How much does it cost to set up an exclusive LLC in Kansas? The Kansas Secretary of State is asking for $165 to file articles of incorporation. You can reserve an LLC name with the Minister of State of Kansas for $30 if you file online and $35 if you file by mail.

Register a

How do I file an LLC in Kansas?

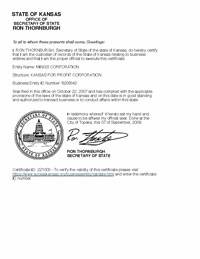

To form an LLC in Kansas, you must file documents outside of the organization with the Secretary of State of Kansas, which costs between $160 and $165. You can apply online or by mail. The Memorandum of Association is the legal document that formally establishes your Kansas LLC.

Powerful LLC In Kansas, Here’s Everything You Need To Know.

A Limited Liability Company (LLC for short) is a way to legally structure a business. It combines the limited liability of a corporation with flexibility and freedom from formality.activities offered by a corporation or an individual entrepreneur. Any business owner trying to limit their sole liability for business debts and lawsuits is effectively considering forming an LLC.

Creating An LLC In Kansas Is Easy

In Kansas To form an LLC, you must file Charter of the Minister of State of Kansas, which costs from 160 to 165 dollars. You can start online or by email. The Memorandum of Association is the legal document that formally registers your Kansas company.

Step-by-Step Instructions For Amending A Kansas LLC Company

The Secretary of State of Kansas (SOS ) authorizes online filing . You can amend your Kansas corporate articles by completing them electronically on the Kansas the.gov Business Center website. You can access it by going to the SOS website and clicking on the Business Data Feed Center link at the top. Then you can edit the file. You need to know the Business Entity Term and/or Business Entity ID. Secretary of State number. You can pay online by sending a credit card or choosing an accountentry.

Kansas Annual Return Fees And Instructions

If you are a corporation, LLC, or a corporation that does business in Kansas, you must pay $50 each year for an archival annual return report. If you mail your return, there is a $5 fee. For these companies, reports are usually due no later than the 15th day of the 4th month after the end of the given financial year, which in most cases falls on April 15th.

Name Of The LLC

H2> The Layout On The Next Page Is A Little Confusing And Tries To Ask You If You Have A Name Up Front Or Not (which Isn’t A Special Requirement, By The Way).

How To Positively Register An LLC Registered In Kansas

Start the process of creating an LLC by naming your business. This is by no means just branding: in the eyes of the Kansas state government, there is no business without a proper name. Accordingly, you must decide what you would like to name your corporation before proceeding with the Kansas LLC registration process.

Step By Step: Register Kansas As A ?Limited Liability Companies

With all of this, they decided to form an LLC in Kansas. Get your members, your business technology, and some seed capital, and you’re on your way.

Do you have to renew LLC every year in Kansas?

All LLCs doing business in Kansas are required to file an annual return each year.

How long does it take to get an LLC in Kansas?

Get the fastest Kansas LLC establishment online with hassle-free services as well as help starting your business.