Make Sure The Connection To The Domain Is Secure

www.nolo.com you need to check the security of your connection before proceeding.

Great Nebraska LLC Organization Is Simple

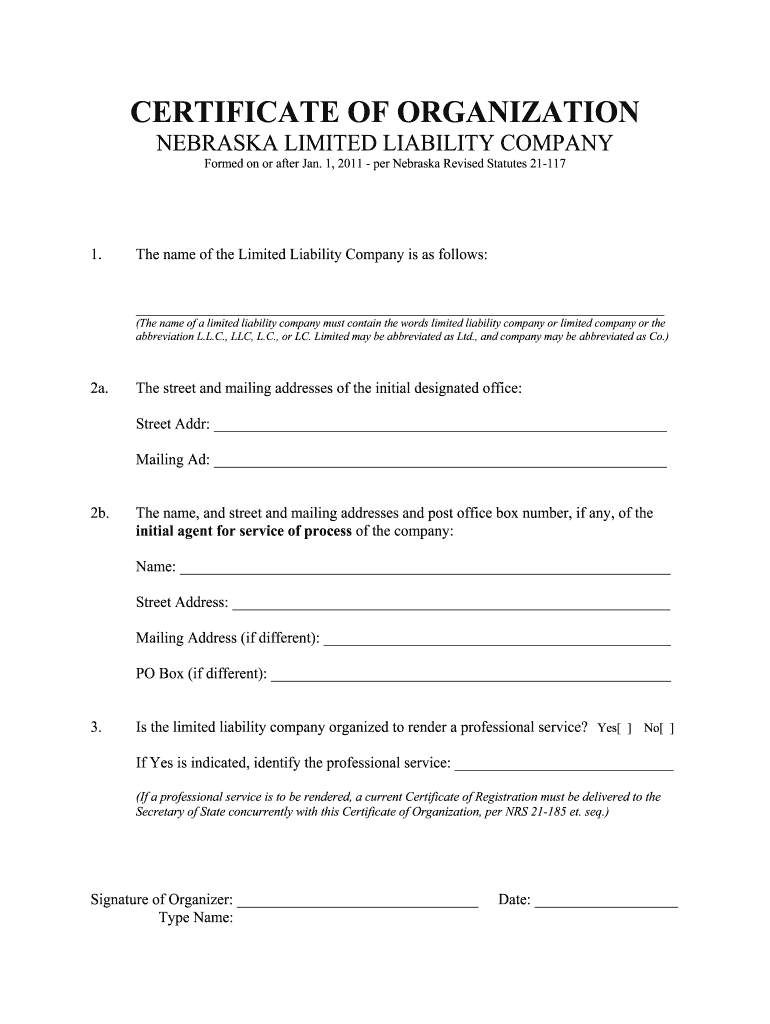

Nebraska LLC. To form a Nebraska LLC, you must present your organization certificate to the Secretary of State of Nebraska, which will cost $100. You can apply online. A Certificate of Organization is a legal document that formally establishes your Nebraska limited company.

How do I set up an LLC in Nebraska?

Nebraska LLC. To form an LLC in Nebraska, you must file a Certificate of Organization with the Secretary of State of Nebraska, which costs $100. You can apply online. An organization certificate is a legal document that officially registers your company in the state of Nebraska.

Name Your Nebraska Limited Company

When it comes to naming your limited liability company in Nebraska, it is not as easy as it seems at first glance. You can’t just pick any name and be done with it. First, you need to make sure that the name you want is not taken or too similar to the name of another company. We can show you how to do most of these things using our Nebraska company name search page. You can also check the availability of the name on the State Secret websitecetar of Nebraska.

What Is The Difference Between The Legal Name “Option” LLC And The Trade Word?

The legal name of your LLC is usually listed on your certificate of organization. A trade name (sometimes called a DBA) is any other name under which your company does business with Does llc. Trade names must apply for registration with the Nebraska Secretary of State. To register a business name in Nebraska, you must complete a business name application and submit it to the State Department online ($100) or by completing a standard paper form ($110). After applying, you must publish the act to see how the local newspaper advertises your company logo. The newspaper then issues an affidavit of publication, which you submit to the appropriate Nebraska Secretary of State. Give your business 45 days from the date of registration of your business name to take care of the type of requirements for the application.?blindings.

Get Certified By The State

L. The state will provide you with a certificate confirming that the LLC officially exists after all documents for the formation of the LLC have been filed and certified. If you submit documents to the LLC by mail, the Secretary of State will issue a certified and stamped copy of your marriage certificate to the organization. If you apply online, most people can download a new certificate.

Additional Documents Are Required During Registration.

