Subordination. Operating agreements do not need to be filed with a state government agency, so LLCs are usually controlled by the Department of Business or a similar body. Instead, if Incredible LLC decides to create a Pledge to Work, it must be written clearly and concisely and signed by all members of all LLCs.

Can I make my own operating agreement?

Do you need an operating agreement when registering a limited liability company (LLC)? Recall that operating bonds are legal documents that ensure the proper management of the LLC, as well as protect the personal liability of the business. Most states do not require LLCs to have this document, so many LLCs choose not to create one.

Why You Should Enter Into An Operating Agreement

Some states require an operating agreement with an LLC. In some cases in the past this was only necessary if the GmbH had significantly more than one member. Although this isNot strictly required by law, the operating agreement serves a number of other important purposes:

What Is A Written Operating Agreement?

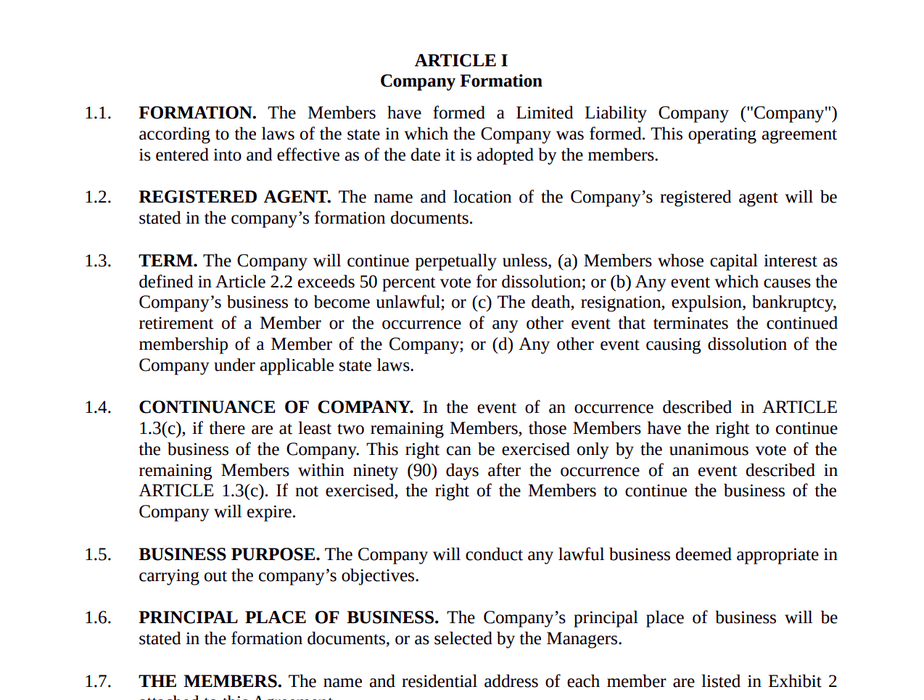

The written operating agreement is, of course, the legal contract that is entered into when registering a limited liability company (LLC). This Agreement defines certain laws, processes and rules governing the processes under which the Company operates within the company.

Article III: Capital Contributions

This section applies to members who have the money to form an LLC. There may be some debate about how the extra money is collected from members. For example, an LLC can issue “shares” of property when transferred for cash.

Who Needs To See A Treadmill Agreement?

An LLC agreement is not primarily beneficial, but also necessary to carry out certain business transactions. For example, lenders and banks often ask for a valid copy of an operating agreement when your big business is trying to get financing or openbe a business checking account.

Ownership

What percentage of the LLC has all the members you can get? Active Company Participation describes an agreement on how the profits, failures, and assets of an LLC are distributed among the members of a country.

What Is An LLC Operating Agreement?

An Operating Agreement for a Limited Liability Company (LLC), also known as the Memorandum of Association of an LLC, is a license document that defines the rights and needs of each member of an LLC and includes clauses such as:

Find Out What Should Be Covered If A Typical Operating Agreement With One Member Is The Actual LLC, Articles Of Association (or Equivalent Document Such As Articles Of Association) And Employment Agreement. The Articles Of Association Are Filed With The State, Telling The State That There Is A New SMLLC, Telling The Court That There Is An SMLLC, And Telling How To Contact The Company. Meanwhile, The Operating Agreement Defines Some Of The Most Important Rules For Implementing SMLLC. Unlike Arrangement Clauses, An Operating Agreement Is Generally Not Required To Formexcellent Or Small Business, It Is Registered In My State. Instead, An Operating Agreement Is Optional, Though Recommended. If You Choose A Template, Keep It At The Official Location Of Your Current Business.

What Is An LLC?

To form an LLC, you must complete the necessary paperwork with the secretary established by the State Chancellery. The insurance policy of the LLC business structure provides insurance protection for its participants. The Debt Society cannot confiscate a member’s personal assets to pay off debts. Form an LLC (Limited Liability Company) if you want a simple business structure that protects the personal assets of the owners (i.e. members). Create an LLC Operating Agreement if our business is active in your situation.

What Is An LLC Operating Agreement In Florida?

A LLC Operating Agreement is a contract in Central Florida . or owners, members, LLCs in Florida who, among other things, regulate the members? a lot of cash benefits for the LLC, payments, including the profit of the LLC, and that,how decisions are made in an LLC. Unlike organizing a content site, an LLC operating agreement is not required in Florida. However, it has always been a good idea to formalize the election among LLC members in a performance agreement.

What Is An LLC Operating Agreement?

An LLC operating agreement is an important part of a Letter of Law outlining ownership rights and membership obligations in the LLC. The agreement establishes financial and social information that meets the specific needs of client companies. From day-to-day operations to what usually happens when a member needs to leave their business, an operating agreement is essential to your business and should be created as soon as you form an LLC.

Do I need to file an operating agreement in Florida?

Florida does not require you to have aAn implementation agreement for your own Limited Liability Company (LLC), but it is highly recommended that you have one. When modernizing your business, it is helpful to seek legal advice from a Florida LLC trial attorney. Business lawyers will not necessarily be able to help you set up an LLC, but remember that they can also help protect your personal business through a comprehensive operating agreement.

Does the IRS require operating agreement for LLC?

The IRS has introduced new audit rules that require amendments to every LLC operating agreement and limited liability partnership (LP) agreement. While we have never experienced such significant claims, it is important to make changes to insurance before December 31, 2017. The IRS will gladly punish non-compliance.

How do you write a simple operating agreement?

If you are using a company like Limited Liability Company , you need a written user agreement. This may seem like a complicated process, but it’s actually not as confusing as you might think. With the support of business lawyers , You can enter into a corporate contract for your talent LLC “Multi-Member” Where one face gmbh in five easy steps.