Michigan Annual Returns And Fees

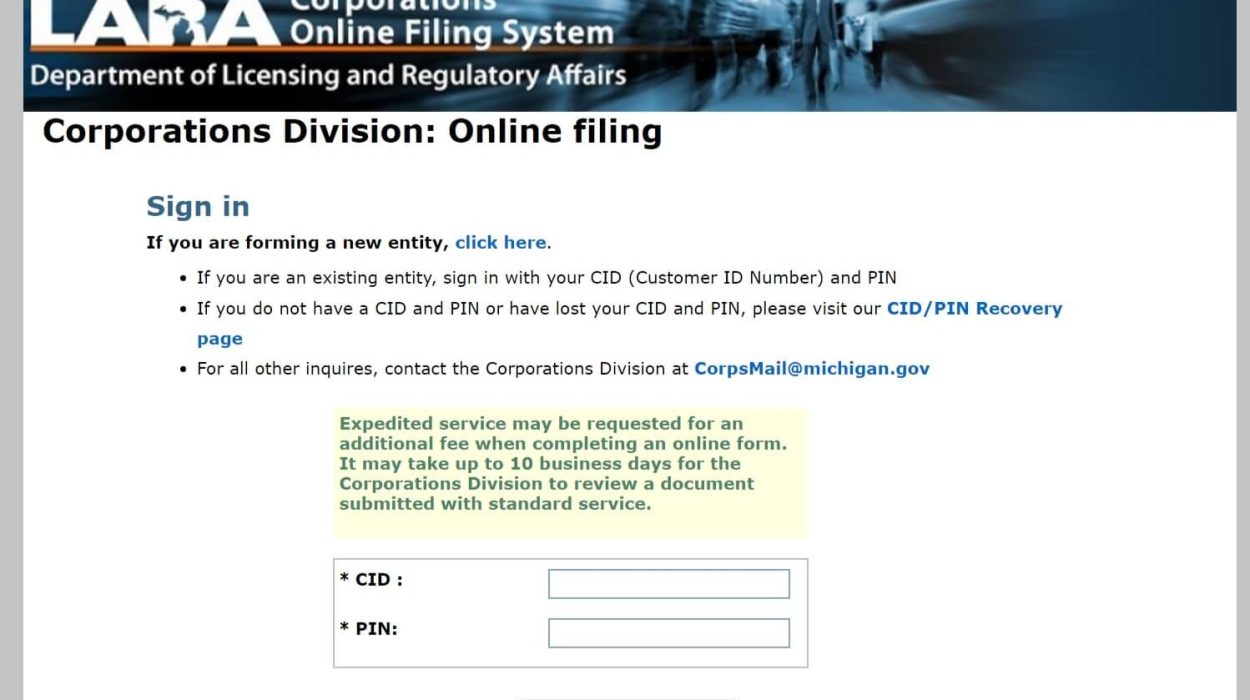

Michigan Annual Returns must be filed using LARA Corporation’s comprehensive online filing system OR simply submit the pre-filled form the state will provide to your representative -resident within 90 days must include the filing date.

What Is Michigan’s Annual Return?

When it comes to annual returns, most states want to knowThat is, whether you have made any significant changes to your report. , such as adding a new employee and owner, or changing the business address. In Michigan, this information is submitted to the Division of Corporations of the Michigan Department of Licensing and Regulation (LARA) for submission. The entire process can be completed through the LARA State Business Portal.

Michigan Annual Return Submission

Lara requires the State to submit a pre-printed Total Budget Report form to the LLC, the representative of the corporation that otherwise is a resident, approximately three months before the due date. Limited liability companies and corporations may wish to receive electronic notices to the e-mail address of a Hawaii resident representative. The option to submit the annual report online was available approximately 90 days before the main date.

About The Michigan Annual Report

Businesses and nonprofits should help you file annual returns to stay in good standing. Secretary with conv.ovim. Annual returns are required in most states. Deadlines and fees vary greatly from state to state and inject into Entity.

