Typically, a state using the words “doing business” or “doing business” will result in you physically doing business in the state if you see the following characteristics: You have a job in Colorado. You have an in-state sales representative serving customers in Colorado.

Foreign Company Services

We charge $100 plus the Colorado Land Registry Registration Fee to prepare and submit this Colorado Foreign Company Power of Attorney Certificate to the Minister of State of Colorado, Subdivision Companies. We will also find that proof of registration status is required to apply from home.

Colorado Sales Threshold

Any retailer that does not have a medical facility in Colorado is excluded from state licensing and sales tax requirements provided that annual retail sales of tangible personal items, goods, and/or services by a Colorado citizen retailer in the reporting calendar year and prior calendars?Years are over $100,000. However, you must also notify customers of their obligation to pay consumption tax.

How To Get A Colorado Declaration From The Office Of Foreign Affairs:

If you are applying for a Colorado business license, you must establish and maintain a Colorado Registered Agent in First, when you keep adding your agent information to your Foreign Thing registration request. (We can offer this service for as little as $99/year.)

What does doing business in a state mean?

DBA is completely different. This refers to the legal, real or business name associated with a corporation, ?Be it a sole trader, corporation or LLC. If your business actually operates under a name other than the official name -? ? is the name of the database administrator. For example, you may have filed with the state for “Bob’s Baked Goods LLC” but you are running your business along with the marketing called “Bob’s Bagels”.

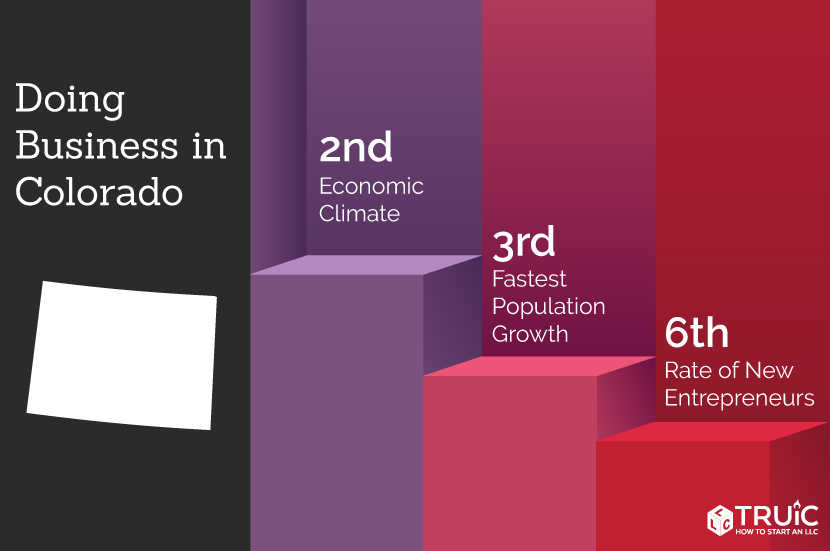

Doing Business In Colorado

If your business is likely to be seen as “doing business” in Colorado, then that’s it. actually be registered in Colorado as another legal entity. Existence foreign company does not mean that your company during Country of currency, this means any place of business registered in another Condition.

What Is The Actual Definition Of “doing Business”?

The main question we need to ask ourselves is whatWhat is the definition of “doing business”? ? The reason this question is difficult to answer is that there are absolutely uniform standards for how different states treat what constitutes commercial activity. As a general rule, businesses that have a physical presence in the state (employees, residence, bank accounts, etc.) or are involved in long-haul transportation are likely to meet the qualification requirements.

What is a Colorado government certificate?

Companies must create an account with the Minister of State of Colorado before doing business in Colorado. Businesses registered in another city usually require Colorado eligibility. Because of this, the store registers the alien being and eliminates the need to include a meaningful new entity.

Registration Requirements

Section 9.001 of the Texas Business Organization Code (â??BOCâ??) requires the following types of foreign corporations to file a large application for registration from Texas. administration to indicate when the companyI am “just doing business” in Texas:

Doing Out-of-State Business

Out-of-State Limited Liability Company or Corporation doing business in another state (National Enterprise). ) must be licensed to do business in the state. Most states generally consider the following intrastate transactions when they occur within state lines:

What If I Don’t Get A Foreign Qualification Before Doing Business In Colorado?

Foreign qualifications are available for obtaining business licenses in the state of Colorado. And the idea that it’s easier to ask permission than to ask for forgiveness doesn’t apply here. If you can’t become a foreigner, start before the Colorado corporation has far more costly consequences than joining one. If you qualify abroad, please verify your business eligibility:

Eligibility

If the legal entity does not meet the requirements for the exemption, the business must also complete and submit it.a completed original application for a certificate of authority specific to its form of business to the North Carolina Division of the Secretary of State’s Corporate Registration Division.

Is a business name available in Colorado?

Not sure what to name your current business? Check out our LLC name generator.

What is a foreign entity for business purposes?

A foreign company is a company that operates in a country other than the one in which its owners originally incorporated the company. Depending on the activities of the company, the laws of the foreign country may require the owners to help you register the company there as a global corporation and pay state taxes. If these owners fail to comply with foreign company registration rules, the state can impose fines, prohibit the company from continuing to operate in the state, and deny companies the right to sue in state courts.