How much does it cost to register an LLC in CT?

Here are the steps you and your family need to take to form an LLC in Connecticut. For more information on setting up an LLC in each state, see Nolo’s article How to Start an Operating LLC.

Register Your Business

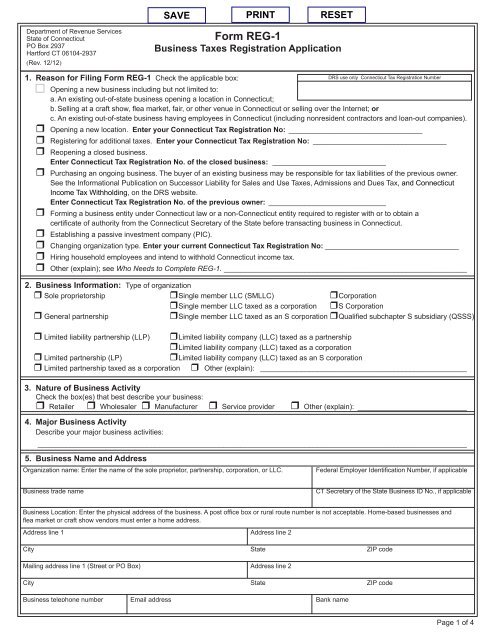

All taxpayers are now required to register online through myconneCT, the registration application (REG-1). If you register a tax account, you must make each payment electronically. DRS indicates that a direct payment from your credit or checking account will be used. Credit card payments are accepted but carry a high fee. If you are registering for sales tax, space occupancy, over-the-counter cigarette sales, or (retail) tobacco shops, a temporary permit is available for immediate printing. BE SURE TO PRINT A COPY FOR YOUR RECORDS. Once you receive a temporary permit, you can use it immediately. During the practical application process, you create a username and password to access myconneCT. Once you and your family have applied, you can log into your myconneCT account using your CT tax registration number. As an advanced CT company, you must now work with myconneCT to manage your account, save? Addresses, names, officers, and types of taxes are accurate and up to date.

It’s Easy To Register An In Llc Connecticut

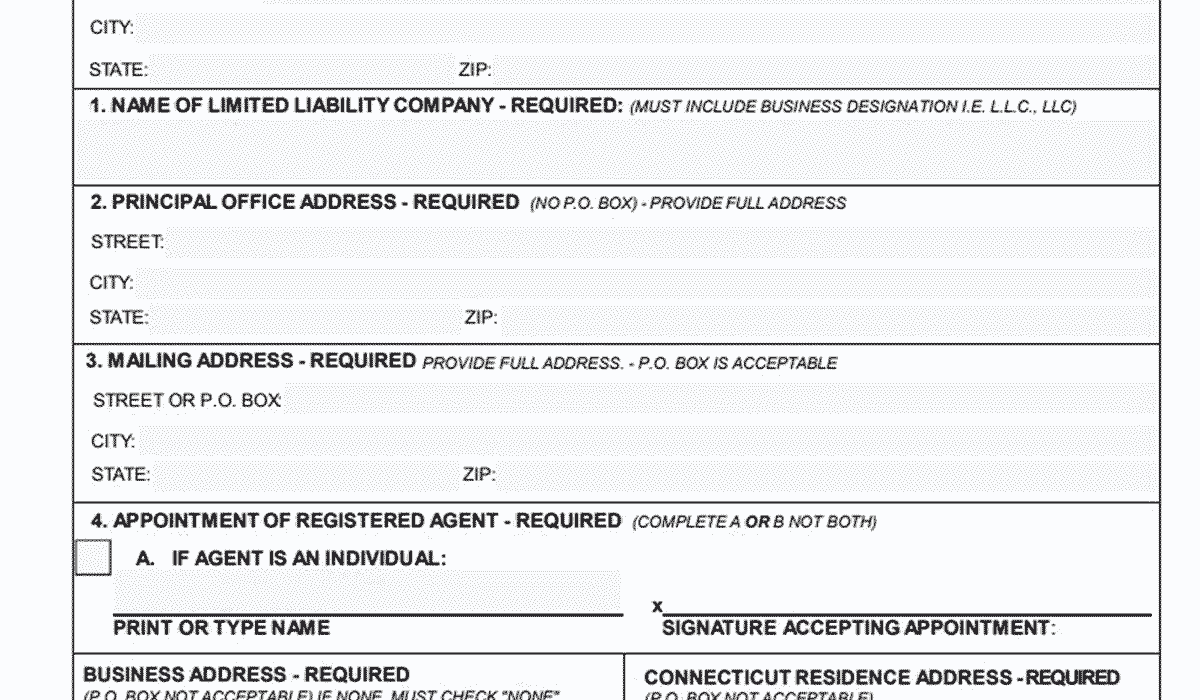

To form an In llc CT, you must submit an organization certificate with the Connecticut Secretary of State, which costs $120. You can apply online, by mail, or in person. The Certificate of Organization is the document that formally establishes your Connecticut limited liability company.

Choosing A Company Name

If you are a sole proprietorship, you can conduct business in Connecticut under your name as your own legal name or a very good intended corporate name. If you are choosing a nickname for your business, I would say that it should be distinct from names and other state registered companies and trademarks.

Choose A Name For Your Limited Liability Business

Under Connecticut law. , the name of the LLC must contain the word “Limited Liability Company” or any abbreviation “LLC” or “LLC”. “Company” “Company”

Companies/LLC

If you are meIf you are a corporation or limited liability company, LLC, you must now apply to the Secretary of State of Connecticut, who will register your company name with Norwalk. You can contact the office at (860) 509-6200 or simply (800) 540-3764 for more information.

Submit Giant Organization Certificate

You can now submit a Certificate Organization with the Secretary of State to legally register your LLC in the state. You have the option to send the certificate online or by mail, and the registration fee is $120. Fees can be paid by credit card.

Connecticut Formation LLC Package:$269Generally

What is included in the Connecticut LLC package?A registered agent in Connecticut offers the best LLC service in the state. Our agents in Glastonbury are well versed in Connecticut business regulations. This experience and first-class customer service gives people everything they need to keep their favorite business afloat.Order Connecticut LLC right now!For a total of $276 (including ?$136 registration fee) you get:

Step 2: Determine The District

Once you have determined a specific location when zoning, you will want to determine in which zoning area the property or house is located. You can detect this situation by searching for the address that contains the viewer and the property that selects the zone level.

Insert The Connecticut LLC Organization Certificate

If you are ready to enable your Financial Institution Hacking with limited liability. You complete the Certificate of Organization and submit it to the Secretary of State. In other states, this document is referred to as the “Charter of Organization”.

How do I set up an LLC in Connecticut?

To include another LLC in CT, you must submit a Certificate of Organization to the Connecticut Secretary of State, which costs $120. You can apply online, by mail, or in person. An organization certificate is a legal document that officially registers your Connecticut LLC.

How long does it take to form an LLC in CT?

You can register an LLC in Connecticut in 4 agency days if you apply online (or 5-6 weeks if you apply by mail). If you need a Connecticut LLC to be faster, customers can pay for expedited processing.

How do I register a business name in CT?

Starting a New Business in Connecticut?In addition to DRS-related information, check out the new Connecticut Business Startup Online Checklist tool below, which includes information from all types of government agencies and creates a personal directory for you.