Michigan Annual Return Instructions And Fees

The cost of filing an annual return in the City of Michigan depends on the type of business you have. Commercial companies must file by May 15 and pay a $25 filing fee. Nonprofits must pay $20 to apply by October 1st. Michigan foreign corporations must pay a $25 filing fee by May 25, and limited liability companies by February 15.

Before You Apply To Register An LLC, Register With The State Of Michigan

H2>Before You Head Out To OOO Right Away, There Are A Few Important Things You Need To Do Beforehand. For Example, You Need To Make Sure The Name You Want For Your Business Is Available At The Time Of Registration. The Following Sections Describe The Steps You Need To Take Before You Start Applying For LLC Status.

AnnualMichigan LLC Annual Report

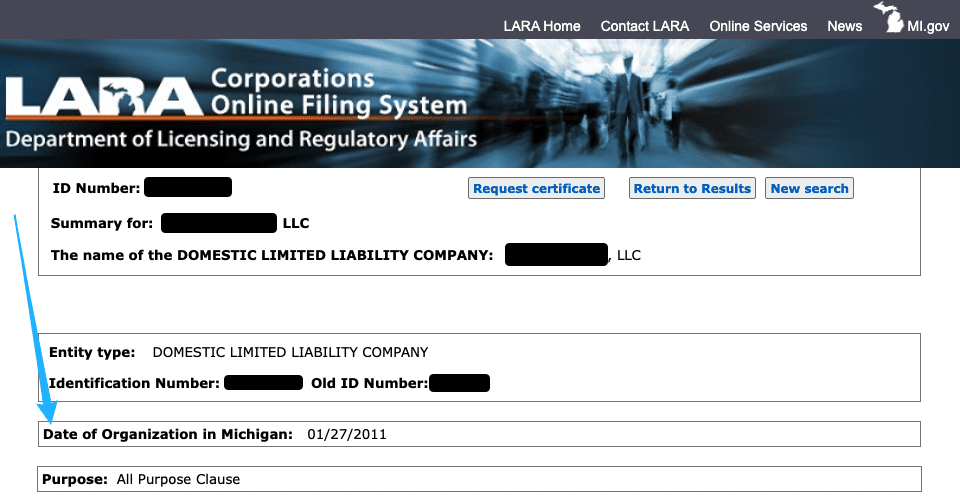

An annual report is probably essential for all types of businesses. It certifies that the information provided to the Secretary of State is accurate. Updated &. The information provided in the annual report helps government officials ensure that all businesses pay taxes. The Michigan Annual Report is filed with the Michigan Department of Licensing and Regulatory Affairs.

Choose The Best Name For Your Michigan LLC

Your LLC’s reputation must be different from that of other named commercial entities, already registered with the Michigan Department of Licensing and Regulation. You can check the variety of names in the Michigan business database. You can reserve a name for six years by filing a name reservation request with the Michigan Department of Licensing and Regulation. You can submit any request or file online. The fixed rate deposit is $25.

What Is The Michigan Annual Report? Why Is This Important?

Consider hosting an annualAn annual review report for your LLC. It is similar to the census in that it collects key information about the contacts and structure of every company in Michigan.

Michigan Annual Report

Every company in Michigan except this one must limited partnerships and limited liability companies submit a 12-month report to the Secretary of State. They can be submitted online, published, mailed, or possibly personally delivered. The pre-printed form has been successfully sent to your registered agent, who must notify you three months in advance of the unexpected date. Forms must then be submitted to the Michigan Accreditation and Regulatory Authority (LARA) Division of Corporations.

If renewal is received May 15 or later, the current year report is also required with the $25.00 filing fee and the penalty fee is $10.00 per month or portion thereof, beginning May 16 (see section 921). Foreign profit corporations may owe additional fees

The Business Corporations Act, PA 284 of 1972, Section 925 provides that many domestic corporations are automatically dissolved under Section 922, and a foreign consortium whose certificate of authority has been terminated under Section 922 or Section 1042 may resume its coexistence or certificate of authority by processing the declaration and payment of the required price for the years for which they have not been filed and for each additional year between them, as well as the penalties provided for in Article 921. After the filing of the protocol and the payment of the costs and penalties in stages, the coexistence or power of attorney is extended .