New Hampshire law does not require an LLC to enter into an operating agreement. Most states require their companies to enter into an operating agreement to allow them to revise their corporate structure. It is possible to bypass this process by using New Hampshire, and an LLC is not subject to any legal sanctions.

Does NH require a LLC operating agreement?

Every New Hampshire LLC owner must have an operating agreement to take care of the management of their business. While far from being required by state law, an operating agreement will set out clear rules and therefore expectations for your LLC, as well as establishing actual trust in you as a legal entity.

How To Register An LLC In New Hampshire (6 Steps)

Applicants wishing to register a domestic or foreign LLC in the State of New Hampshire should verify that their company details are available before proceeding. submission process. The Secretary of State’s authority allows applicants to directly search state records to ensure that a particular company name is accessible and therefore unique.

National Forms

BACK

What Is A New Hampshire LLC Agreement?

The US Small Business Administration (SBA) notes that the excellent “operations” document is an important document used by an LLC because it describes personal financial activities. and functional solutions, including rules, regulations and/or regulations. » Designed to manage all internal business operations in your own way, tailored to the needs of business owners. Once the body of the document is signed by the employees (owners) of the LLC, it becomes a joint contract binding them to the terms of the country.

Why Should An LLC In New Hampshire Have A Big Business? Agreement?

A New Hampshire limited liability company requires an operating agreement because the corporation cannot act on its own. To be successful, LLCs need real people (and various other companies) to run their business.

Appoint A Registered Agent

Every LLC in New Hampshire must have a designated agent to deliver the process tonew condition. This is a private or corporate employer who agrees to sue on behalf of the LLC if they can be sued. The registered agent may be a new Hampshire resident or a corporation, LLC or limited partnership licensed to conduct new business in Hampshire. A registered agent must have a physical address in New Hampshire. A list of registered employees is available on the website of the New Hampshire Secretary of State.

