Steps For Choosing An EIN And Registering A Kentucky Corporation

There are many reasons to consider when deciding which business structure to choose. Some corporate kitchen appliances have these inherent advantages or benefits, especially companies that may publicly issue shares to raise funds. When you’re trying to define a national or international business, corporations are usually the best fit.

Is the Kentucky EIN the same as the federal EIN?

Registering an EIN in Kentucky? Apply online and get your Tax ID in less than an hour using this Kentucky Tax ID Application Guide. Many find it surprising to realize that even if you own a multi-member corporation, trust, non-profit organization, partnership, property or LLC, you need to prepare personal information about each of your couples. This simple taxpayer identification guide will help a person apply for an official Kentucky taxpayer identification number?and (EIN).

Wait Until Your Kentucky LLC Is Approved.

Wait until your Kentucky LLC is approved by the Secretary of State before applying for your EIN. Alternatively, if your LLC application is likely to be rejected, you have an EIN to link to a defunct Commonwealth of Kentucky LLC, which could potentially be a Limited Liability Company, LLC, C-Corp, or S-Corp. The first step in registering in Kentucky is to decide on the structure of the business. Then select the legal entity name and search? real name availability to make sure your chosen business name is available sooner.

Steps Obtain Your Kentucky Tax Identification Number (EIN):

The first important step in the current application process is the preparation of the application. Regardless of which program you choose, you should formulate a few questions about your business to make the whole process faster and more efficient by gathering answers from these people in advance.

Kentucky Tax Identification Number

In addition to obtaining your Kentucky Federal Tax Identification Number (EIN), you will probably also need a Kentucky Tax Identification Number. This ID is required to pay taxes, territorial income taxes, and/or sales taxes on the equipment you sell. As a rule, the state taxpayer identification number is used to:

Request New Or Additional Numbers

KCTCS system manager working with accounting andstate departments of the treasury, see KCTCS System manager and treasury accounting and operations will almost ask for ID Must-have numbers.

Check Your Company Name And Register With The State.

Most companies must be registered near the state before registering in Lexington. . (If you are the sole owner of this business, the petition is not mandatory. You can skip it, you will still need to register with the city.)

Equality Claim Opportunity/Affirmative Action

H2>The University Of Kentucky Is An Equal Opportunity/empowerment Employer And The Educational Institution, In Addition, Does Not Discriminate On The Basis Of Age (40 Years And Older), Skin Color, Religion, Disability, Ethnicity, Gender Expression, Gender Identity, Marital Status, National Political Background, Religione, Paternity, Race, Religion, Gender, Sexual Orientation, Veteran Status At Admission Or Sometimes Participation In An Educational Program Or Maybe Even The Activities (such As Sports, Studies And Housing) That He Unfortunately Does, Or Some Other Policies Or Practices In The Workplace.

Learn How To Get An EIN In Kentucky

The process of getting an EIN in Kentucky may seem complicated at first, but if you know what you are doing and follow it instructions, or apply for your own tax identification number with a specialized company, applying for an employer identification number will be much easier.

KY $39 Tax Identification Number

Also known as merchant authorization , Wholesale ID, Resale ID, Reseller ID.

How do I find my Kentucky tax ID number?

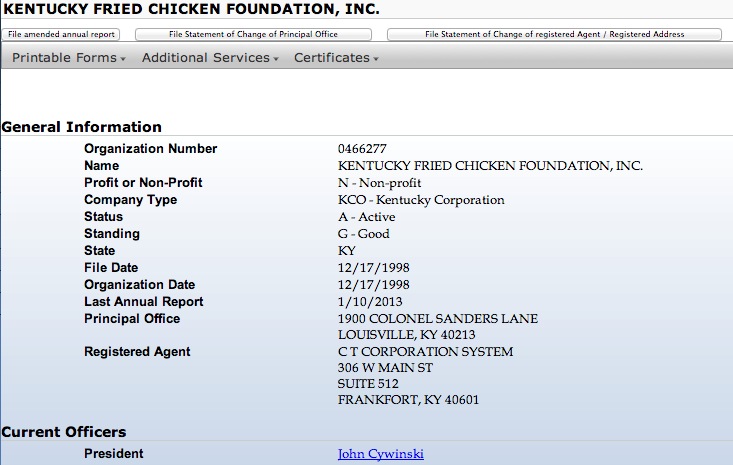

In Kentucky, state tax identification numbers for businesses are called Commonwealth Internet Marketing Business Identification Numbers or CBIs. If you need a company’s CBI for tax purposes, you have the option of getting it directly from the company. You can also find these RCCs in various public company business documents.

How much is a EIN number in Kentucky?

EIN instead of Employer Identification Number, which may be issued by the IRS to Kentucky LLC.