Are there annual fees for an LLC in Texas?

If someone is running a Limited Liability Company (LLC) in Texas, they need help figuring out the cost of registering your business with the Texas Secretary of State. The fees below are effective from June 2018, but the range and level of fees may be extended at any time. For up-to-date information on the current forms and costs of an LLC in Texas, please contact the Secretary of State online.

Overview Of Limited Liability Companies In Texas

Installers’ limited liability is governed by Title 101, Section 3, of the Texas Commercial Organizations Code. To form an LLC in Texas, file the Articles of Incorporation referred to in the Articles of Association with the Secretary of State of Texas.

Costs Of Forming An LLC In Texas

New LLC incorporated? Texas. must have a certificate of formation of responsibility?? Limited Liability Company (Form 205) with the Secretary of State of Texas and payment of a $300 filing fee. Are there

Penalties For Late Payment Of Fees In Texas?

Yes. If you do not pay the fee, the state may cancel your registration. In addition, you may be subject to civil or criminal liability if you use a fictitious name without registering it.

![]()

Company And Obtaining Licenses

Depending on your industry and your geographic location your business may require federal, state, and local permits/licenses to operate legally in Texas. This is true whether you are creating a large limited company or some other opportunity structure.

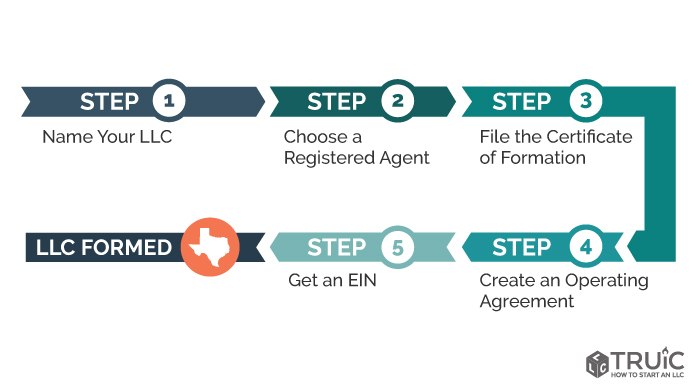

Here Are The Steps You Need To Take To Form A Texas Limited Liability Company (LLC) Incorporated /h2>Here Are The Steps To Register A Limited Liability Companyew (LLC) In Texas. For More Information About Starting An LLC In Any State, See How To Start An LLC.

State Taxes

In terms of filing income, most LLCs are so-called taxpayers. through payment organizations. In other words, the responsibility for paying federal income tax lies with the LLC itself and with the actual individual members of the LLC. By default, LLCs do not pay federal personal income tax, at best, to their members.

Certificate Of Incorporation Costs

The Texas Certificate of Incorporation bears the bulk of the cost, which can be very vary greatly depending on whether you provide a domestic LLC or a foreign LLC. However, you can submit both applications to the Texas Secretary of State.

What Is An LLC?

A Limited Liability Company (LLC) is a corporate organizational structure in the United States in which certain owners are not personally liable for the debts or obligations of the Company. LLCs are hybrid organizations that combineThere are factors of a corporation with factors of partnership or individual ownership.

Before You Create A Great LLC In Texas

Always such a good offer, learn the exact steps and principles before applying for OOO. In Texas, although every state, there are a few specific requirements that you must meet before you begin the process.

The Total Cost Of Registering An LLC In Texas

Title n This is not always a mandatory step to start an LLC, this can be a useful tool. If you have some unfinished business before applying for your certificate of registration, but you have a good name in mind, it might be worth applying for a booking. The hefty $40 fee gives you 120 days of exclusive rights to that name, which you can renew for subsequent $40 payments. You can reserve a name online or perhaps even with a paper form.

Do I need to renew my LLC in Texas?

If you want to register or operate a Texas Lender Limited Liability Company (LLC), there are many different documents that need to be prepared and filed with the state. This article hides the most important continuing registration and regional tax reporting requirements for Texas LLCs.