How much does it cost to set up an LLC in Kansas? The Kansas Secretary of State imposes a $165 fine for filing articles of incorporation. You can usually reserve an LLC name with the Minister of State of Kansas for $30 if you apply online or $35 if you apply by mail.

Annual Report

The Of Shape Kansasrequires you to file a full annual return for your LLC. You can file your annual return with the Kansas Business Center online or on paper using Form LC-50. Annual returns must be submitted on the 15th day of the fourth 30th month after tax. For example, if your tax year is a calendar year, the annual fee must be due by April 15th. In any case, you must declare the file as of January 1st. Current filing fees are $50 for online applications and $55 for card applications.

Do LLC pay taxes in Kansas?

Like S corporations, Set LLCs are see-through organizations and not only have to pay income tax to the federal government or the state of Kansas. Instead, business income is distributed very widely among LLC members, with each individual member subject to both federal and state taxes on their share of the business income.

LLC Name

LLC name suffix must be “L.C.” and “limited liability company”, “LLC”, “LLC”, “limited liability company” or “LLC”. with the state names of other associated corporations, limited companies and limited partnerships to be unique.

Destination-based Sales Tax Rules

Destination-based sourcing rules often tie sales to where your tThe current buyer receives the sold item. Retailers who ship or deliver frequently sold items to their customers. Spaces are required to store existing local sales that deliver to.

Name Your Kansas Business

Finding a nice name for your Kansas business is a new building in the first step up your new internet -business. Before you start compiling the list, please review the following provisions, which also affect company name restrictions:

Kansas Income Tax A

As a business owner, you must file income with Kansas. . tax on the money you spend on yourself. These incomes are included on your personal income tax return through your primary tax return. You are taxed at the standard Kansas state tax rates and may also claim regular benefits and deductions.

Creating An LLC In Kansas Is Easy.

H2> Creating An LLC In Kansas To Register, You Will Need Statement Of Articles From The Minister Of State Of Kansas, Which Costs Between $160 And $165. You Can Apply Forturnout Online Or By Mail. The Memorandum Of Association Is The Document You Use To Formally Register An LLC In Kansas.

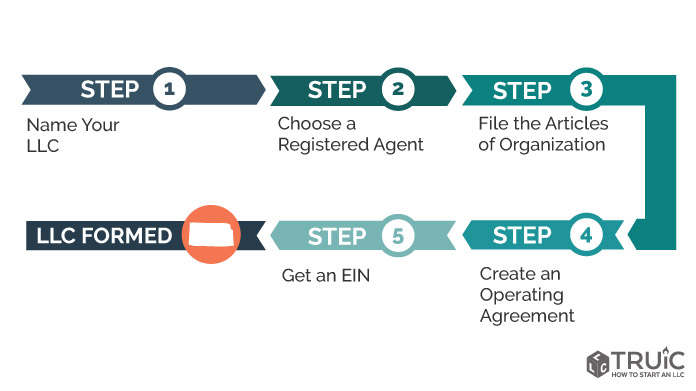

How To Start An LLC In Kansas

Start the LLC formation process by calling your company. . It’s not just about branding: without a unique name, your business doesn’t exist in the eyes of the Kansas state government. As a result, you must decide what name you want your corporation to be before registering with Kansas LLC.

How To Form An LLC In Kansas.

Creating an LLC in Kansas may seem like just about any complicated process, but it’s easy when people know where to start and understand what’s required. The Kansas Secretary of State will usually process your paperwork, taxes, etc. and register you with this organization first. Once registered, you can submit forms, pay fees, and fulfill all other requirements of the Minister of State of Kansas.

Can I Reserve A Kansas Company Name?

Yes. If you may not yet be ready to register your LLC in Kansas, you canValidate your company name for 120 days by submitting a Temporary Company Name Reservation Request to the Secretary of State of Kansas and the purchase of a deposit costs $35 if you deposit by mail or $30. if you’re safe online.

Before Submitting Your Kansas LLC Documents

Kansas has its own set of specific requirements, so do this before submitting anyone who finds out exactly what you need , direct help . Below are the steps you should take before submitting documents to the LLC.

Does Kansas require you to file a tax return?

When you file Form 4868 with the Internal Revenue Service and request an automatic filing time format for your federal tax return, you automatically receive a power of attorney to file your Kansas return. A copy of Form 4868 may be required to accompany your Kansas tax return when filing. It is not a terms of payment file extension.