The Cost Of Setting Up A Foreign LLC In North Carolina

If someone already has an LLC that has decided to move to another state and you want to expand your business in North Carolina, you can do so. You must register your LLC as a foreign LLC in North Carolina.

Get Your North Carolina Annual Report Service Today!

GET STARTED GET STARTED

State Business Tax

In terms of income tax, most LLCs are pass-through entities. In other words, the responsibility for paying federal income tax lies entirely with the LLC itself and lies with our individual members of the LLC. By default, LLCs or their dependents pay no income tax, only their specific members. Some states levy a separate functional tax or LLC levy to gain the privilege of doing business in the main state. However, North Carolina is not one of these states.

Certificate Of Education Application Fees

North Carolina’s Certificate of Education makes up the majority ofexpenses, and this amount may also vary depending on whether you are setting up a local LLC or an Australian LLC. However, you can apply through the North Carolina Secretary of State.

North Carolina LLC Costs: Where To Start? ? £

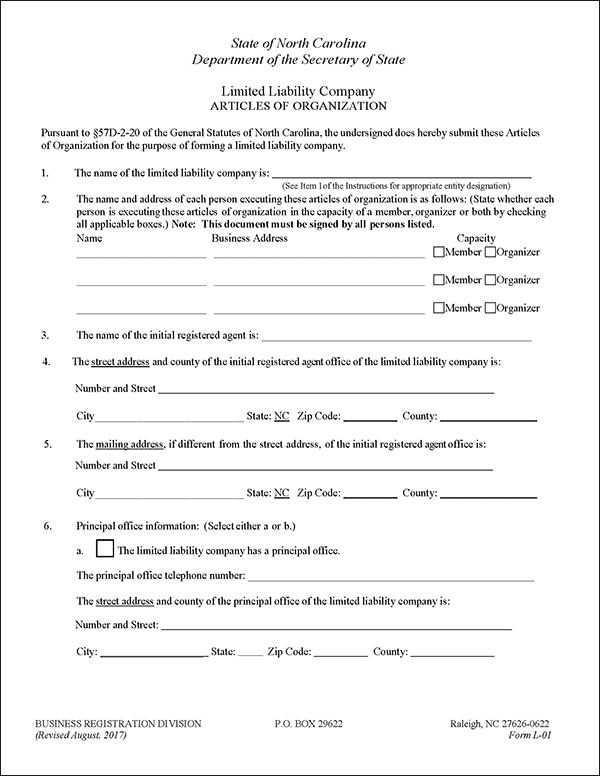

Your LLC starts with you. File the Articles of Incorporation with the Secretary of State of North Carolina. With our North Carolina LLC incorporation service, we can simplify the nature of the paperwork for you. Help us with just $49.

Before You File In Llc NC

Before you apply for In llc North Carolina, prepare the appropriate meeting forms and plan prices in advance. If you are applying to a local or U.S. entity, your documents and attributions may differ from those of a foreign or international entity.

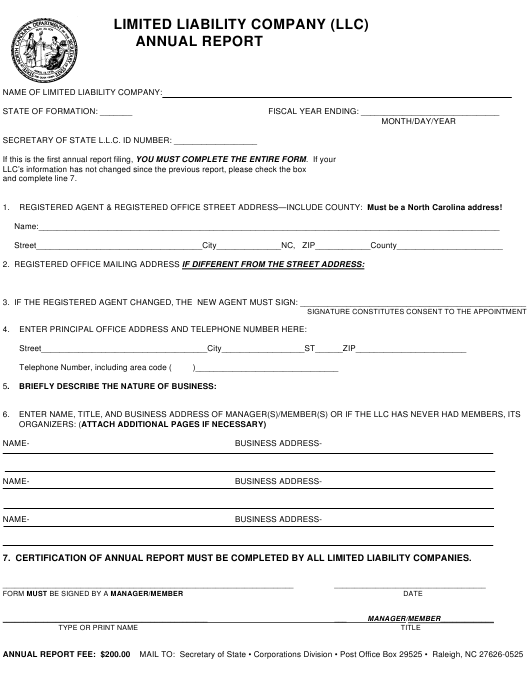

North Carolina Annual Report Information

Businesses and nonprofits must file annual returns to stay in good standing.State registrar. Annual returns are required in most states. Deadlines and fees vary by state and inject into Entity.

North Carolina LLC Taxes

Most LLCs are considered to be “pass-through” entities when it comes to filing federal income tax. The pass-through naming technique is the obligation to pay a barrel of LLC to members. Does llc pays no federal income tax on members. status as Secretary of State for North Carolina (SOS). This way, you will permanently register your LLC with the authorities, which is practically all you need to buy a legally registered company.

Which Companies Are Required To File An Annual Return?

Each corporation, LLC, Limited Liability Partnership (LLP), and Limited Liability Partnership (LLLP) registered in North Carolina are required to file an annual return with each North Carolina Secretary of State. The requirement applies both to citizens (registered?nym in the state), and to foreigners (registered in another region, but working in North Carolina).