The annual fine for limited liability retailers (LLCs) in New Mexico is $0.00. In addition to having no gross fees, your New Mexico LLC may also not be required to file financial statements. These are just some of the reasons why New Mexico has become almost every desirable place to start an LLC.

New Mexico LLC Annual/Recurring Expenses

There are many other types of taxes that we as entrepreneurs must pay. Income tax, non-profit items, sales tax, payroll tax (if you hire employees), sales and use tax, property tax (if the LLC owns real estate) and more.

NM LLC Registration Fee

You set up an LLC in New Mexico submit your statutes with Secretary of State of New Mexico. The item can be mailed and stored in their E-File system. Product E-Files requires You can create a great account and pay a deposit fee for many conveniences. This is calculatedThis is when a person tops up your account. If also The registration fee is only $50.

The Cost Of Registering A Foreign LLC In New Mexico

If you already have an LLC that is considered registered in another state and you want to expand your business in New Mexico, you must register your LLC simply because you are outsourcing your LLC to New Mexico.

Initial Costs Required To Set Up A New LLC

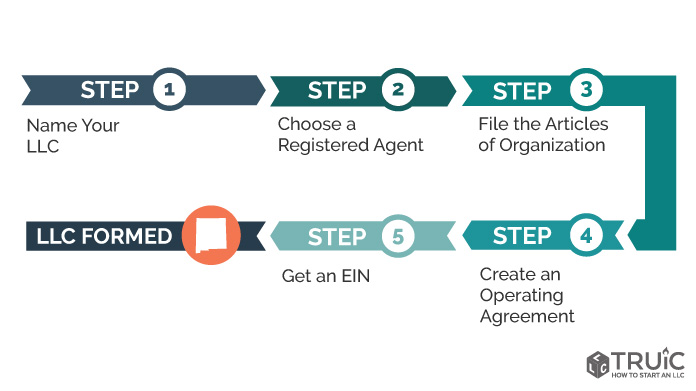

Let Mexico start by discussing the absolute basics. You cannot form an LLC in New Mexico without filing Articles of Association; It is this document that technologically registers your business in the state. It costs $50 to apply.

Choose A Name For Your LLC

In the state of New Mexico, your LLC name must contain the words “Limited Liability Company” or “Limited Liability Company” . Limited liability. or contain any of them referring to the following abbreviations: “LLC”, “L” lc”, “.L.C.”, possibly “L.C.” The word “Limited” can be used as an abbreviation for “Ltd.”cation is short for Co as.

Annual Return

Unlike most other states, New Mexico does not require you to complete an LLC form to file an annual return. LLCs are registered in Mexico to file information on income and income of through legal entities (PTE). Be sure to upload a copy of the required application to the New Mexico Revenue Department (TRD) website.

The Cost Of Filing Certificates Of Incorporation

The New Mexico Certificate of Incorporation actually costs r is responsible for most prices, which may also vary depending on whether you are setting up a local LLC or another foreign LLC. However, you can introduce any New Mexico Secretary of State.

Name Reservation: $20

You can reserve an LLC if you have a reasonable option but are not ready to proceed with company registration. Names keep others from claiming your name when most people think about it.

Have An Accurate Budget

Only in New Mexico, at $50, are the cheapest soy classes.Danish LLC in the country. But you will receive additional commissions if you hire an institution to help you form an LLC and act as a registered agent. These fees can vary greatly depending on the insurance company and services you choose. Be sure to consider costs and carefully plan to provide the services you need.

LLC Name Name

This, in the case of an LLC, must be in a “Limited Liability Company”, “Limited Liability Company”, “LLC”, “LC”, “LLC” or “L.L.C.” The name cannot be the same as or similar to the name of a domestic or foreign LLC, or a name additionally registered by another LLC, unless the written consent of the other LLC is obtained. The corporate name must not imply any purpose other than that specified in the articles of association. You cannot use the words “Bank”, “Insurance”, “Little League”, “Olympic”, and “Trust”.