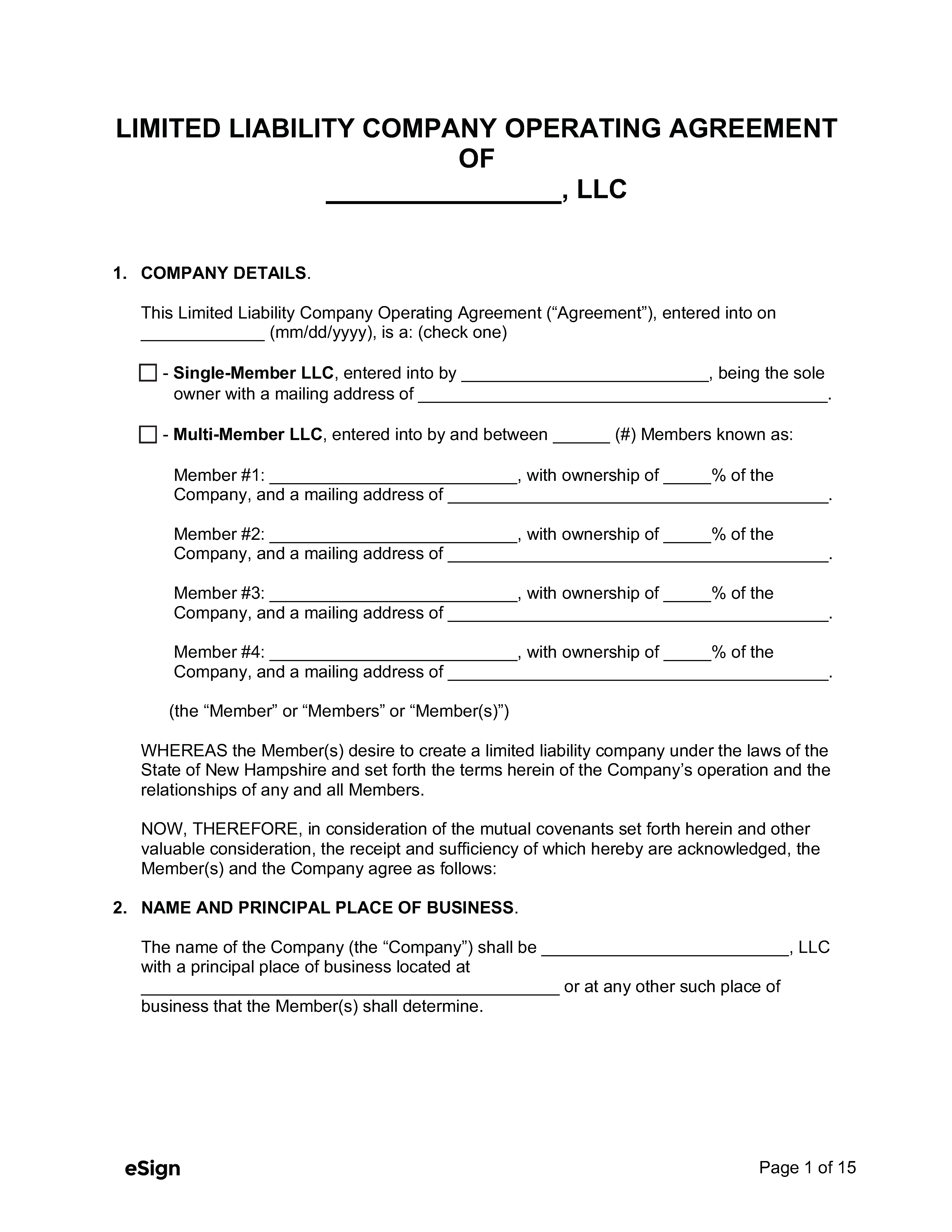

Contents Of The New Hampshire LLC Operating Agreement

Operating is the legal vehicle for transferring the organization to the LLC structure and detailed procedures. The topics described are not limited to a one-time or multi-member LLC with one member. Although these provisions are not representative of day-to-day operations, they should be included in principle.

New Hampshire Operating Agreement Laws

Official Rule of Operation New Hampshire LLC Operating Agreements, of course, can be read in 304-C: Limited Liability Companies. ?But the New Hampshire Secretary of State warns that the most accurate information is undoubtedly contained in “bound volumes, supplements to the New Hampshire Revised Statutes, with Commentaries.” Below we have detailed some of almost all known operating agreements in New Hampshire:

What Is A Limited Liability Operating Agreement?

The operating agreement specifies your business structure and official locations. Determines ownership, establishes operations, defines customer responsibilities, and provides legal protection. Basically, remember that this is all everyone really needs to know about your LLC. And it’s a document, so there are no additional filing fees.

New Hampshire LLC Operating Agreement Template

Downloadable LLC Operating Agreements, available for free download from RocketLawyer and LawDepot, will help you to resolve specific legal and service issues. , providing you with a powerful operating agreement tailored to each business. You will also have access to their entire library.A library of individual proposals, contracts, and other important legal documents.

Insert Recent Articles Of Incorporation

An Is llc was incorporated in New Hampshire by filing a valid State Memorandum of Association New Hampshire with the New Hampshire Secretary of State. The certificate can be submitted manually over the Internet or printed and mailed to the Secretary of State’s office. A $100 application fee may apply and credit card may be the preferred method of payment.

Can I add an operating agreement to my LLC?

One way to act like a real trustworthy company is to have documentation similar to other LLC vendors. An LLC with more than one male body (owner) has a document called an excellent operating agreement that prepares most of the legal assistance when the market starts.

Can I write my own operating agreement?

Do you need an Operating Agreement when registering a new Limited Liability Company (LLC)? It’s quick enough to recall that operating agreements are the legal documents that ensure the proper management of the LLC and protect the personal debt of the business. Most states do not require LLCs to have this document, so many LLCs preferdon’t cut it.

How do you form an LLC in New Hampshire?

Here are the steps to register a Limited Liability Company (LLC) in New Hampshire. For more information about starting an LLC in any state, see Nolo’s article on starting an LLC.

What is a limited liability company in New Hampshire?

Limited liability corporations incorporated outside of New Hampshire that will be incorporated or currently incorporated in New Hampshire.