The long-term operating agreement is the key document used by an LLC as it sets out the financial and therefore operational decisions of the business, including rules, regulations, and changes. The purpose of the document is to regulate the inner workings of an online business in such a way that it meets the established needs of business owners.

Does Nebraska require operating agreement LLC?

An LLC in Nebraska must have an operating agreement because the new legal entity cannot operate alone. An LLC needs real people (and other businesses) to run the sellers’ operations.

How To Register An LLC In Nebraska (6 Steps)

Before starting the LLC application process, each applicant is advisedcheck the availability of your legal entity name to make sure it won’t be accepted, unfortunately. over another company or bought a name. The Secretary of State allows written requests for names by mail (POBox 94608, Lincoln, NE 68509-4608), email ([email protected]), and fax ((402) 471-3666).

Why Would A Nebraska Limited Company Ideally Need To Have An Agreement?

A Nebraska limited company should have a power of attorney because the corporation cannot act alone. An LLC needs real people (and other companies) to work in public companies.

What Is An Operating Agreement With An LLC In Nebraska?

Most of the required documents are required to work with an LLC. The generation process, including your organization certificate, can be easily completed online through the eDelivery platform offered by the Nebraska Secretary of State. Your business organization certificate is part of the official registration of your new business with the state government. Application fee, usually 100USD, is associated with the filing of this document.

Select A Name

A name may be reserved for 135 days for the exclusive use of an applicant whose name is available in another not yet registered business (§ 21- 109). To find out if a telephone is available, you can send a request by mail, fax, or email.

Here Are The General Steps You Need To Take To Find A Limited Liability Company (LLC) In Nebraska.

H2> A Limited Liability Company (LLC) Is Often The Legal Structure Of A Corporation. It Combines The Limited Liability Of One’s Own Business With The Flexibility And Lack Of Formality Offered By A Partnership Or Partnership. Any Business Owner In The Market Who Wishes To Limit Their Personal Liability For Trade Receivables Should Consider Forming An LLC.

â?? Choose A Name

Each limited liability entity will have an original name, different from any other entity in the history of the Secretary of State. Accessibility to themThe money will be checked online with corporate and business searches. An online check may not be the final proof that a manufacturer is available. Therefore, it is critical that you submit a written request to the State Department:

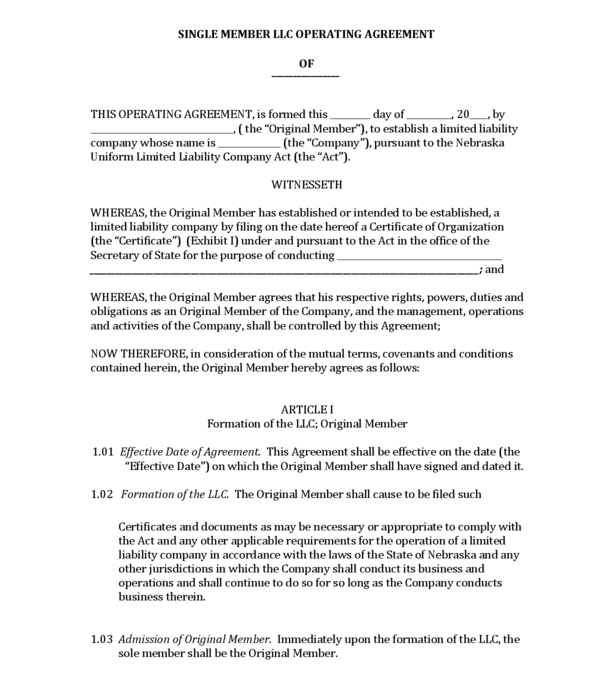

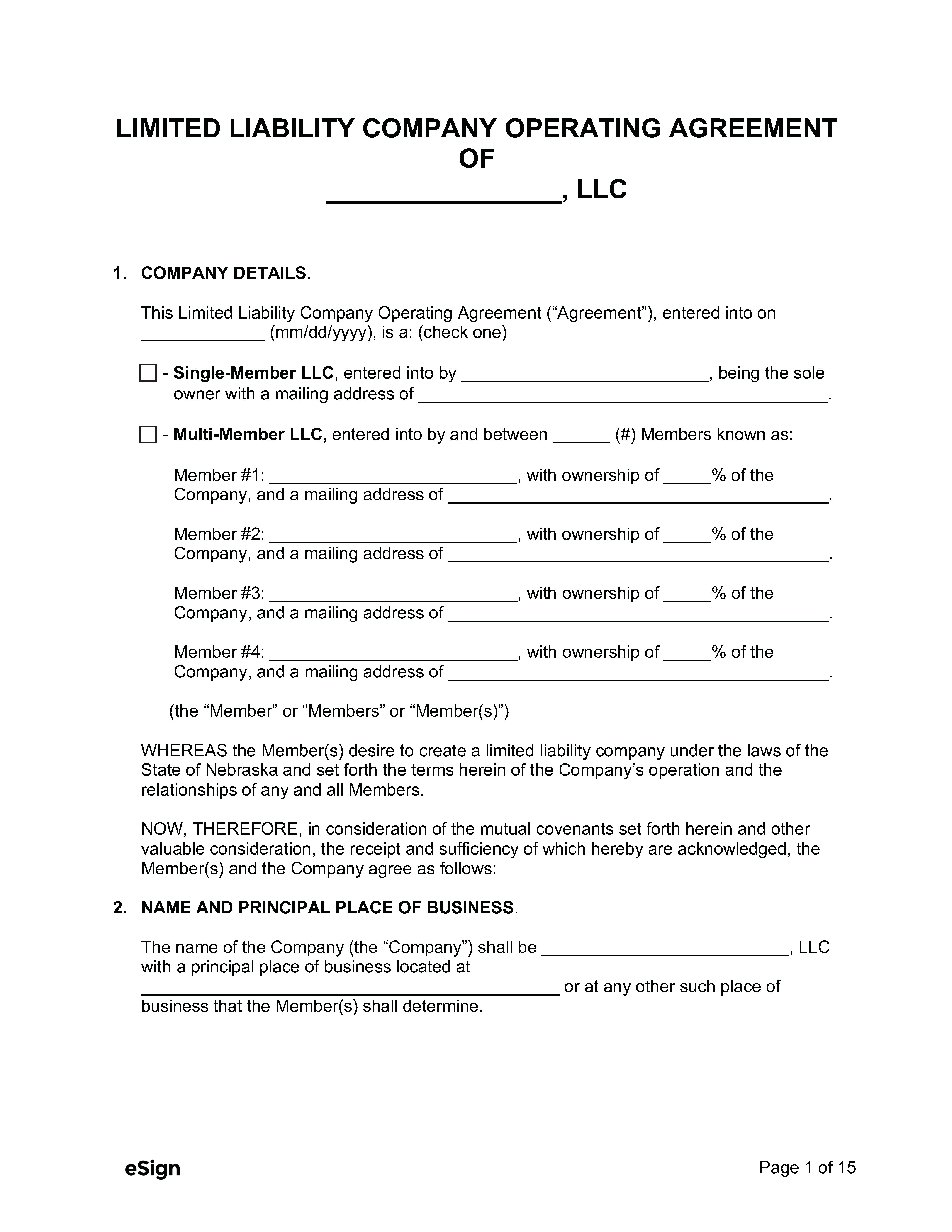

Contents Of The Nebraska LLC Operating Agreement

The Operating Agreement is a legal document that details the organization and operation of the LLC. Topics covered may be limited to a single member, or perhaps an LLC with multiple members. While these specifications do not affect day-to-day operations, they must be considered for legal reasons.

Management

4.1 BUSINESS MANAGEMENT. Location and property name of each managerare attached as Appendix 1 to this Agreement. By electing members whoMajority with a share of the capital of the company, as indicated in Appendix 2, simply becausechanges from time to time so that many managers are elected by membersdetermine, but not less than one, with a manager elected by the members asManagementActing Director.

Nebraska LLC Operating Model

RocketLawyer and LawDepot’s non-contractual online operating agreements will help you address specific government and regulatory issues to provide you with a business license tailored to your business . In addition, you can access their extensive library of custom business forms, contracts, and other important legal documents.

What Is An LLC Operating Agreement?

The Operating Agreement provides structure and authority your business. . He appoints management, establishes the company, regulates responsibilities, is a member and provides legal protection. In fact, it contains all the points you need to know about this LLC. And this is an internal document, so there is no processing fee.

Can I add an operating agreement to my LLC?

One of the ways they act like a real business is usually that they have the same type of records as other LLC owners. An LLC with more than one member (owner) that has a document called an operating agreement prepared with the help of a great lawyer when starting the business.

Can I write my own operating agreement?

Do you need an activity license when registering a limited liability company (LLC)? As a reminder, operating bonds are legal documents that guarantee the proper functioning of the LLC, as well as protect the personal liability of the business. Most states do not require LLCs to have this document, which is why many LLCs are reluctant to create one.

What do you need to know about LLC operating agreement?

An LLC doing work is a document that sets out the ownership, management, and legal rights and obligations of each member of that particular organization. The operating agreement is the only document that records the ownership of the business. The property is not owned by the state. States Required (5) – California requires an operating agreementsolution LLC,

When to write an operating agreement for a new company?

Therefore, it is recommended, only after the creation of the youngest company, that the partners draw up and sign a company contract. The operating agreement is likely to be the only document describing the identity of the company. There is no evidence that most people own a business.