You must file a Minnesota tax return if your Minnesota gross income meets the minimum data requirements ($12,525 in 2021). To determine your gross income in Minnesota, use the Minnesota Gross Income Calculator.

Annual Renewal

The State of Minnesota requires your family to file an annual renewal forfor the respective LLC. You can email the reconstruction (blank forms are available for download) and/or possibly complete it online on the Department of State website. Only a few details are required, such as your LLC’s state photo number, legal name, registered agent and medical office address, name and mailing address associated with at least one responsible LLC, and a few other basic details to allow renewal to be completed.

Partnerships

For federal purposes, all partnership records must be completed on Form 1065, which is an informational statement. No taxes are paid through the partnership with this refund. Other types of schedules may be required, including K K-1 and K-1 schedules. Sole partners use Schedule E (Form 1040), prepared from the information contained in their Schedule K-1 Form 1065, to report their allotted portion of partnership income, deductions, loans, and losses associated with individual Form 1040. Form SE (Form 1040) is used to calculate Social Security and Medicare taxes for the self-employed.

Does a single member LLC need an EIN in Minnesota?

Minnesota Limited Liability Companies can operate in Minnesota, but due to the other state having to file its articles of incorporation with the Minnesota Secretary of State. For more information, see “Minnesota and Foreign Limited Liability Companies” on the state government website.

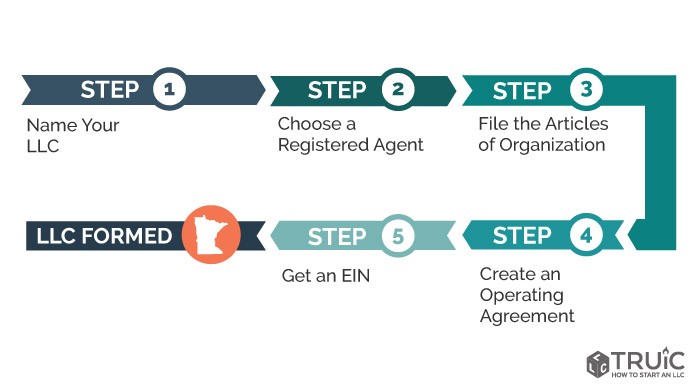

Creating An LLC In Minnesota Is Easy

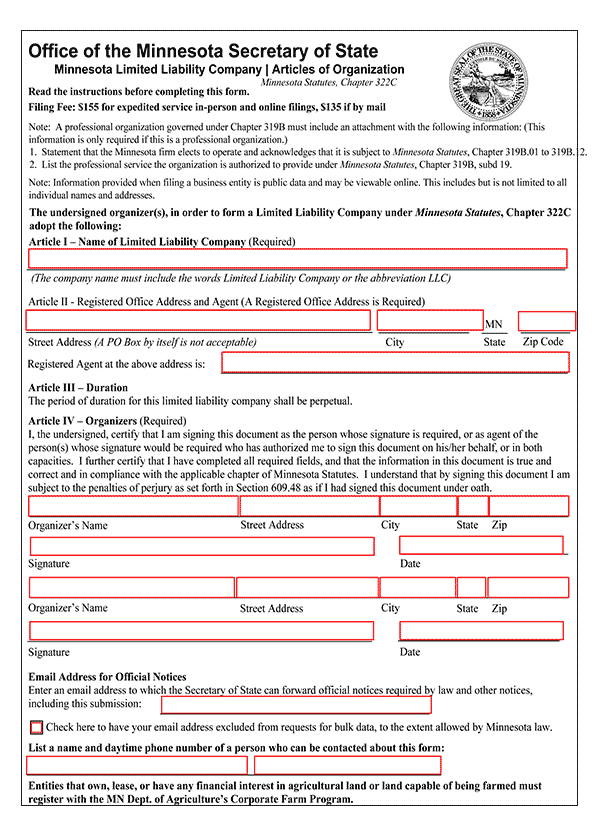

Minnesota LLC – To form a Minnesota LLC, you must file a Memorandum of Association Secretary of State of Minnesota for $155 net. You can apply online, by mail, possibly in person. The Memorandum of Association is the legal document that formally establishes your Minnesota LLC. A

Choosing A Name For Your LLC

Choosing a name for your business is considered an important first step in starting a new business and should be done as early as possible in the process. be filled in to avoid naming problems. The State of Minnesota dictates that you must meet a few specific requirements when choosing the name of your preferred LLC. These requirements include that your name contains one of the following: Name

Name

Llc LLC Must End With “Limited Liability Company”, “LLC” Or “L.L.C.” The Legal Name Must Not Deceptively Resemble The Specific Name Of Another National Society.va, A Disabled Society, A Limited Liability Company, An Internet Limited Liability Company, A Corporation, A Foreign Limited Partnership, A Foreign Limited Liability Company, Or A Foreign Seller With Limited Liability. Conduct Business In Accordance With The Form, Unless: (1) The Other Company Intends To Change Its Name, Cease Operations, Merge Or Exit From It, And (2) Has Received Written Consent To Form A Company.

The Cost Of Running A Business

Does LLC formation start with a lot of paperwork? ? The process is usually not that difficult if you have knowledgeable or experienced help. Start your LLC with the following steps:

MN LLC Vs. MN Corporation

What the Experts Say We’ve covered the common characteristics most commonly associated with all LLCs and corporations, then we’ll come back to cover more specific details of what Minnesota sells as an LLC or Minnesota corporation in other states, which will lead people to the finalanswer the question of which organization is best for your business. Each state has its own tax laws and regulations that govern how its business works for you, and these unique characteristics should be considered when choosing a finance company. The information in this section may include this data for Minnesota LLC and Minnesota Corporation.

Make Sure Your LLC Name Is Available

You can decide what name your LLC gets. Before choosing a name, you really need to make sure it’s available to work in Minnesota. If you are registering an amazing out-of-state LLC and your official LLC designation is not available in Minnesota, you may need a fictitious name to use as your fictitious name instead. Your

Minnesota LLC Name

Choosing a name for your business is really the first step to starting a Minnesota LLC. This is an opportunity to get creative and define exactly what you and your business have to offer. When considering how to name your LLC, remember that your name isYou need to be unique and descriptive. The best name to associate with an LLC should be:

Minnesota Tax Election For An LLC

When an LLC has only one owner (known as the actual “member”), it is the Tax Election service. The IRS quickly ignores him for federal income tax purposes. An LLC member reports LLC salaries and expenses on their tax return.

How do I file taxes as an LLC in Minnesota?

For tax purposes, LLCs must apply for a federal employer identification number with the Internal Revenue Service (IRS) and a Minnesota tax identification number directly with the Minnesota IRS. LLCs in most cases file the same type of tax returns in Minnesota as they do with the IRS.

What are the filing requirements for an S corporation in Minnesota?

Documentation requirements? for an S corporation If your corporation has elected to be taxed as a designated S corporation under section 1362 of the Internal Revenue Code (IRC) and you are doing business in Minnesota, you must complete Form M8, S Corporation Return, Submit.

Do I have to file a Minnesota tax return?

If you are a part-time resident or non-resident, you must apply if your gross income in Minnesota meets the minimum global filing requirements. You must file a specific Minnesota tax return if your gross income is at least equal to the amounts shown for your age and filing status in the table below.

What are the minimum filing requirements in Minnesota?

Minimum Tax Filing Requirements You must file a Minnesota income tax return if it appears that your gross income is not less than the amounts shown for your age and status in the table below. Gross income is the total income before deductions or expenses. Note. Partial residents and non-residents must use the “Under 60” and “Single” columns.