For Domestic Companies:

When preparing for training, consider the following special requirements. From Pennsylvania to.

Filing Pennsylvania Articles Of Association

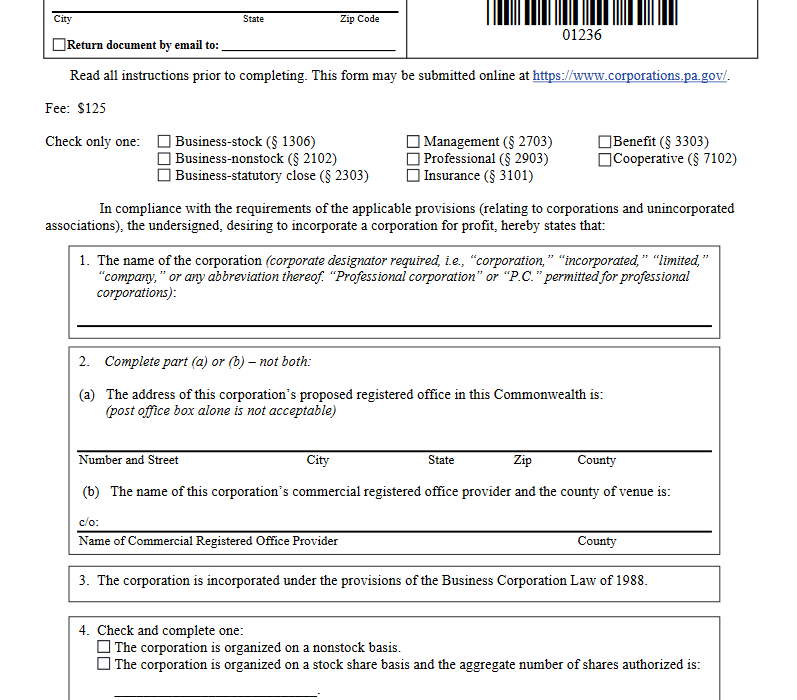

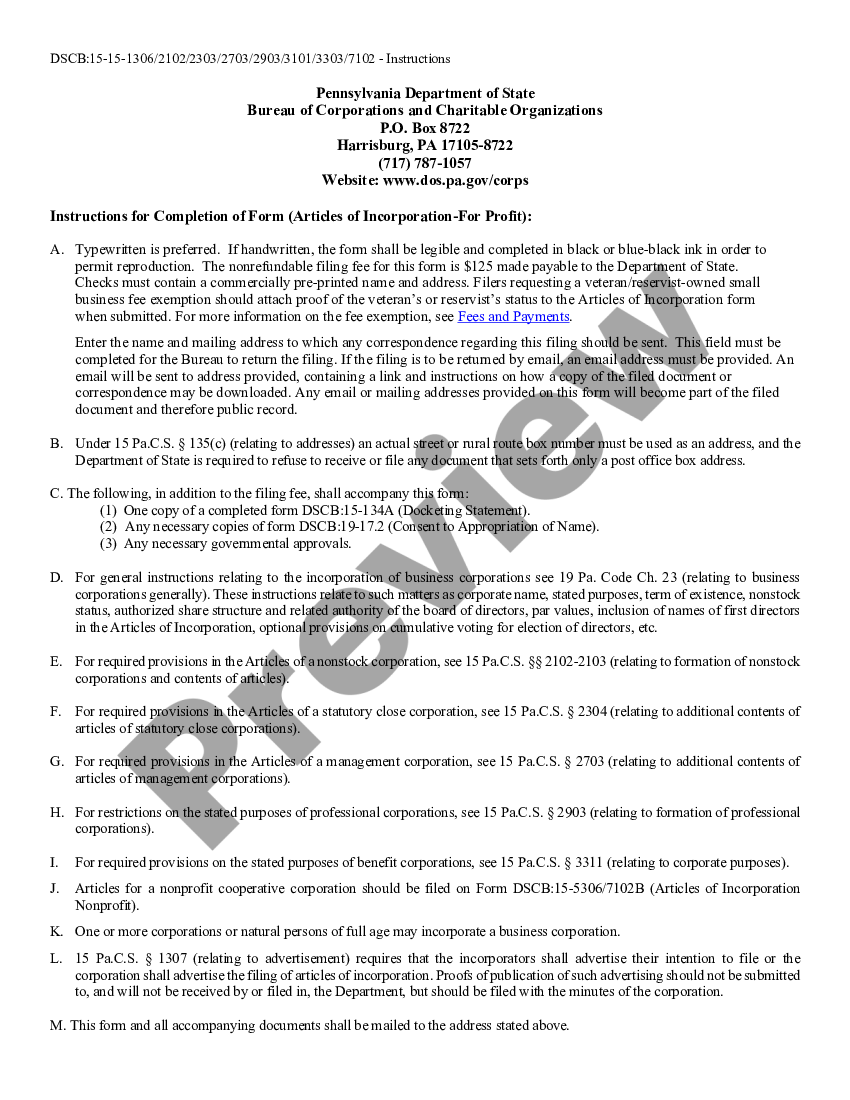

The Pennsylvania Articles of Association (AOI) provides you with the basis for determining which organization declares and registers in the state. When you have an approved area of ??interest, you can get everything you need for business purposes, including your tax identification number, licenses, and permits. Sure, there are separate forms for domestic (in-state), unknown (out-of-state), and non-profit corporations, but we’ll focus on for-profit corporations. Individuals completing the form must be of legal age and must be registered in the United States. Resident.

Pennsylvania Registration Application

The Pennsylvania Funding Application requires you to provide the required computer information to the Pennsylvania Department of State. These articles provide the government with the necessary information about the purpose and nature of the company.

Type Of Legal Entity

The government usesforms a form for 1 different types of companies: shares, registration, non-stock, management, profession, insurance, forward-looking and cooperative. Each type is governed by different sections that refer to Pennsylvania’s consolidated laws. Please note that cooperatives must also create additional sections to complete the Bylaws. Advice. Most companies are public.

Open A Commercial Bank Account Of Any Type

Use special commercial banks, so credit accounts are required to continue your activities. corporate veil. If your personal and business accounts are mixed, your personal investments (your home, car, and other valuables) may be at risk if a lawsuit is filed against your LLC.

Other Documents Required During Incorporation

