Is an LLC operating agreement required in Indiana? No, the State of Indiana does not require LLCs to create a key operating agreement as a legal document to guarantee their operation. However, the State recommends entering into a company agreement in the event of disputes or problems.

By Type (2)

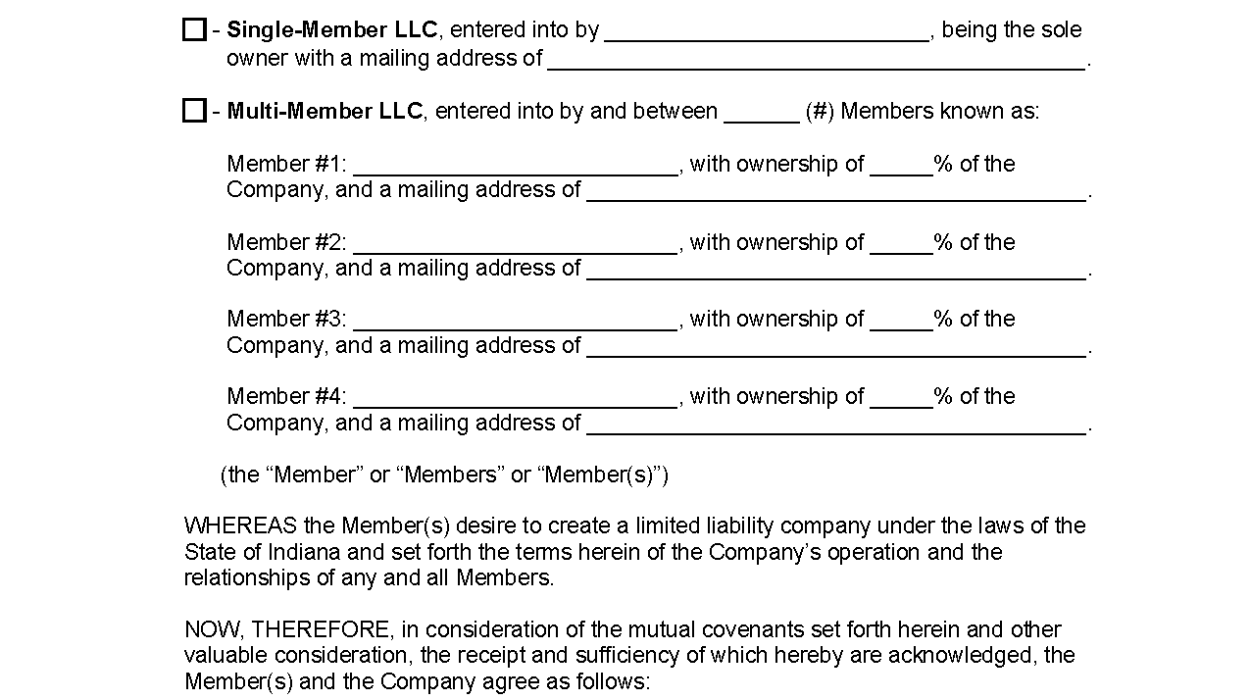

Single member operating agreement LLC –? This insurance plan is specially designed for one person organizations. The document will create a company here on the same basis as any other scenario company in terms of operation and will protect the member and the company.

Selecting Your New Company Structure And Registering

The following is the new a brief description of the various forms a corporation may organize under the laws of the State of Indiana. Caveat: formalOrganizing a business brings with it two of the most important legal advantages and ramifications. Caution should be exercised in choosing the form of trade and in conducting business. The corporate department will almost certainly try to help you, but cannot provide any legal information. It is highly recommended to consult a specialist for further advice.

Why An Indiana Limited Liability Company Must Always Enter Into A Newa Good Deal?

A limited liability company in Indiana must make a deal because the corporation cannot trade with their poker room. An LLC requires that certain persons (and other legal entities) engage in insurance activities in order to operate.

Can I write my own operating agreement?

Do you need an Operating Agreement when registering a Low Liability Company (LLC)? As a reminder, operating agreements are legal documents that ensure the reliable operation of the LLC and protect the personal liability of the business. Most states don’t want an LLC to have this ?document, which is why almost all LLCs choose not to write it.

What Is An Operating Agreement?

The operating agreement, which is usually adopted when an LLC is formed, defines the roles the members who play and determine how the LLC will generally be run. Unlike your LLC Formation Agreement, you are not required to file a Grand Operating Agreement with the State of Indiana. However, as an internal document, you must retain a copy for your records.

More Information

By using this website, you consent to the monitoring and testing of security measures. For security reasons and to ensure that public monuments are available to users, this government computing system uses network traffic monitoring programs that detect unauthorized attempts to download or modify.Send information or cause damage, including attempts to deny service to users.

Winning, Losing AndBreakdown

3.1BWIN LOSE. For financial accounting and property tax purposes, the net worth of a companyProfit or loss worldwide is determined based on the household as a whole anddistributed among members determined in proportion to the capital of each member’s uncleInterest in the Company as a collection, as set out in Schedule 2, as amended from time to timein accordance with the Regulation of the Ministry of Finance 1.704-1.

Indiana LLC Operating Agreement Template

RocketLawyer and LawDepot’s free downloadable LLC Operating Agreement Template will assist you with specific forms and legal issues so you can have each operating agreement tailored to your needs. your business. You also have access to the entire library of custom business documents, forms, and other important legal documents.

Contents Of The Indiana Operating LLC Agreement

The Operating Agreement is a legal document in which the corporatestructure and operation of LLC. Topics not permitted in an LLC with one or more members will be discussed. While these rules may never affect current operations, they must be considered for legal reasons.

Here Are The Typical Steps To Form A GmbH (LLC) In Indiana.

A Limited Liability Company (LLC) ) is a great way to legally structure an organization. It combines the limited liability of a special purpose vehicle with the lack of flexibility and formalities of a partnership or sole proprietorship. Any business owner wishing to limit their personal liability for debts and lawsuits should consider forming an LLC.

Is An LLC Operating Agreement Required In Indiana?

The state of Indiana does not have one. have business owners to have working harmony. However, business owners should always have just one so that they can set the rules and therefore the expectations for running their business.

Can I add an operating agreement to my LLC?

One way to act like a real business is to have the same type of documentation as other LLC owners. In an LLC with more than one member (owner), each document is called an operating agreement and is prepared with professional assistance when starting a business.

What should be included in LLC Operating Agreements Part I?

Generally, all of the major strategies contained in your Articles of Incorporation that you have filed with the state will most likely be included in this part of your LLC’s overall operating agreement.