

If you want to form and own a limited liability company (LLC) in Idaho, you must prepare and file various forms with the state. This article covers the basic filing and filing requirements for an LLC in Idaho.

Here Are The Basic Steps You Need To Take To Register An Idaho Limited Liability Company (LLC).

Commercial Limited Liability Company ( abbreviated GmbH) is the legal form of the company. HeIncorporates your limited corporate liability with the flexibility and freedom from formalities normally provided by a partnership or sole trader. Any business owner trying to limit personal liability for business debts pending litigation should consider forming an LLC.

Are You Ready To File Your Idaho Annual Return To Submit It?

Social media is becoming an increasingly popular way for companies to communicate with clients, colleagues and customers. We specialize in providing useful information and tools that can help you grow your business. Contributions

Receiving

In Addition To An Approved Copy Of The Organization’s Certificate, Officially Creates Your Idaho LLC. But Your Spending Is Probably Not Over Yet. Here Are Other Fees That You Will Definitely Have To Pay To Start Your Business In Idaho.

What Is The Idaho Annual Report? Why Is This Important?

Consider compiling an annual report detailing your LLC’s annual review. She looks likeA census in the sense that its purpose is to collect the necessary conversational and structural information about every business in Idaho.

How much does it cost to renew LLC Idaho?

Once you have filed your Idaho LLC Annual Return, you can proceed to the next lesson: Idaho LLC Business License with Permits.

How much does an LLC cost in Idaho?

Here are the steps your entire family needs to take to form an LLC in Idaho. For more information on starting an LLC in any country, see Nolo’s article How to Start a Good LLC.