How do I reinstate my LLC in KY?

The reinstatement of a Kentucky corporation requires the filing of an application for reinstatement with the Minister of State of Kentucky and may require the payment of punitive damages.

Restoring Or Reviving A K?Corporations Of Kentucky.

If your Kentucky LLC has been administratively dissolved by the Secretary of State of Kentucky (SOS), you can easily restore it at any time. You must first submit the complete file and apply for restoration. The recovery pack application is available on the SOS Business Services website. You can click on the Online Business Services link and then go to the business search pages where you can enter your company name and then print the application container. You can pay the fees in cash and therefore pay by check, debit or credit. Paychecks are ideally payable to the “Kentucky State Treasurer” due to bad reputation, potential penalties for non-compliance, and the loss of many of the benefits offered by this type of business. One way to address these issues is to recover in Kentucky.

Recovery/Recovery For Business.

Many states require you to apply for a “tax exemption” or possibly a recovery”. liberation” is gaining momentum. tax creditsYou restoration of your essence. This is published proof that your company has freed everyone past due or past income taxes with a government tax authority, often the Treasury Department or Tax department. States requiring a tax certificate require that a letter or The certificate must be submitted along with a special reintegration form. According to the state, It can take weeks or months to get a tax clearance. If you received absolutely no tax Customs Clearance, Port Compliance can refer to and receive your state’s tax laws. Your degree is yours.

Are You Ready To Re-establish Your Business In Kentucky?

Social media should increasingly become the preferred medium that companies install for their clients, colleagues and clients. We are committed to sharing information, and informative tools will help you increase engagement?ness.

What Is The Kentucky Annual Report?

The Kentucky Annual Report is a document that changes the status of changes in your organization. Regardless of whether the conversion actually took place, the state requires companies to submit this report annually.

What Else Should I Know About Dissolving A Kentucky Corporation?

When the state of Kentucky merges your corporation, your corporation’s name becomes easily accessible to anyone who wants to use it. This is one of the reasons why experts say you should never dissolve a corporation, because you are absolutely certain that you will no longer do business in this state. This is when the state liquidates all your business without your knowledge and therefore does it. This can happen if you do not submit your 60th Annual Return within a few days of the due date. Rebuilding your business can always be a challenge. The recovery includes the completion of the Kentucky recovery package. This file must include a reinstatement application form, an annual reinstatement report,proof of agent change, registration, and a new certificate of quality from the current Kentucky Treasury or the Department of Unemployment Insurance. Finally, the recovery fee for this Kentucky company is $100, plus you have to pay $15 each year if you missed the annual return. In general, administering a dissolution and re-instatement can be a burden for a club and it is best to avoid this dilemma altogether.

Kentucky Charities Annual Reports And Submissions

If you need to provide potential donors with accurate information about your organization, you must submit your annual report by June of every 30th year. You can submit your annual report directly from January 1st to June 30th:

Our Illinois Driver’s License Attorneys Are Looking Out For Your Interests

If you live 30 miles from the Illinois border, you need someoneintroduce myself to you in particularHearing to reinstate your driver’s license, but since you live further, you can complete the process by ?mailin the best newspapers outside the state.

How do I dissolve a corporation in Kentucky?

To dissolve each Kentucky corporation, file the articles of incorporation that led to the dissolution and three exact copies to this Secretary of State of Kentucky (SOS). If the forms provided by Kentucky SOS often do not meet your needs, you may not be able to provide additional documentation, but you are eligible if you need to develop custom resolution elements. Kentucky SOS offers two forms of liquidation depending on the business you are liquidating while you are in business.

Who has to file an annual report in Kentucky?

The Kentucky Select Report is a comprehensive report that gives you detailed information about the company’s performance over the past year. 3 minutes of reading

How do I reinstate an entity in Kentucky?

