Limited Liability Company. Limited liability companies (LLCs) incorporated by the Michigan Department of Licensing and Regulation (LARA) are required to file an annual return (known as an annual return) by February 15 almost every year.

Michigan Annual Returns Due Dates And Fees

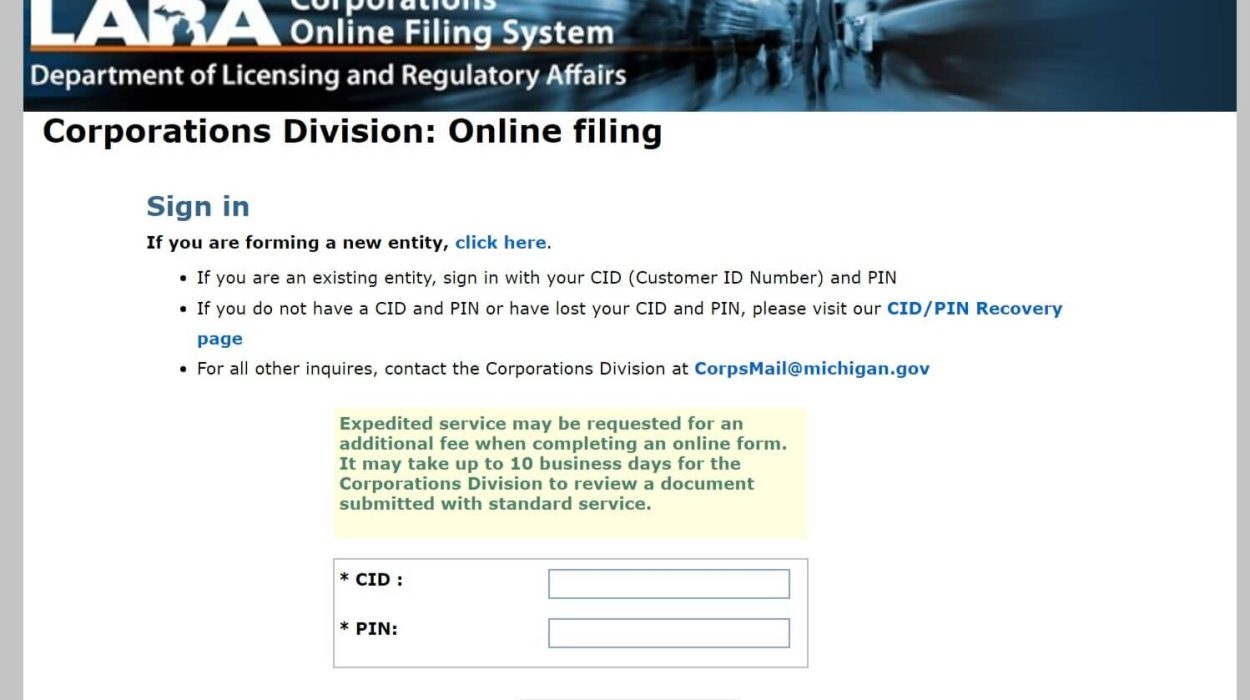

Michigan Annual Returns must be filed through LARA Corporation’s online filing system OR if you submit a pre-filled form, the State will permanently become your resident agent on 90 days. before the deadline.

Does an LLC have to file an annual report in Michigan?

Every insurance company limited by liability is required to file annual financial statements every year. The office sends a special pre-printed form to the head office associated with each company 90 days before the due date and time. The company must check the outline for correctness and report any changes to the materials of the resident and the head officesee. If a limited liability company is registered after September 30, the application does not need to be submitted once a year on February 15 immediately after its registration. If you do not provide an annual policy, the password will become invalid after two years and the name of another designated company, limited liability partnership or limited liability company will become available.

What Is Trusted Michigan’s Annual Report?

For the annual report, the state also wants to know if there has been a major change in your business. like adding new managers and owners or changing your organization. In Michigan, this information is shared with the Michigan Department of Licensing and Regulatory (LARA) Corporations. The whole process can be completed through biEach state’s LARA business portal.

Michigan Annual Return Instructions And Fees

The cost to file one type of Michigan annual return depends on the type of business the buyers own. Businesses must submit a new application by May 15 and pay the $25 fee at the time of application. Nonprofits must pay $20 to apply by October 1st. Michigan foreign corporations must pay $25 to file by May 15, while LLCs must pay the same amount to file by February 15.

Annual Report Contents

As a rule, a particular annual report filed by a Michigan LLC (or other relevant legal entity) contains all the information necessary for its corporation and its members. useful. Required Contents of the Franchise Annual Return or Accurate Annual Tax Return:

What Is The Michigan Annual Return? Why Is This Important?

Think of the annual report as an annual review of your LLC’s status. It is similar to a census in that it aims toThe State of Michigan will request a useful Financial Declaration File for your LLC. You must submit your Registration Application by February 15 of each year. A (Except for newly acquired LLCs incorporated after September 30 of the previous year, which are not required to report on February 15 immediately after the February 15 registration date.)

What Is A Special Report?

The purpose of filing an annual gross return is to validate the state of your business in Michigan. Please note that this is not an optional submission. This would be necessary and the $25 cost is usually minimal compared to what you can lose if you miss a deposit. business income tax will now be 4.95% tax on the taxable base to become federally taxable business income. Special rules result in various taxpayers, such as home builders and car dealerships, having fabulousreduced tax base because the business tax and modified gross receipts tax are based solely on sales in the state of Michigan.

What Happens With The Filing Of An Annual Return?

The Annual Health Report is a process that informs your archival society annually from the State of Michigan. Businesses such as corporations, LLCs, and partnerships are required to report each year that they are definitely registered to do business. Failure to file annual reports with the Secretary of State of Michigan, who is affiliated with the Department of State, can result in very late payments and fines, as well as a loss of “good reputation.” and active status, as well as the subsequent liquidation of your company’s office and business. Depending on the type of company and your incorporation, incorporation or qualification status, you may be required to pay an annual report processing fee with varying deadlines for submitting individual documents online or by mail. Filing the Michigan Annual Return, like filing, is best doneGo through the legal process to allow lawyers to register. Have Spiegel Utrera, & PA staff complete these Michigan annual returns accurately, but also on time.

Michigan Annual Application Reports

Michigan may have different renewal labels and fees or taxes depending on the type of service. Below is a contact list of various commercial organizations in Michigan and renewal policies for individuals.

What is the Michigan annual report?

Businesses and nonprofits must submit annual returns to stay on good terms Ad secretary. Annual returns are required in most of the United States. Deadlines and fees vary by state and entity type.

Is there an annual fee for LLC in Michigan?

Registering an LLC here in Michigan costs $50. This is a fee payable in accordance with the Michigan State Statute.