Business Structure

Before the decisionTo be registered with the Department to invest taxes, entities such as corporations, LLCs, and partnerships doing business should check with the Secretary of State of Georgia for their reporting requirements.

p >

Explanation Of Employer Tax Liability (Publications 15, 15-A 15B)

Publication and additional 15PDF contain information about employer obligations regarding taxable wages, employment withholding tax, and what tax filings must be filed on an ongoing basis. More advanced issues will be covered in Version 15-APDF, and taxation procedures for various employee benefits can be found in Version 15. We encourage employers to download these catalogs from IRS.gov. Copies can be requested online (Search and Forms publications) or by calling 1-800-TAX-FORM.

How much is a EIN number in GA?

The EIN Online Application is the preferred way to apply for and obtain an EIN for Loyal Customers. Once the application is completed, the guide will be verified during an online session and the EIN will be issued immediately. The online application process is available for any location whose principal place of business, office or agency, or possibly legal residence (in the case of an individual) is in or within the United States.

Steps To Obtain A Georgia Tax Identifier (EIN) – Number

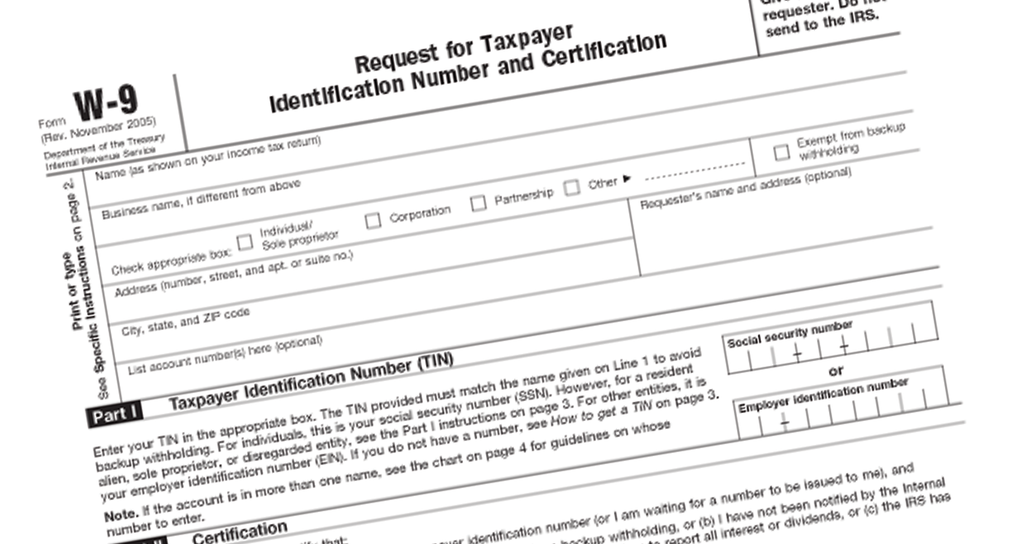

Obtaining an Identification Number taxpayer should oblige your company to register with the competent administration. Accordingly, you will be required to provide personal information about yourself and others.other founding members of your business (i.e. your affiliates). While there are many different ways to apply, it is likely that each application format will require you to provide the same amount of information about your key personnel. Proactively gathering this information can greatly speed up the completion of computer software. Be sure to write down their correct legal names, court addresses, and Social Security telephone numbers (SSNs). That’s all you need.

Wait For Your Georgia LLC To Be Approved

Wait for your Georgia LLC to be approved by the Secretary of State before you register to file A. Otherwise, if your LLC filing is rejected, you have an EIN placed on a non-existent LLC. Trying to get a tax ID in GA is very easy. The Georgia Taxpayer Identification Number is often the identification number assigned to your business. It’s like a social security number that you can use toopening a line of credit in the name of someone’s company, opening bank accounts, and other things such as paying taxes. It can also be called a mandatory taxpayer identification number if you have hired workers.

What Can An Employer Identification Number (EIN) Be?

EIN is short for Employer Identification Number, sometimes referred to as a federal tax number. Employer identification, Fein, federal identification number, or federal tax number, called an identification number. It’s a unique nine-digit number, still like a social security number, a fantastic person, but more of a business ID.

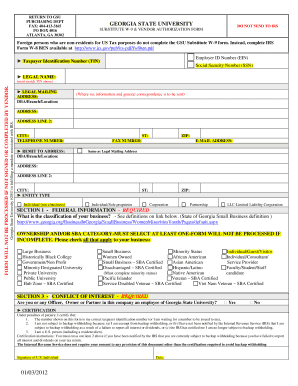

Georgia Tax ID

Apart from getting a federal tax ID. In (a) Georgia, you will most likely also need a Georgia tax ID. This ID is required to pay the service tax, state income tax, and/or sales tax on goods thatwhich you are selling. Typically, a state tax identification number that belongs to an individual is used:

Using A Georgia Tax Identification Number (EIN)

An ideal Georgia tax identification number (EIN) is a plan that used by most corporations. trusts, estates, non-profit organizations and even religious organizations must complete. Also suitable for businesses and corporations that are not required to obtain a Taxpayer Identification Number (EIN) throughout Georgia, provision is recommended as it can potentially help protect personal information of individuals type while restricting their use of the same Control Identifier (EIN). )) is allowed. instead of their social security number in various activities required to run their business or organization, including obtaining local licenses and permits in Georgia. Any business that meets yes to any of the following criteria must obtain a tax identification number.EIN at Consult Georgia:

Georgian Government Agencies

Contact state government agencies to get your tax number. The EIN lookup will be done in GA. If you have lost your Georgia Employer ID and need your Employer ID, your company can contact the New Secretary of State’s Office in Georgia or the Georgia Department of the Treasury that collects taxes. The state government maintains a database of family businesses currently registered in the state and paying taxes sorted by their Georgian employer i.e. d.

How Do I Get An EIN In Georgia?

You must first register with the Internal Revenue Service (IRS) to obtain a federal tax identification number in Georgia. Georgia. Obtain a Georgia Tax Identification Number before registering your business with the Georgia Secretary of State.

Is Georgia tax ID the same as EIN?

How to get a GA Tax Identification Number in the Marketplace is quite simple. The Georgia Taxpayer Identification Number is the identification number assigned to your business. 3 minutes of reading

Does an LLC need an EIN in Georgia?

Starting a new business comes with many challenges. Described below are some of the important steps you must take to keep your business in line if you decide to register an LLC in Georgia. To learn more about starting an LLC, watch the webinar What You Need to Know When Deciding to Register a Small Business.