How do you calculate franchise tax in Delaware?

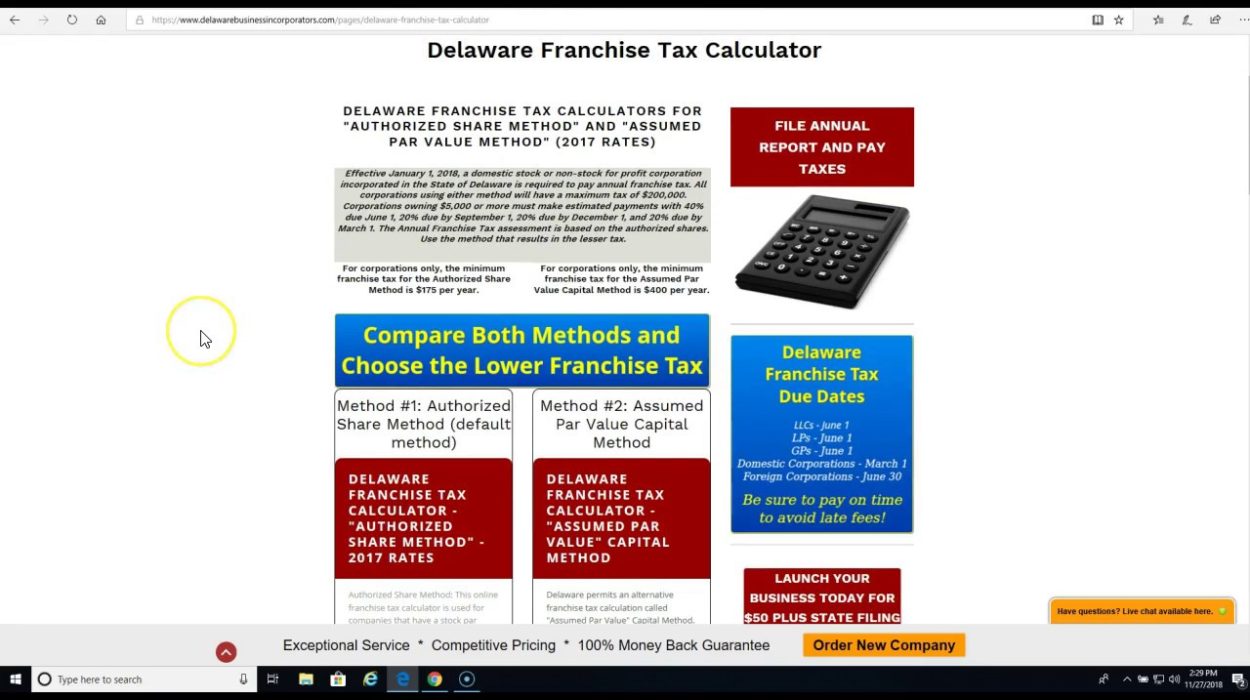

Effective January 1, 2018, a true local corporation or non-profit corporation incorporated in Delaware will be required to pay an annual franchise tax. The minimum tax is $175 for corporations using the allowed shares method and a mandatory tax of $400 for corporations using one of our notional nominal capital methods. All wound upThose using either method have an ideal tax of $200,000. Businesses with debts of $5,000.00 or more make settlement payments, with 40% due on June 1st, 20% on September 1st, 20% on December 1st, and the rest on March 1st.

Do I Have To Report Delaware Franchise Tax?

If you added in Delaware, yes, you will need to report and pay Delaware Franchise Tax. Most VC-backed startups are Delaware’s C-Corps, which usually means that most VC-backed startups want to introduce DO. Limited liability companies, partnerships, limited liability partnerships and limited liability partnerships must pay an annual fee or tax. Companies registered in Delaware are a lot of stories. Businesses can use two methods to calculate their annual franchise tax. The default method for Delaware is Authorized Sharing. This choice is pretty simple; 5000 or ?More shares pay a minimum of $175. If your own German company has high quality assets, this particular method of estimated nominal value of capital is much more difficult, but has a cheaper tax calculation. Don’t forget to add the $50 annual registration fee. Delaware companies are required to file their annual franchise fees online.

