Massachusetts tax identification number: 04-6002284. The Commonwealth fall is used for payroll tax purposes.

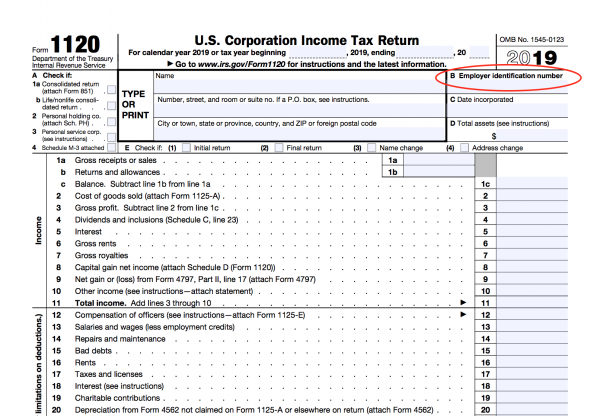

How do I find a company’s EIN number?

Most people know their created social security number by heart, but not all entrepreneurs know their tax number. Your EIN is not something you use every day, so remembering this most important number is not easy,how to remember one work phone number or address.

Massachusetts Tax Identification Number: What Is It?

Massachusetts Tax Identification Volume is needed to pay licenses and fees for a large company. A federal tax identification number, or EIN, is a number similar to a personal social security number. Has 9 digits and is actually broken down into 7 + 2 digits, just separated by a dash.

The Steps To Your Massachusetts Taxpayer Identification Number (EIN):

The first thing to do is prepare the answers you will need to complete the VAT identification application. This process registers a person’s business with the government, so you must provide all the correct data, but you can also provide it more efficiently if you collect this data on the fly. First, you need complete legal information about these people: and the addresses of all of your founding members, including all of you and your founding partners. You also need the security of all social numbers. N?Finally, you need a business address that serves as the legal name for your business.

Wait For Your Massachusetts LLC If You Want To Be Approved

Wait for your Massachusetts LLC if you need approval from the Commonwealth Secretary before applying for an EIN. Alternatively, if you are denied LLC registration, you will receive an EIN attached to your small defunct LLC for Employer Identification Number, and is sometimes almost referred to as Federal Employer Identification Number, FEIN, Federal Tax Identification Number, or Federal Tax Identification Number. . This is an important, unique nine-digit number that is similar to the Social Security Number for individuals, but instead identifies a specific Massachusetts Tax Identifier (EIN). The person will likely also need a Massachusetts tax ID. This ID is required to pay business taxes, state income taxes, and/or sales taxes on goods thatwhich you are selling. Typically, a State Tax Identification Number is used to:

Using A Massachusetts Taxpayer Identification Number (EIN)

Obtaining a Massachusetts Taxpayer Identification Number (EIN) is likely a process that performs most companies. , trusts, estates, non-profit and religious organizations should be detailed. Even for businesses and corporations that are not normally required to obtain a taxpayer identification number (EIN) in Massachusetts, obtaining an taxpayer identification number (EIN) is recommended because it can help protect individuals’ personal information and policies by allowing them to: use their taxpayer identification number (EIN) in lieu of a Social Security number in various ventures required to run their business or sometimes their organization, including obtaining local Massachusetts licenses and possibly. Any company that answers “yes” must receive a Masha Tax Identification Number.Massachusetts (EIN):

Additional Information:

We will only issue Form 1095-B until January 31st for eligible members who have just enrolled in the Massachusetts Blue Cross Blue Shield in any time during the calendar year. This form lists the months you had health insurance that covered FHS insurance. With. under the Affordable Care Act.

So How Much Does An EIN Cost?

Applying through an EIN for your LLC is free ($0). Applying for an EIN with Your Amazing Massachusetts LLC is completely free. The IRS does not charge a fee for applying for an EIN. With that in mind, how long would it take to get a large Ein number in Massachusetts? In fact, even if you apply online, it can take 4-6 weeks before the Massachusetts federal tax is emailed to you with your username.

Start Your LLC The Easy Way

Creating an LLC is a box that needs to be checked. Simple, fast and hassle-free. We will considerTrill the 13 most popular LLC formation services to make sure they really understand what new founders need. Our recommendation:

$39M VAT ID

Also known as Seller Authorization, Wholesale ID, Resale ID, Reseller ID.

How long does it take to get an EIN number in Massachusetts?

Apply for a Massachusetts Taxpayer Identification Number (EIN)? Learn more about how to apply online using this quick guide to applying for a Massachusetts tax ID. You are required to provide certain personal information about each of your business partners, even if you are a non-profit corporation, corporation, estate, trust, partnership, or a multi-member limited liability company. Get more tips on applying for a Massachusetts Official Tax Identification Number (EIN).