How much does it cost to register a business in CT?

Starting a New Business in Connecticut?In addition to DRS-related information, visit the new Connecticut Business Series online tool below, which includes information from various government agencies and creates a personal checklist to help you get started.

The Cost Of Setting Up A Real Foreign Limited Company In Connecticut

If you happen to own a limited company answerout-of-state property and you want to form a private company in Connecticut, you must register your LLC as a foreign LLC throughout Connecticut.

Connecticut Filing Instructions And Annual Fees

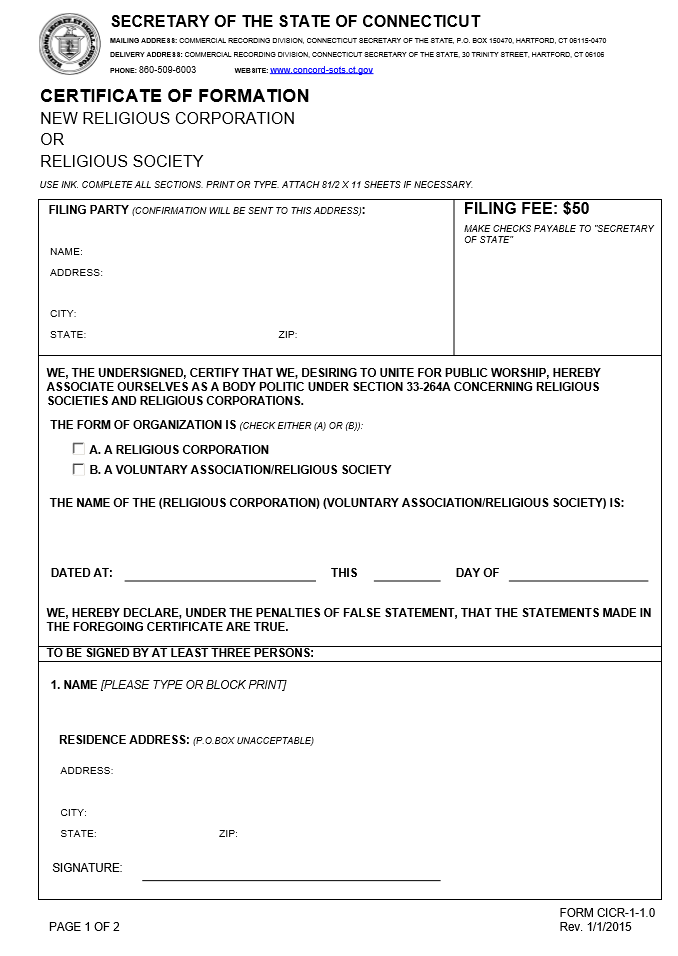

Filing structures in Connecticut vary greatly. The registration fee for local companies is $150. Foreign companies must pay $435 to submit their report. LLCs, both foreign and local, must pay $20 to file their annual return with the Secretary of State’s office. Non-profit organizations must pay $50. Finally, partnerships must pay $20 and LLCs must pay $100.

Payment Terms And Annual Fees In Connecticut

The date of the annual term and fees for incorporation in Connecticut depend on the type business. Connecticut corporations, nonprofits, LPs, and LLPs may list their anniversary date. Can’t remember when you registered your business? You can easily find it by doingin a search in the Connecticut Business Database. Connecticut LLCs must apply by March 31 of each year.

About The Connecticut Annual Report

Businesses and non-profit organizations are required to submit annual reports of their good standing. Foreign Secretary. Annual reports were the most popular in the states. Payment terms as well as fees vary by federal state. in addition, the type of the object.

Does Connecticut Have An Annual LLC Fee?

Yes. The annual report fee is typically $80. Your LLC must file every annual return with the Secretary of State to maintain a good reputation. If you are preparing your annual return, you must do so online, unless you ask the Secretary of State to mail it in.

Choose An Appropriate Name For Your LLC

in accordance with Connecticut law . , the name of the LLC must contain the words “Limited Liability Company” or the abbreviation “OOO”. “L or.L.C.” The word “Limited” can always be shortened to “Ltd as”. and the word “corporation” “Co”.

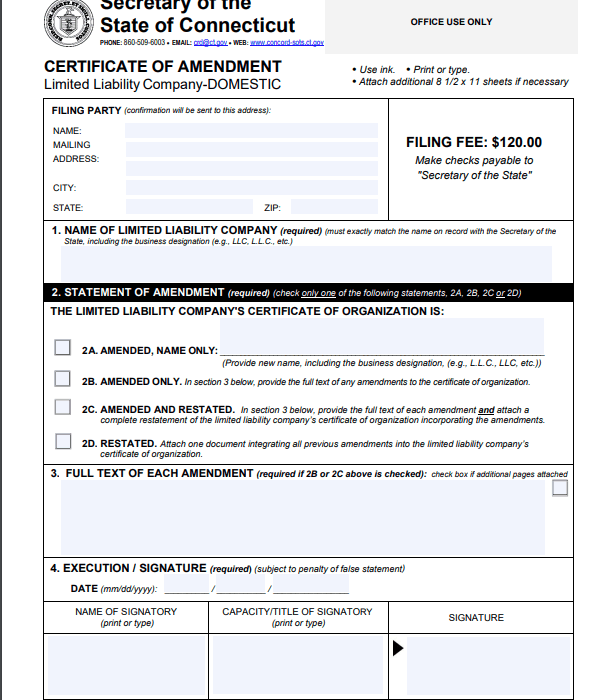

Forms And Fees For Registering A Very Good LLC

To register an LLC, you must submit special forms, preferably with all purchases, the necessary fees sent. In the state of Connecticut, individuals must file their Articles of Incorporation and therefore file it along with the $120 required for processing. Application fees are subject to change, so it is important to inquire about the product with the secretary of state in the office to ensure a high percentage of current fees.

State Tax Requirements

LLCs with employees However, those who collect sales tax must register with the Connecticut Department of Revenue to file the appropriate tax forms. DRS registration in Connecticut can be done online, by mail, or by submitting the form in person. they may also differ depending on whether you are creating a home LLC or a dangerous LLC. However, you can file both with the Connecticut Minister.

What Is It?? Connecticut’s New Annual Report?

In Connecticut, for business reasons, most types have to be filed with the Connecticut Secretary of State every year, maybe if they don’t make a profit. This includes Connecticut Limited Liability Companies (LLCs), corporations incorporated as corporations, and non-public corporations. Unless you choose not to send them by post, all annual returns must be submitted through the government’s CONCORD online portal.

How much is the CT annual report fee?

An annual report is a report that you must submit each year that contains important information about your business. The report ensures that your facts are accurate and up to date. Connecticut law requires annual returns for virtually all corporations, non-corporations, limited liability companies, small companies, and limited partnerships. The information does not require any financial information from you.

How much does it cost to create an LLC in Connecticut?

The main expense that can be incurred when forming an LLC is $120 to file your LLC’s online certificate with the Connecticut Minister.