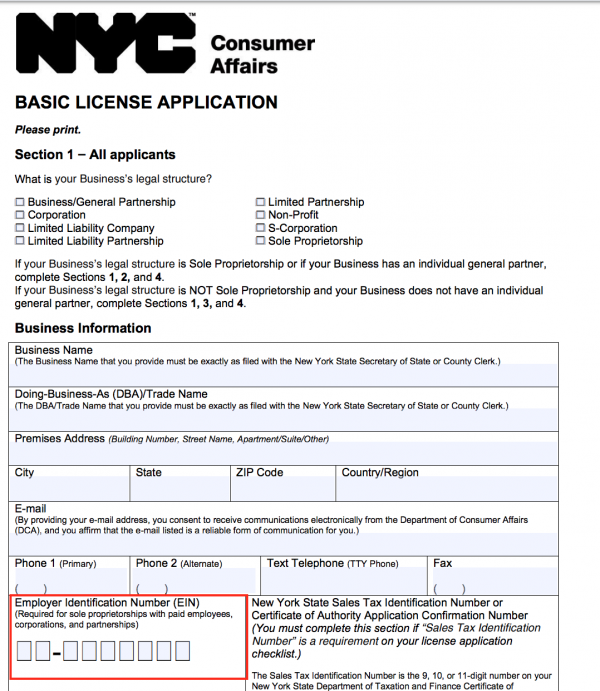

You need an EIN to identify your company to the IRS and then to New York State. You can obtain an EIN by: visiting the IRS website “Apply for an Employer Identification Number” (EIN) or. Call the IRS at 1-300-829-4933 or.

Explanation Of Employer Tax Liabilities (Publication 15, 15-A, Or 15B)

Publication 15PDF provides information about employer obligations with respect to taxable wages, deductions at source, and income reporting. More advanced issues are discussed in Publication 15-APDF, and taxation procedures for a growing number of employee benefits can be found in Publication 15. We encourage employers to upload various types of publications to IRS.gov. Copies can be requested virtually (search for “Forms and or Publications”) by contacting 1-800-TAX-FORM.

What Is An Employer Identification Number Or Possibly An EIN?

H2 > The IRS Issues An EIN To All Businesses. Option Nine Consists Of Numbers, So It Refers To The Social Security Number. Anyone Who Is Permanently Independent Can Use An EIN Instead Of A Social Security Number When Completing W9 Forms.

Steps To Get A Tax Number:

Before getting more information During the process,Take a lot of time to collect the necessary information for your company and its partners. It will also save you time in the long run and make the application process smoother.

What is NYS EIN number?

Learning the New York State EIN is one way to getl Employer identification number, commonly known as tax identification number. 3 minutes of reading

How Do I Cancel My EIN?

If there are new errors with your first EIN ask the person or you need to cancel your EIN number for any reason, all you have to do is send a letter of resignation to the IRS.

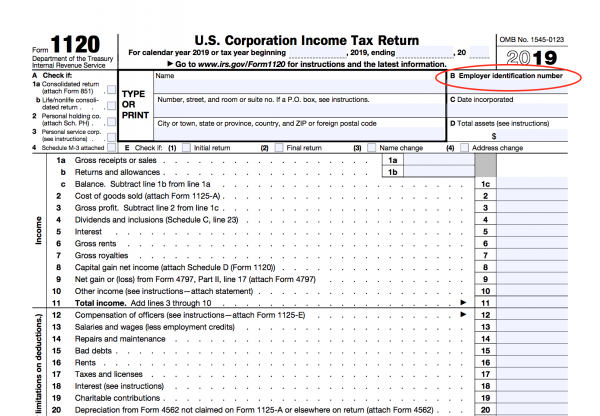

What Is An Employer Identification Number (EIN)?

EIN is short for Employer Identification Number, sometimes referred to as Federal Employer Identification Number, Fein, Federal Identification Number, or Federal Tax Identification Number. This is a completely unique nine-digit number, similar to a social security number for an individual, but instead identifies that company.

Using New York Tax Numbers (EIN)

York tax identification (EIN) is often a process that is required by most corporations, trusts, estates, non-profit organizationsations and churches. Even for businesses and corporations that are unlikely to need to obtain a New York Taxpayer Identification Number (EIN), it is recommended that one be obtained as it can help protect the privacy of individuals’ information by granting each individual permission to use their Taxpayer Identification Number (EIN). ), as well as a social security number in various activities required to operate their business or organization, including obtaining the necessary permits and permits locally in New York. Any business that meets any of the following criteria must obtain an EIN:

What Is An Employer Identification Number (EIN)?

The term Personal Identification Number (EIN) refers to a unique identifier assigned to a service object so that it can be easily identified by the Internal Revenue Service (IRS). TINs are commonly used by employers for tax reporting purposes. The series consists of nine digits and also has the format XX-XXXXXXX. Businesses can apply for EINs directly with the IRS, which will usually issue them immediately.

The Benefits Of Obtaining An EIN

An Employer Identification Number (EIN), also known as a tax ID, is a 9-digit code assigned by the IRS to register with your recipient company. . You can think of it like a social security number for your business. An EIN is often required by a partnership, corporation, or corporation to open a government-owned commercial bank account, obtain funding, hire employees, etc.

How do I find my EIN number in NY?

If you previously applied for and received an Employer Identification Number (EIN) for this company, but have since lost it, do any or all of the following to find the number:

How do I find a company’s EIN number?

Most people know their individual security code by heart, but most entrepreneurs don’t know their tax identification number. Nobody uses your EIN every day, so remembering this number is not as easy as remembering your phone number and business address.

Is the NY sales tax ID same as EIN?

It can be difficult to pinpoint exactly what a mysterious IRS cell phone number is and why you should be single. We explain how the entire VAT identification system works and why this number can be useful for your craft business.