A limited liability company (LLC) is a land-based structure that combines some variants of corporations and partnerships. Limited liability companies that are residents of Minnesota or that do business in Minnesota but are residents of another state must register their articles of association with the Minister of Minnesota Designate.

How do you create a LLC in MN?

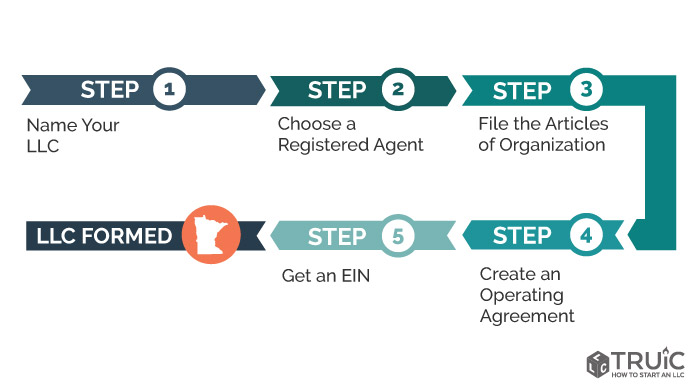

Here Are The Steps Your Business Needs To Take To Register A Limited Liability Company (LLC) In Minnesota. Limited

A Reporting Company (LLC for short) is a way to start a business with a legal structure. . It combines the limited liability of a corporation with the flexibility and informality of a partnership or individual ownership. Any business owner wishing to limit their personal liability for business money and lawsuits should consider forming an LLC.

Can I Reserve A Company Name In Minnesota?

Yes. If you would like to call Dibs with a trusted business name but are not available anytime soon?To form an LLC, you can file a Big Name Reservation Form with the Minnesota Minister and pay a flat rate of $35 ($55 online) for the reservation. your business for up to one year.

At A Glance: Your Budget And Timeline

Here is an overview of the documents, total cost, and time required to create this task LLC in Minnesota. Be sure to read the last step Book “Current – Quotes” – to understand your ongoing maintenance costs Qualifies for Minnesota LLC.

Filing Articles

An LLC is formed in Minnesota by filing articles of association with the Secretary of State of Minnesota. You can submit articles for or by mail. The online deposit amount is $155 and the invoice by mail is $135.

Seven Important Steps To Starting A Good Business

After you have an LLC name or the name of the company you have chosen and you have completed the necessary steps Steps to transform your business, but your work is far from complete

The list of LLCs must endbe written as “Limited Liability Company”, “LLC” or “LLC”. Limited liability company, foreign company, dangerous limited partnership, foreign limited liability company in addition to a foreign limited liability company authorized to do business in the State, except when: (1) another company is about to sell its name, change its name, cease operations, dissolve or retire, and (2) written consent may be obtained from that person.

Costs Of Running A Business

Creating an LLC can start with a lot of paperwork of all kinds? The process is not that difficult as you have knowledgeable and experienced support. Start your LLC by following these steps:

Choose A Name For Your Minnesota LLC

The very first basic step in starting a Minnesota LLC is to give your LLC a custom name. Before naming your establishment, you should know that the name must be easy to remember, accessible in the state you are in.Go ahead and comply with all LLC identification rules.

Why Do You Choose Which Business You Should Register In Minnesota?

According to a study by WalletHub, Minnesota is ranked 17th among the best places to do business. The Land of 10,000 Lakes scores highly for ease of use with licensing, Think Government training programs, and the ease of use of online government websites to start a community business and then learn how to start and run a small company.

What’s An Interesting Change In Minnesota?

The State of Minnesota requires all retailers to report any changes they may have to products originally registered in the statute/organization attached to it. To do this, your company must go through the change process and provide full documentation.

How do you register a LLC in MN?

How much does it cost to start an LLC in MN?

Here are the new steps you need to take to deal with an LLC in Minnesota. To learn more about starting an LLC in any state, check out Nolo’s article How to Help You Start an LLC.

How are LLCs taxed in MN?

When it comes to income tax, most LLCs are pass-through entities. In other words, the obligation to pay federal income tax passes on the LLC itself and falls on the individual members of the LLC. By default, LLCs do not pay income tax themselves, but only their respective members. However, Minnesota charges an LLC a separate fee for licensing business in the state. The collection is multi-urOwnership and applies to LLCs that have created $500,000 or more through government property, payroll, sales, or receipts.

How long does it take for an LLC to be approved in MN?

What is the payment term for an LLC? This is the amount of time it may take the state of Minnesota to compare and enter your LLC record into their system. Once your LLC is recognized, the state will return the approved PDFs to you electronically or by mail.

How to start a LLC in Minnesota?

What are the best companies to work for in MN?