Delaware Franchise Tax Calculator

Don’t worry if all of the above calculations seem a bit complicated to you. Delaware has a handy spreadsheet calculator that you can download here. (To use, click this particular “Save As” link, then open the spreadsheet .xls file with an application on your computer such as Excel or Numbers.)

Annual Tax Return: < /h2>In Addition To The Franchise Fee, The Local Corporation (meaning A Specific Delaware Corporation) Must Pay The Delaware Franchise Tax By March 1 Of Each Year. There Are Two Methods For Calculating Tax: 1) The Method Of Permitted Shares; And 2) The “Assumedand Capital. However, A Has A Choice Of Which Method To Use. Delaware Has A Method For Calculating Allowed Shares For Each Taxpayer, But It Is In Each Taxpayer’s Interest To Also Calculate The Franchise Tax Using The Notional Par Value Method (and Use This Method If It Results In Lower Taxes). /p>

Due Date… Coupled With What Happens If You Don’t Pay Tax In Delaware

Annual return and franchise tax must also be paid by March 1st. Notice after the annual return and due tax deduction will be sent to the registered agent of the company in December or January of each year. Delaware requires that these reports be requested electronically.

How To Calculate Delaware Franchise Tax

Delaware business tax varies, the amount depends on the franchise option. The total tax-related cost of the franchise is a combination of taxes actually due and annual port dues.

Corporate Franchise Tax

All corporations registered in the stateFor example, Delaware is required to file an annual franchise tax return and pay franchise tax. Religious and altruistic non-state corporations are exempt from taxes, but unfortunately must file an annual return. Tax and annual financial statements must be filed every 12 months by March 1st. The minimum tax is $175 and the maximum tax is $200,000. Taxpayers who pay $5,000 pay taxes quarterly, with 40% due June 1st, 20% due September 1st, 20% due December 1st, and the remainder due December 1st. /p>

What Is The Delaware Franchise Tax?

Despite its current name, the Delaware franchise tax is not considered a franchise. Instead, Delaware bills for the right to own a Delaware corporation could be imposed.

The Implied Nominal Value Of Capital Method

The implied nominal value of capital method uses a different general tax calculation method that requires the total amount of assets issuedsigned and approved futures contracts and face value. per share. This method is much more difficult, but in the end this tool costs $400. 🙂

How much franchise tax do I owe Delaware?

If you’re ready to help you file and pay your Delaware franchise tax now, visit our online franchise tax form. BUT

Do I have to pay Delaware franchise tax?

Annual report of the company and payment of franchise tax

How do I avoid franchise tax in Delaware?

The Delaware Franchise Tax is the final tax levied by the State of Delaware on the right to have an employer there, which is necessary to maintain a good business reputation. Reading time: 8 minutes

Is there a franchise tax calculator for Delaware state corporations?

Franchise Tax Calculator** and Disclaimer – Division of Corporations – Delaware E.The calculator can only be used to calculate shares with a parity rate. The taxes due are primarily based on the “Permitted Stock Method” and are printed in connection with the annual Franchise Tax Notice that each business receives each year.

How much does it cost to open a franchise in Delaware?

Once the payment is confirmed, you are all set. The minimum sales tax for franchises in Delaware is $175 and the registration fee is $50. The minimum franchise tax in Delaware, combined with annual return fees, is $225 for local corporations. The Delaware franchise tax for your business is simple.

How much tax do I pay on shares in Delaware?

Delaware corporations are required to file their annual franchise taxes online. 5,000 or fewer businesses pay a property tax of at least $175. From 5,001 to 10,000 shares, a $250 property tax is payable. For each additional 10,000 shares, add $75 to the total tax, with a maximum franchise tax of $180,000.

How do I figure my annual Franchise Tax?

Companies can use two methods to calculate their annual film tax. The default method for the state of Delaware is Allowed Sharing. This option is quite simple; 5,000 or less, you pay the regular $175.