What should an operating agreement with a manager-managed LLC include? A written operating agreement administered by a manager should define both the sources of energy and the responsibilities of the managers as they provide guidance for the needs of the participants, for example in the transfer of shares. There is a lot of land to cover.

Does Indiana require an operating agreement for LLC?

An LLC in Indiana must have an operating agreement because a corporation cannot act on its own behalf. An LLC needs real men and women (and other companies) to run the agency’s operations.

What Is An Operating Agreement?

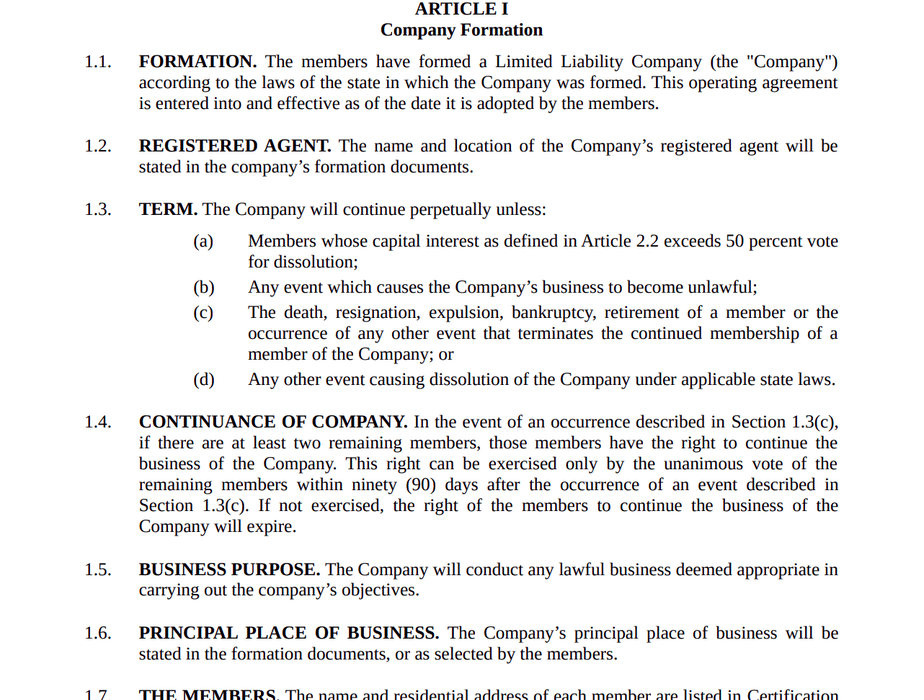

An operating agreement, which is usually adopted when an LLC is formed, sets out the roles of the members involved and defines how the LLC sometimes operates. Unlike your LLC Agreement, you do not need to file this Operating Agreement with the State of Indiana. However, a copy of the internal document must be kept for your records.

What Is An Indiana LLC Operating Agreement?

The Operating Document is an important document that all Indiana Limited Liability Companies must adhere to. must be established by corporate affairs. A good rule of thumb is to create a working agreement that goes through rAnnie stages of the process of organizing an LLC. For example, when filing articles of incorporation with Indiana, Secretary of All States, consider preparing an actual working agreement. While many LLCs believe that a verbal agreement may be sufficient, a written agreement is more reliable in protecting the business.

What Is An Agreement? The Agreement Is A Legal Contract That Details The Structure And Operation Of The Organizational LLC. Topics Not Limited To A Small Member Or LLC With Multiple Members Will Be Filled. While These Provisions Do Not Affect Day-to-day Operations, They Should Be Included For Real Reasons.

Choosing Structure And Registering Your Business

The following is a brief description of each type of form that can be pre-planned in an Indiana entity. Caveat: formalStarting a small business brings both great benefits and legal implications. There needs to be careful negotiation about which form of business to continue to use untilbusiness is working. The Companies Department is happy to help, but cannot provide legal advice. It is also highly recommended to consult a lawyer for monitoring.

Indiana LLC Operating Agreement Template

Free Online LLC Operating Agreements from RocketLawyer and LawDepot help you resolve specific state and court issues so you can create an operating agreement tailored to your needs. case. You’ll also have access to their entire library of custom business forms, contracts, and other important legal documents.

Here Are The Simple Steps To Follow To Set Up A New Limited Liability Company. (LLC) In Indiana.

A Limited Liability Company (LLC for short) is definitely a way to legally structure a business. It combines the limited liability of a true corporation with the flexibility and freedom from partnership or individual ownership requirements. Any business owner who wants to be able to limit their personal liability for business debts and lawsuits shouldConsider creating an LLC.

When To Create Operating Agreements

The recommendation is most useful for creating your existing LLC agreement when you register your business. If all members simply agree, you can always enter into an operating agreement as your LLC matures.

How To Form An LLC Through Indiana: Indiana LLC Ultimate Guide

Research You For example, you understand How to open an LLC in Indiana but worried that filing might be too complicated? Don’t worry, this guide will help you understand the job better.

â? ? LLC Name Decision

The first step in establishing a limited liability company in which a name is chosen that has not yet been approved by the Secretary of State. The name must include one of the following: “Limited Liability Company”, “LLC”, or “LLC”.

If a change to LLC is required. Owners change their LLC operating agreement when its terms no longer fully reflect their member obligations, the company’s surgical treatment, or equity contributions. Rolled over time? some owners are likely to change due to growth, a change in business direction or skill set. As the business grows, a more formal and streamlined structure may be better suited to manage day-to-day operations and long-term development. In addition, some webmasters may invest additional capital in an Internet business to support operations, and their individual purchase must be recognized and protected. If such specific situations arise, it is necessary to amend the main contract.

What is a multi member operating agreement?

A multi-member LLC operating agreement, also known as an MMLLC, is a robust contract that sets out the agreed ownership format and sets out the terms and conditions of a multi-member LLC. In addition, it sets clear expectations regarding the powers, duties and responsibilities of each member. It also sets transparent? financial and social relations between employees and managers. Join Stokes Lawrence shareholders Sean Griffey and Olivia Gonzalez for this webinar on Thursday, June 9th.

How do you add a member to an LLC in Indiana?

Your Indiana LLC amends the change clauses, typically to update the company name, expiration date, member/manager information, principal/mailing address, and change your registered agent in Indiana. You can also use this form to transfer your Indiana LLC to a Home Master LLC.