Submission of the useful annual report of Illinois LLC. After registering an LLC in Illinois, you must file an annual return and pay a one-time fee of $75 each year. You must manually file your annual return to bring your Illinois LLC into line with the Secretary of State of Illinois.

What Is An Illinois Annual Return?

An Illinois Annual Return must be filed annually to maintain good standing and comply with LLC requirements if you own an Illinois LLC. LLCs have the option to file their annual return online or by mail. Applying online is often more expensive, but it only takes two business days to process the notification. Cheaper to send by mail, but development time may take 10-28 business days.

How Do I Calculate Franchise Tax In Illinois?

Does Illinois offer several ways to calculate total tax collection? ? and encourages companies to use the core process that results in the least core variety. Here is a summary of the two options:

What Will I Get, I Would Say State?

If you mail your annual report by default, the Secretary of State of Illinois will mail it to you. No refund will be given. Nickany warnings or confirmations. However, if you mail two copies of the annual return, along with a self-addressed and stamped envelope, you will receive confirmation in the mail.

Illinois Annual Registration Instructions And Fees

Compliance with this law To comply, every Illinois corporation must file an annual return with the Illinois Department of Business Services. Costs vary depending on the type of business entity. Here is a fantastic overview of the fees and basic filing requirements:

What Is An Illinois Annual Return?

For other filings, the State of Illinois requires companies to file returns periodically to prove it ? ? Re in accordance with the work with the rules of the applicable jurisdiction. The permit is proof that you are following the rules and reporting reliability and legitimacy.

The Cost Of Forming A Foreign LLC In Illinois

If you already have an LLC registered in another state and therefore, if you want to expand your business inUnder Illinois, you must register your LLC as a foreign company in Illinois.

Online Company Registration

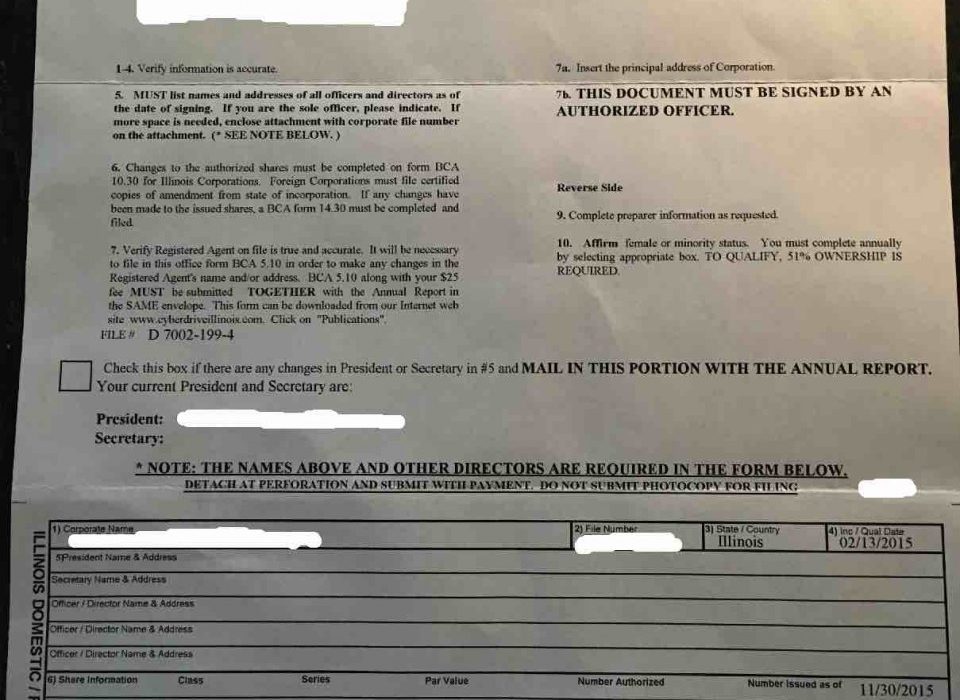

Companies can be registered online through CyberDrive. The only restriction placed on corporations is that they can, at best, issue shares of common stock. You may not issue shares valued via online filing.

Annual Return

The state, which is located throughout Illinois, requires you to file a 12-month return for your LLC. You can receive the annual report online from the SOS website or by mail by completing Form LLC-50.1. The report contains basically the same information as the article organization. The report is due annually and also on the first day of the month in which your LLC is formed. For example, if your LLC was incorporated on July 15th, say that it would have defaulted on July 1st. The current medical history fee is $75. Late filing (more than 60 days after the due date) will result in an additional $300 penalty.

Annual Report Contents

Generally, the Annual Report filed at the time of presentation by Illinois LLC (or any other working organization for that matter) contains all the information about its corporation and its members. Typical contents of an annual return or franchise annual tax return:

How Complete Is An Illinois Annual Report In This Regard?

You amend your Illinois corporation’s articles of association by completing an Amendment Form BCA 10.30, Articles of Amendment, in duplicate, by mail or in person with invoice submitted to the Secretary of State of Illinois. As a result, how can I renew my corporation for Illinois? To restore a corporation, you must file BCA 12.45, Application for Reinstatement, with a duplicate, to the Secretary of State’s office. You must also submit years that were not submitted for articles. For more information call 217-785-5782.

Does Illinois require annual report for LLC?

Here are the Illinois requirements for LLC members/managers:

How much does it cost to file an Illinois Annual Report?

Get the Illinois Annual Report Service today! For a $100 federal fee, we file their annual return. For most domestic LLCs, this is a total of $175. If you own a corporation in Illinois, we will send you a prepared annual return for you to add tax information, and then submit the return for completion.

What happens if an Illinois LLC does not file an annual report?

The Illinois State Government charges a $100 late filing fee for an annual article. If an LLC fails to file an annual return for two or more consecutive years, the Department of CommerceInfluence and Consumer Affairs has the right to terminate the activities of the LLC. An LLC can file its annual return online or by mail.

What is the penalty for late filing an annual report Illinois?

Illinois Annual Return Late Filing Penalty Generally, there is a $300 fine if an LLC is 60 days late in filing its annual return. This may be in addition to the base application fee. In case of delay of the LLC for 180 days, the state administratively terminates the activities of the LLC.

What is the filing fee for the Corporation and LLC annual report?

The corporate and LLC annual return filing fee is $75. Businesses also have an additional tax credit of at least $25. Additional payment selection fees apply to all online applications.