Register online at INBiz. Click “Register Now” at the bottom of the page and follow the instructions. You will receive a Taxpayer Identification Number within 2-3 hours after registering online. For more information, please contact the agency at (317) 233-4016.

Explanation Of Employer Tax Liabilities (Publications 13, 15-A, And 15B)

Publication 15PDF contains information about employer tax liabilities with respect to taxable job pay, tax withheld, and tax credits that must be ?Deposited. More complex are the facts discussed in Publication 15-APDF, and the tax treatment of many employee benefits can be seen in Publication 15. We encourage employers to purchase these publications from IRS.gov. Copies can be requested online (search forms and publications). or call 1-800-TAX-FORM.

Wait For Your Indiana LLC To Be Approved.

Wait for your Indiana LLC to be approved by the appropriate secretary of state before apply A. Otherwise, if your LLC application is rejected, you will have a different EIN attached to a defunct LLC Indiana LLC

If you already live in Indiana, you may know how many resources and opportunities there are for entrepreneurs. Otherwise, families will not have to look far for statistics. Approximately 97% of Indiana’s businesses are small business owners with over 500,000 employees employing 1.2 million Indiana residents in total. This means that over 45% of working Indians work in small businesses, which is a good thing.belt information if you are a beginner entrepreneur.

Fixed Taxpayer Identification Number (EIN) Application Steps Obtain An Online Taxpayer Identification Number

that you will need to complete your application. While there are many methods available for your business, almost all of them follow the same scaling format. You answer a few questions about your company and its founding partners, submit your application, and then wait to receive our release by mail or email (depending on the method chosen).

The Steps To Successfully Obtain An Indiana Taxpayer Identification Number (EIN):

The first thing you need to do is collect information that will help you complete the application. Applying for tax identification will result in you receiving several key files relating to you, your company and your key business partners. This process registers your business with the government, so it should be checked for accuracy anyway. First, aboutCarefully collect information about your business partners and co-founders. You must have your full legal names, your phone number, your phone number, and your social security number.

Indiana Tax Identification Number

In addition to getting your federal tax number (EIN) in Indiana, you may also need an Indiana tax identification number. This ID is required to pay income tax, state income tax, and/or sales tax associated with the items you sell. Typically, the state identification number is used for the following purposes:

How much is a EIN number in Indiana?

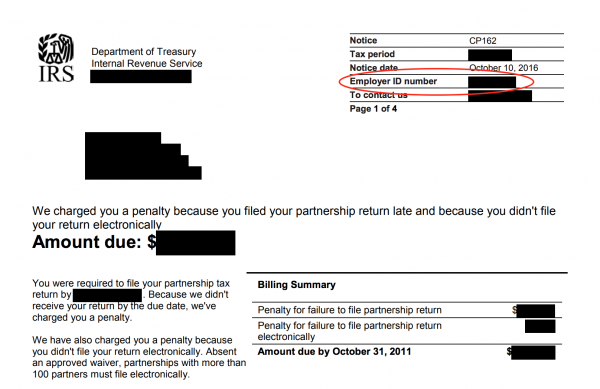

The EIN appears as an employer identification number and could potentially be issued by the IRS to your fabulous Indiana LLC.

How Much Does An EIN Cost In Indiana?

Using an EIN for your LLC is usually completely free ($0). Applying for an EIN for your limited liability employer in Indiana is completely free. If you are applying for an EIN, there are no fees or charges from the IRS.

Is Your EIN The Same Type As Your Employer’s Taxpayer Identification Number?

Your IDEIN Number Your federal tax identification number. You need it to pay federal taxes, hire employees, open a bank account, file petitions, and for business licenses and permits. Applying for an EIN is free and you must do so immediately after registering your business. How much does it cost to register a business in Indiana? How much does it cost to register another business in Indiana? To form an LLC in Indiana, send your Articles of Incorporation, along with a $100 registration fee, to the Secretary of State of Indiana. It also costs $100 to register Absolute Corporation in Indiana.

What Is An Employee Identification Number, Or EIN?

The Employee Identification Number, or EIN, is nine digits. , unique, long-term number. It’s also known as Your Employer’s Current Federal Identification Number (FEIN) or, you see, Federal Tax Identification Number, and it’s actually assigned to a business by the Internal Revenue Service (IRS). This tax identification console wasThe first was created by the main IRS in 1974 by decision of the Department of the Treasury (TD), not to mention that it is intended for the main paying employees of certain companies, as well as for filing corporate tax returns. .

What Is An Employer Identification Number (EIN) For Limited Liability Companies?

Your Employer Identification Number, or perhaps an EIN, is a kind of social security table for your business that allows you to IRS to easily identify your business. It is also known as the federal tax identification number (FTIN) or sometimes as a taxpayer identification number (TIN) for businesses.

How do I find my EIN number online?

Ideally, you should remember your tax identification number or keep it in an easily accessible place. With all of this getting your attention as a trusted small business owner, you may not realize you don’t know your EIN until you’re halfway through your tax return. Don’t worry! Finding a forgotten, lost, or misplaced taxpayer identification number is actually quite easy and won’t cost you anything. Here is a guide to gathering people at the Bundesplatz unhindered when looking for ID. We will also tell you how to find another company’s EIN.

Does Indiana require a state tax ID?

For millions of Americans, entrepreneurship is a calling, and every time you have a business idea that truly reflects someone else’s will, you can make that dream a reality. Indiana is a particularly welcoming place for entrepreneurs and small business owners, but there are still a few important steps that need to be taken.about to take before you can start authorizing money in the state.

Do I really need an EIN number?

You may need to obtain a wonderful EIN for a number of reasons such as business, probate or trust banking, and employee verification. Businesses also need EINs if they need to file payroll tax returns; excise declarations; or the return of alcohol, tobacco and additional firearms. You may need a TIN for the following reasons:

Where to find my Ein number?

How do you use an EIN number?

How to verify my Ein number?