860-297-5962 (anywhere)800-382-9463 (inside CT only – outside of Greater Hartford)860-297-4911 (TDD/TT users only)

Registration Information

Starting a new business in Connecticut?In addition to drs-related information, visit our new Connecticut online activity reporting tool below, which includes information from various government agencies and creates a personal checklist if you’d like to help you get started.

Company/SARL

If the corporation is a corporation or limited liability company (LLC), you must register your Norwalk business name with the Secretary of State of Connecticut in due course. You can contact the office at (860) 509-6200 or (800) 540-3764 for more information.cations.

Choosing A New Business Name

If you are a sole trader, anyone can do business in Connecticut by owning their legal name or intended company name. When choosing a really good nickname for your IT business, you will want to distinguish yourself from the various company names and trademarks registered in each of our states.

Other Information

You should also get identification numbers state and federal tax. Contact the IRS for your State Identification Number and the required registration forms. Phone number is 800-829-1040. The Connecticut ID Go number can be found on the Department of Revenue website for forms and information. Phone number: 800-382-9463.

C Corporation

Incorporating your own corporation requires the preparation and filing of a Certificate of Incorporation with the corporate secretary. in which you choose to include. Once incorporated, the company becomes a separate legal entity and is subject to the laws relating to incorporation in the United States.United States.

Contact Information

We submit the following documents to the Secretary of State of Connecticut – business registration. Enforcement Division Provide services to our valued clients. We share this background information to the general public as a courtesy. As authorized client agent, you get access that you can specify The templates are pre-filled with our company’s personal information to help you save time searching for it. Information.

Choosing A Company Name

In Connecticut, a person can use their own name or use a fictitious name. Because of the simplicity and federal nature of trademark protection, it’s always good to hope that the name isn’t too far removed from the name of another registered company. To make sure your company name is available, search the following taxpayer databases:

Registration And Filing Fees

Certificate of company name cancan be obtained from the link above or at the city office. To sign a business name, any registered member must complete a business name certificate, sign it in front of a good notary public, and submit the file form to the city clerk. All certificates must be original and notarized before they are submitted to your City Clerk. an organization offered by the Connecticut Secretary of State that offers a $120 bonus. You can apply online, by boat, in person or in person. An organization certificate is a legal document that formally establishes your liability as a Connecticut LLC.

What is Secretary of State number CT DMV?

If the Secretary of State’s number is not registered with the above DMV, you cannot use it for service.

Is CT Tax Registration Number same as EIN?

Want to get your Connecticut Taxpayer Identification Number (EIN)? This Connecticut Taxpayer Identification Number Application Guide will guide you through the basic steps you need to take to apply for a Connecticut Taxpayer Identification Number.ikut (EIN). Whether you own a partnership, a multi-member LLC, a corporation, a non-profit organization, a trust, or an estate, this guide will help you learn what you need to know to start getting the proper IRS tax ID.

How many digits is a CT Tax Registration Number?

Connecticut Electronic File. The Connecticut tax registration number is missing or entered incorrectly. Enter your Connecticut tax registration number eleven (11) times for thirteen (13) digits in the following numbers: 1234567-123, 12345678-123, and 123456789-123. -Registration requires a valid Connecticut tax registration number. Review all entries for the CT tax registration number in the General Information section of the State Municipalities Tax Data Worksheet.

How do I get a new CT registration number?

Our new registration is clear, simple and step by step. You will probably receive your CT registration number on time.I. All new CT registration numbers are now likely to be issued as 12-digit numbers. All previous 10 or 11 numbers remain valid and must not be changed in any way.

How do I register and cancel a license plate in CT?

Begin the process of registering and canceling the sheet by entering your secretary’s number, license plate, and license plate class. Your Secretary of State Number is most likely the business ID that is issued whenever you register your organization with the Secretary of State for Tuberculosis.

Do I need to register with the Connecticut DRS?

You must sign the Connecticut DRS if you are an SMLLC, commonly treated as an S corporation incorporated with the Secretary of State of Connecticut, or a foreign corporation requiring registration with the Secretary of State of Connecticut or obtaining a Certificate of Authority from the Secretary of State of Connecticut.

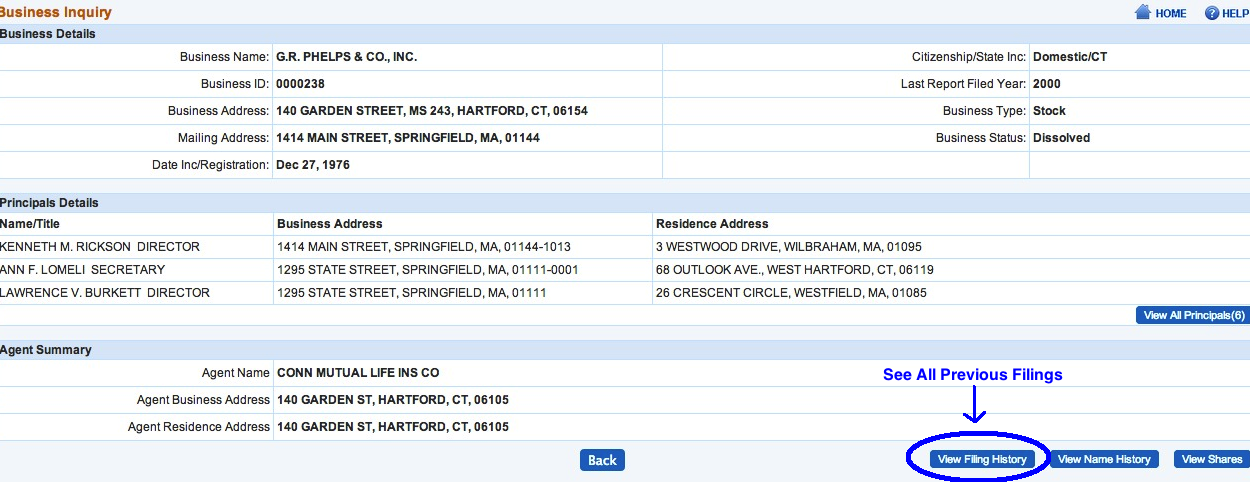

How to find out if a company is registered in Connecticut?

Business and Business Search You can find information about businesses or companies in the industry in Connecticut or any other state by: – ??Searching the website of the state, state, or province where the business is registered.