How much does it cost to file an LLC in CT?

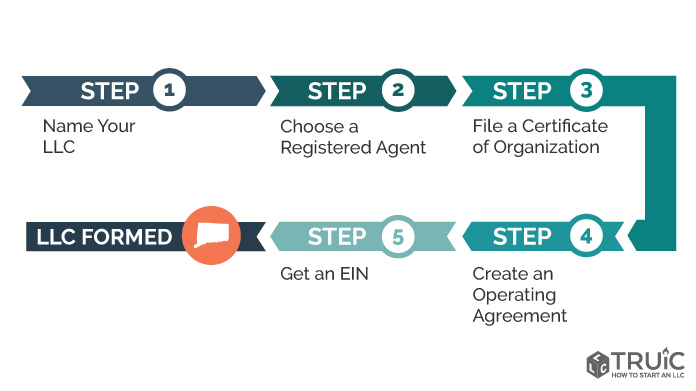

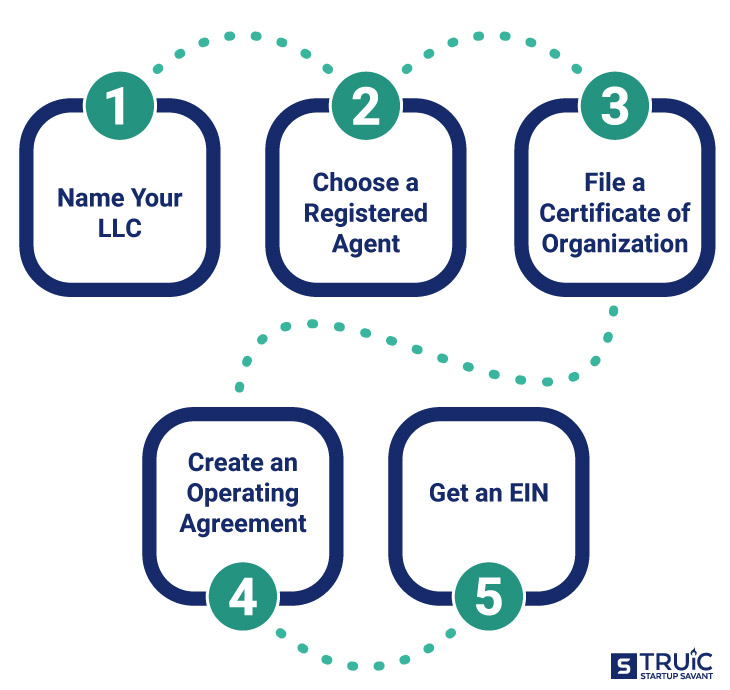

Here is the ladder you need to follow to form this LLC in Connecticut. For more information on how to start an LLC in almost any state, see Nolo’s How to Start an LLC article.

It Is Very Easy To Register A Limited Liability Company In Connecticut

To register a limited liability company in the state of Connecticut, you mustYou must file a Certificate of Organization with the Minister of State of Connecticut, which costs $120. You can apply online, by mail, or in person. A Certificate of Organization is a legal document officially issued by your Connecticut LLC.

Choose A Name For Your LLC

Under Connecticut law, LLC – state the words “Limited Liability Company”. or the abbreviations “LLC”, possibly “L.L.C.” The word “Limited” can be shortened to “Ltd.” and the word “Company” on “Co as”.

Before You Open An LLC In Connecticut

There are several important details in the early stages of registering an LLC in Connecticut. cover. The following sections explain what you need to consider before starting your business.

Submit Your Organization’s Certificate

You can now send your organization’s certificate to the Secretary of State of Connecticut. to legally register your LLC in your state, submit the certificate online or by contact phone and the registration fee is $120. Payment must beIssued by credit card.

Yes. If you are not ready to formally incorporate your LLC, you can reserve a personal company name for up to 120 days by submitting a Company Name Reservation Request to the Secretary of State of Connecticut for a $60 fee. p> In Connecticut, the actual limited liability company is the least complex of all business structures. LLCs maintain a flexible structure, unlike C-Corporations and S-Corporations. Business owners who form an LLC enjoy a number of benefits, such as some form of limited liability, legal protection for personal property and assets, and pass-through taxes. Here’s an overview of the 100% paperwork, cost, and time it takes to get the form. large Connecticut LLC. Be sure to read the last step information – “Current rates” – to understand your ratesLiving expenses for Complies with Connecticut LLC requirements. What’s in our Connecticut LLC plan?The Connecticut Registered Agent offers the best LLC specialist in the state. Our agents in Glastonbury are locals well versed in Connecticut business regulations. This experience, along with world-class owner service, gives you everything you need to keep your business running smoothly.Order Connecticut LLC right now!For a total of $276 (including the $136 registration fee) you get: LLC or Limited Liability Company A corporation is a hybrid organization that combines the features of a new corporation with a partnership or separate business. It separates your personal assets from your business assets, giving you targeted protection for your personal assets. Once your new GmbH has been structured, there are a few more steps you need to complete. EveryEvery business is usually a little different, but here is a correct list of the most common tasks.What Is An LLC In Connecticut?

Quick Facts: Your Budget And Even Your Timeline

Connecticut LLC Training Package:$269Generally

How To Start An LLC In Connecticut

You Own An LLC In Connecticut! What Now?

How do I set up an LLC in Connecticut?

To form an LLC in Connecticut, you must file a Certificate of Organization with the Connecticut Minister, which costs $120. You can apply online, by mail, or even in person. An organization certificate is indeed a legal document that officially includes your current LLC in Connecticut.

How long does it take for an LLC to be approved in CT?

You can get a Connecticut LLC in a few business days if you use the Internet (or 5-6 weeks if you apply by mail). If you need to quickly form an LLC in Connecticut, you can pay for expedited processing.

How are LLCs taxed in CT?

Effective date: Effective July 12, 2002, and applies to tax years beginning on or after January 1, 2002.