The state’s federal tax identification number is 92-6001185.

How do I find my employer ID Alaska?

To register with Square’s Alaska payroll service, you must provide a valid Alaska employer account number and your employer’s Unemployment Insurance (UI) contribution.

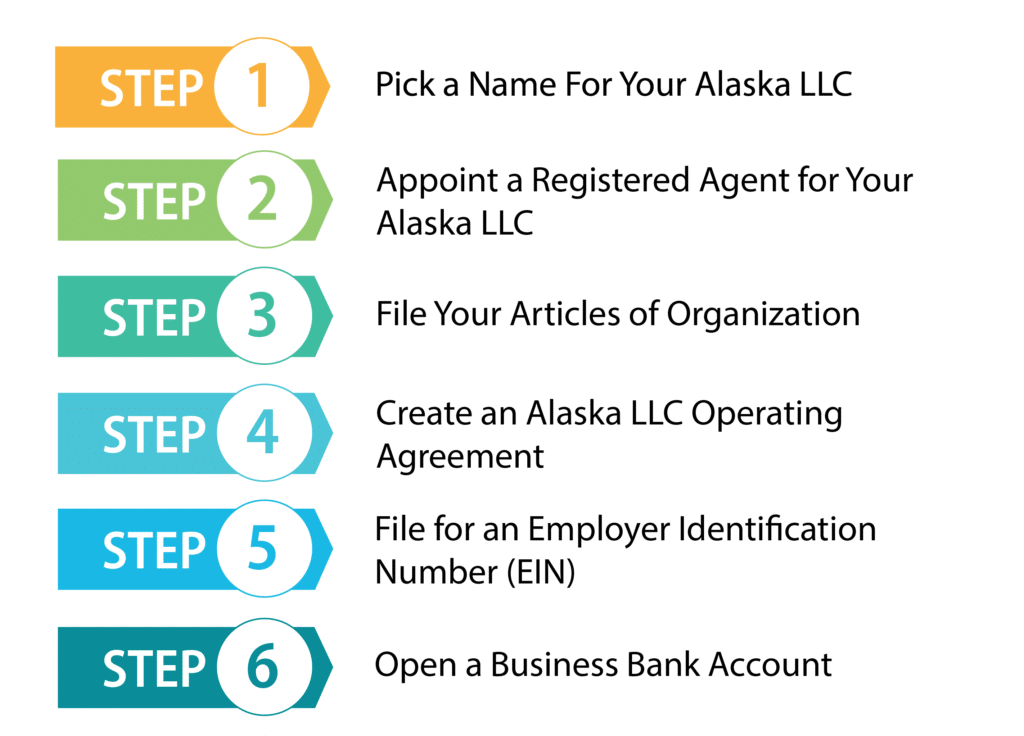

Steps To Get An EIN And Register Your Business In Alaska

BeforeBefore deciding how to start your own business in Alaska, it is important to do some research and understand the details of the outcome of your business. The usual intent here is that they should help you decide which business structure is best for your core business. There are four main options to consider:

Wait For Your Alaska LLC To Be Approved

Wait for your Alaska LLC to be approved in the state of Alaska before applying your EIN. Otherwise, if your LLC registration is denied, you will have an attachment to any type of non-existent LLC.

Alaska Identity Tax

In addition to your federal Identity Tax (EIN) ) in Alaska, you will probably also need an Alaska State Identification Tax. This ID is required to pay the business, state income tax, and/or sales tax you offer for sale. Generally, a state tax identification number is best suited for the following purposes:

ID$39 Tax ID#

Also known as Approval, Wholesaler ID, Resale, Reseller ID.

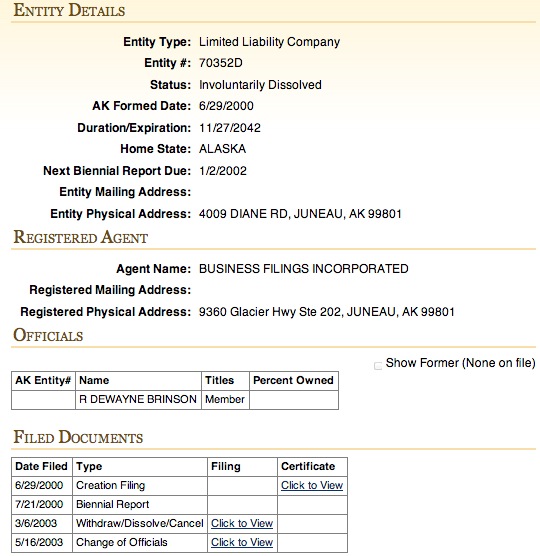

What Is A Foreign Limited Company?

An LLC is always established in accordance with government regulations. The state in which the LLC is incorporated is often referred to as the home state of the LLC. Where an LLC is located is its main center of operations. If the business members of an LLC are trying to maximize the LLC and want to register in other states as well, the LLC is a foreign legal entity in a brand new state. An LLC registered in each of our new states is referred to as a “foreign entity”, “foreign company”, or “foreign LLC”. Setting up an Alaska Foreign LLC is easy and all you need is an EIN.

What’s The Difference Between A Tax ID And A Great EIN?

The terms Tax ID and EIN (stands for Employer Identification) . number) can be used more interchangeably. These are the nine digit numbers provided by the IRS for IDs.identification of an entity or person, called the responsible party, that controls the entity’s funds and assets. Depending on the legal status of your business, you may be required by law to apply for an EIN.

What Can An Employer Identification Number (EIN) Be?

EIN is an acronym. for the Employer Number and is sometimes referred to as the Federal Employer Identification Number, FEIN, Federal Taxpayer Identification Number, or Federal Taxpayer Identification Number. This is a unique nine-digit number that looks like a social security number at best, but uniquely identifies your company.

How do I find a company’s EIN number?

Most people know their friendly security code by heart, but entrepreneurs do not fully know their tax identification number. Homeowners don’t use your EIN on a daily basis, so it’s not easy to remember your work phone number or perhaps your address if you keep that number in your head.

What is an EIN in Alaska?

The Alaska Employer Identification Number (EIN), of course, is known in Alaska as the federal tax identification number and is used to select a legal entity. In general, businesses need a good EIN to operate.

How do I obtain an Alaska tax ID number?

Once your online EIN application is completed, GovDocFiling sends it directly to each tax office. Within a few weeks you will have an appointed and fullget a usable Alaska tax identification number. GovDocFiling simplifies the process of obtaining an EIN and provides all LLC forms that owners need to start their business.

What is an Alaskan Employer Identification Number?

The Alaska Employer Identification Number (EIN) is a nine-digit number assigned by the IRS in the following computer hard drive format: XX-XXXXXXX. It is used to identify all tax accounts of employers and individuals without employees. However, for employee plans, a letter (for example, P) in addition to the plan number (for example, 003) can represent an EIN.

What is a tax ID Number (EIN)?

The federal government uses a taxpayer identification number, also called an employer identification number, to identify businesses. You need an EIN to file your tax returns and obtain a business license. GovDocFiling can help you with this step by giving you more time to enjoy some of the wonders of Alaska and plan your business launch creatively.