Some states require additional registration or settlement at the time of registration, such as registration at the county level, notice of publication in the local newspaper at registration, or possibly filing an initial report. Pennsylvania requires ?following type:

Filing Articles Of Association

Your corporation will be formally incorporated by filing Articles of Association with the Pennsylvania Department of State. The marketing article must include the name of the company; Pennsylvania entity title page or representative name and address for technology plans; the number of shares that the Company is ordinarily entitled to issue; the name and address of each founder; and practically the date of the charter, if it is later than the date of filing. Mandatory items must be accompanied by a completed New Entity Registration Application, Form DSCB: 15-134A. This form must contain the name, company name, and contact details of the person responsible for the initial expense reports; his task; the date of its entry into force, if any; his EIN and the end of tax Christmas.

Incorporating A Corporation In Pennsylvania Is Very Easy

Incorporating an agency in Pennsylvania is a simple process that is achieved by filing articles related to incorporation with the Department of Foreign Affairs . . In the following guide, we will show you step by step how to? Register a corporation in Pennsylvania.

How Much Does A Corporation Cost?

Incorporate an LLC (charter registration), while the Pennsylvania Department of State is almost certainly $125. If you are applying manually, this should be the only fee you pay. However, if you use third party websites or consultants, you will end up paying more. As a reminder, SBDC consultants at Duquesne University can help you register your business for free (on top of the $125 fee mentioned above).

Business

requirements. But it can also bring significant benefits to your business through work. If you have already decided to integrate, Pennsylvania.com can help you through the various steps of the process.