![]()

How are LLC taxed in Maryland?

If you want to set up and operate a limited liability lender (LLC) in Maryland, you must prepare and file various documents with the state. This short article covers the basic filing and filing requirements for a Maryland LLC.

Learn More About Annual Returns And Tax Returns When Reviewing Maryland LLC’s Claims.

If you want to form and manage a Maryland Limited Liability Group (LLC), you’ll need to prepare a gov. This report examines the most important current relationship with state tax reporting requirements for Maryland limited liability companies.

Individual Ownership

For federal purposes, the individualSelf Employer, Schedule C, Business Income or Loss, in person on a 1040 tax return. Self Employment – Farmers File F, Agricultural Profit and Loss Chart. If you are a self-employed person in Maryland, you initiate the same as an individual using Form 502. Your net income or less has been combined with your income and offset deductions at the time of the return and is taxed at applicable tax rates.

Is My LLC Registered For Tax Purposes In Maryland?

Yes . Maryland limited liability companies must file state and state tax returns. However, LLCs are “pass-through” tax organizations, so these income taxes must be paid by individual members of the corporation, and not by the LLC itself. for the government, and the IRS pays.

FORM FOR CORPORATE TAX SERVICES

E-mail: [email protected]. Due to the fact that the laws governing the structuring and operation of corporations and Real Toregulate the effectiveness of UCC funding, not only verification is required, but also the submission of documents to our office, we recommend that you consult with a lawyer, accountant and other specialist. Our employees cannot act as consultants.

Name Requirement Maryland LLC

The name of an LLC must end with “Limited Liability Company”, “LLC”, “LLC”, “LLC”. or “LC” any transaction other than that permitted by these articles of association. The name cannot be identical or deceptively similar to the name of a qualified domestic or foreign LLC. Listing words in parentheses in a manufacturer’s name implies multiple names and is certainly not allowed.

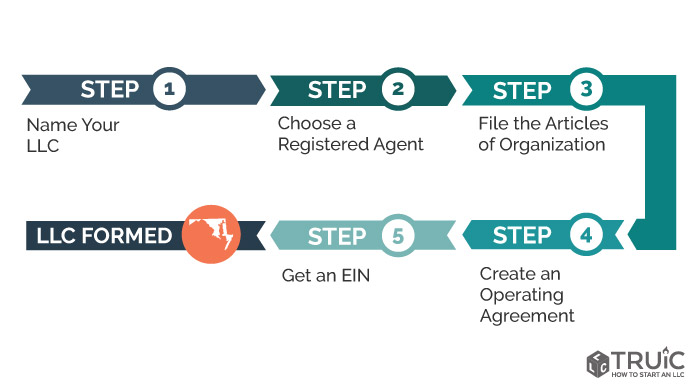

Incorporating An LLC In Maryland Is Easy

LLC Maryland. Form for an LLC in Maryland. You must file the Articles of Incorporation with the Maryland Department of Appraisal for tax purposes, which costs $100. They can be practiced online, by mail, or in person. A charter is a legal document by which Maryland formally registersMy limited liability company.

What Is A Limited Liability Company (LLC)?

and how it differs from other types of professional services. In Maryland, detailed requirements for incorporating and registering an LLC can be found in the Maryland LLC Law (Maryland Article of Corporations and Associations, Law of Ownership of Limited Liability Companies, 4A). An LLC may engage in activities related to any existing legitimate business, purpose, investment or activity, or otherwise, for profit or not, unless acting as an insurer is best. The law also includes certain requirements for operating an existing LLC in Maryland. However, the law is very flexible regarding the powers of the LLC, ie. the actions it must take. An LLC may take the first place to exist in perpetuity or terminate its activities after a certain period of time, and the concept may enter into contracts or conduct other beneficial activities, as determined by its members.Members of an LLC generally have the right to form a company in any way that suits them.

Creating A Single Member LLC In Maryland

Name your corporation as the first step if you want to create a Single Member LLC in Maryland. First, review the Secretary of State’s financial statements to make sure your name is different from other registered business names in Maryland. Second, make sure you have someone in your LLC name that contains one of the following abbreviations or words:

Maryland Annual Return Deadlines And Fees

Late Fees Payment: Your business will be charged a fee of 0.001%. from the general wealth tax or base fee, whichever is greater. In addition, 2% interest will continue to accrue for one month. Below is a table detailing the main penalties.

Corporate Property Taxes

In many Maryland jurisdictions, corporations are taxed on private property owned by the corporation, such as furniture, office equipment, and manufactured goods.enterprises, equipment, tools, materials, inventory and other residential premises not classified as real estate. Most retailers are required to file a personal business application every year from April 15, whether they are owners or not. The minimum fee for this return is $300 per year. Companies are, of course, automatically registered at registration and / or a certificate of incorporation / registration is registered in the state. After the State of Maryland reviews the tax return, a personal property tax bill is prepared. Pay-per-click fees are charged by the Montgomery County Department of the Treasury.

Do you have to file an annual report for an LLC in Maryland?

To successfully file your Maryland Preferred Annual Return, you must complete the following steps:

Is there a yearly fee for LLC in Maryland?

The basic cost of forming an LLC is $100 to file your LLC’s Articles of Association online with the Maryland Department of Appraisal and Taxation.