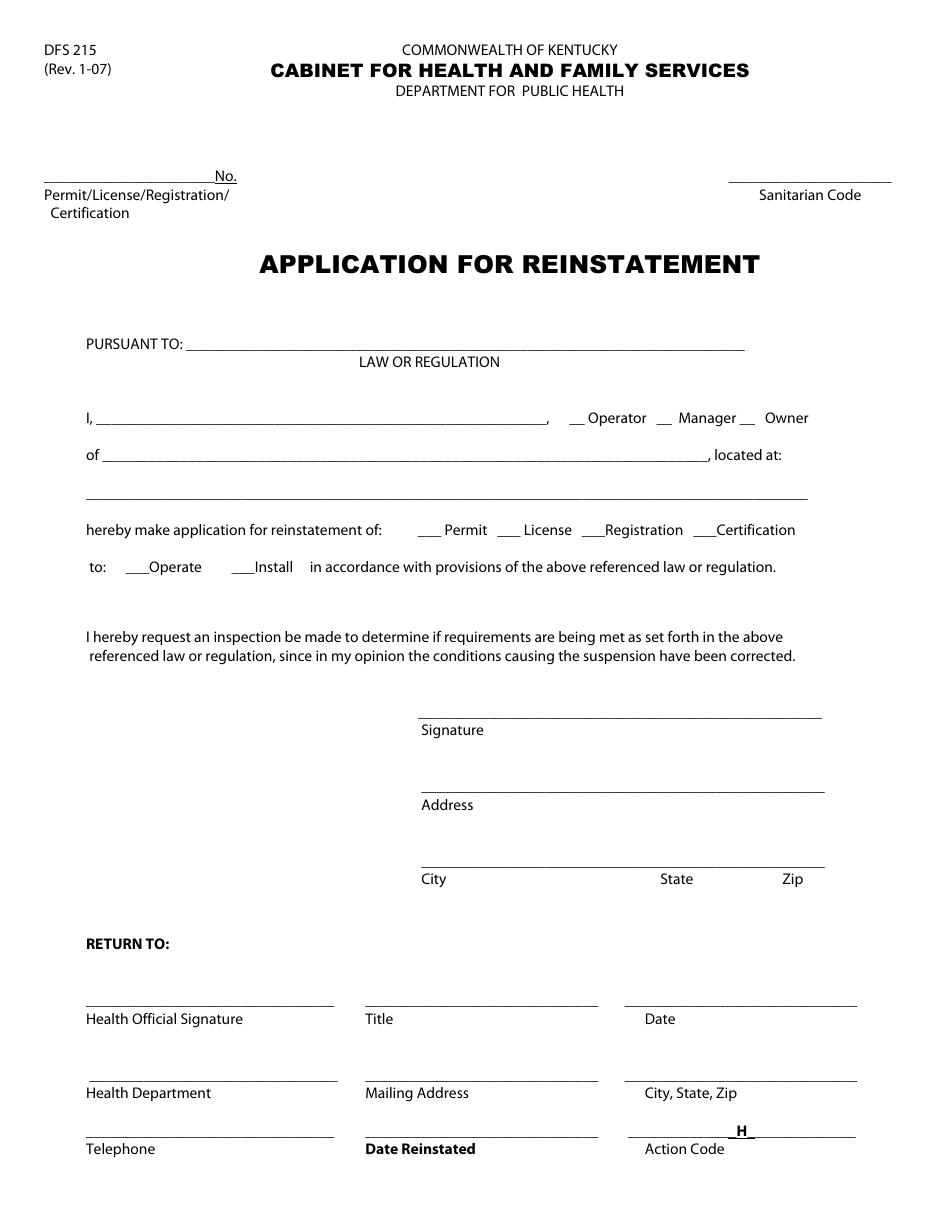

To be reinstated, a company must: Mail a reinstatement application by mail or in person to the Secretary of State’s office. Office of the StateThe Secretary of State will request a duly authorized letter from the Kentucky Department of the Treasury and, in the case of commercial agencies, from the Department of Unemployment Insurance solely on behalf of the Company.

What is included in a reinstatement packet?

A reinstatement package that includes a reinstatement application, an annual reinstatement study, and an application to change director and registered office (if you make a change to your address) must be sent to the Secretary of State’s office.

How do I file an annual report with the Kentucky Secretary?

To help the affiliated secretary of state provide accurate information to the general public, all corporations doing business in the Commonwealth of Kentucky must file an annual return with this office by June 30 of each year. Reports can be submitted at any time between January 1 and June 30 in one of the following ways: by submitting a 12-month report online; Where

What does the Kentucky Secretary of State do?

The Secretary of State of Kentucky oversees state market registrations, notary commissions, background checks, and more. Find corporate rules, rebrand your company and submit your annual report with a personalized online corporate database.