Some locations require additional paperwork or steps to include an individual, such as filing with the county of location, publishing an LLC formation notice in a local newspaper, or filing a reliable initial report. Nebraska requires each of the following:

Step By Step: Starting An LLC In Nebraska

With each of these, you decide to start a Nebraska-style LLC. You have your end members, your business plan, and little to no seed capital, and you’re on your way to your business. Now you must prepare and submit the founding documentsyou.

Training Package LLC “Nebraska”:$253Generally

Our Nebraska LLC training package offers the best price in the state! Our experienced local Lincoln suppliers are Nebraska occupational rules experts! No one else in Nebraska offers the best LLC package at a much more affordable price.ORDER YOUR NEBRASKA LLC NOW!Our competitors cannot beat everything that Nebraska Registered Agent LLC has to offer:Nebraska LLC Professional CorporationFREE operating agreement, membership certificates, first decisions and moreKeep confidential to use our address in founding documents for freeInstant service for registered agentsReal-time Annual Report RemindersLifetime customer support365 Day Registered Agent Service in NebraskaThe contract of the company depends on the structure: one person, several people, etc.Online account to monitor, track and retrieve important business documentsDocument delivery systemAccess to additionalcompany servicesNo hidden fees!Your money goes here:Many registry offices in Nebraska hide how much they charge instead of showing exactly what you get for your money. But we believe in integrity at Nebraska Registered Agent LLC to never surprise you with veiled accusations.serviceexpensesNebraska State Registration Fee104 dollarsOur LLC Formation Services Fees100 dollarsRegistered agent service for one year$49Generally$253

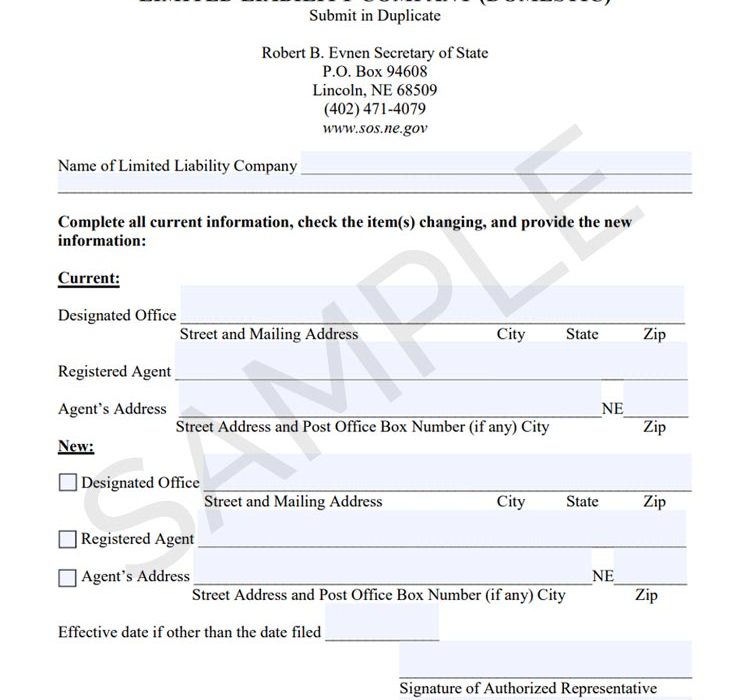

Nebraska LLC Certificate Instructions

Warning. The Nebraska Secretary of State recommends that individuals consult with a licensed attorney and/or tax professional when forming an LLC. You will also most likely use the Nebraska Free LLC organization certificate template below, which meets the basic legal requirements.

Register Your Nebraska LLC

Nebraska does not use an official Secretary of State number, create a new LLC.An LLC is created when you submit a very large organization certificate, a document created by you. This document must include the name and address of the LLC, the name and address of the registered agent, and a list of any professional services that the company is legally authorized to perform in the state of Nebraska. The society can only offer professional services through its members. ? or employees? certification. The participant must sign the actual document.

How much does it cost to register an LLC in Nebraska?

Here are the steps to form an LLC in Nebraska. For more information on starting an LLC in any state, see the Nolo resource How to Start an LLC.

Do I need a registered agent for my LLC in Nebraska?

At a minimum, your Nebraska representative will accept the basic legal documents in favor of your business at a physical vacation spot in the state (known as the chosen office). In other words, the agent address you provide will serve as the official address where all official processes and services for your Nebraska LLC, Nebraska Corporation or Nebraska Nonprofit company will be sent on an ongoing basis.

How long does it take to form an LLC in Nebraska?

How to form an LLC in Nebraska? You are usually here This quick guide is a quick overview of how to set up an LLC in Nebraska.